Golden Independence Mining Corp. is an exploration company currently focused on exploring the advanced-stage Independence property located adjacent to Nevada Gold Mine’s Phoenix-Fortitude mine in the Battle Mountain-Cortez Trend of Nevada. The Independence property hosts a M&I resource of 537,300 ounces of gold and Inferred resource of 943,500 ounces of gold with a substantial silver credit. The Company is actively advancing the near-surface resource towards a production decision with a PEA anticipated in late 2021.

INTERVIEW TRANSCRIPTS:

WSA: Good day from Wall Street. This is Juan Costello, Senior Analyst with the Wall Street Analyzer. Joining us today is Christos Doulis, CEO at Golden Independence Mining. The company trades on the Canadian Securities Exchange, IGLD and on the OTCQB, GIDMF. Thanks for joining us today there, Christos.

Christos Doulis: Thanks so much for having me Juan.

WSA: Great. So yeah, please start off by providing us with an intro of the company.

Christos Doulis: Sure. Golden Independence is a one asset company. Our primary asset, or asset of interest is the Independence Project in Lander County, Nevada. We do have a smaller secondary asset that we’re currently in the process of spinning out into a subsidiary – a company called Hilo Mining. But our focus is the Independence Project, which as I say, is deep in the heart of Nevada, a great jurisdiction to be mining in. It is a project that has been tied up in a private company since the 1960s, so this is the first time it’s getting into a public vehicle. And it hosts a historic NI 43-101 compliant but certainly a very significant resource of just over a million ounces of gold today, which we’re working pretty actively to expand.

WSA: So yeah, can you bring us up to speed on some of the most recent news regarding the spin-out there with Sprott and some of the other activity with the Hilo Mining?

Christos Doulis: Sure. So I mean, I don’t think that the spin-out of Hilo is the key focus for the company but it is an interesting little spin-out, that’s the spin-out of our Champ Property. Given that it is not the focus of the company, we think that — but the property still has merit, it’s a Canadian asset of interest. As you know, we found — we think that the best way to unlock value for it is to put it into a dedicated company with a group that will advance it. We will be significant shareholders of Hilo, and I doubt we will be sellers of the shares anytime in the near future. But as I say, our focus is to continue to advance our gold project in Nevada. You noticed, that, yes, Sprott is an advisor to us. Ultimately we think that there’s a chance here that this project may be of interest to our neighbor, which is NGM, the joint venture between Barrick and Newmont, or perhaps another Nevada focus mining company.

So we thought it would be wise to have Sprott work with us there. They’re well-known in their M&A capacity, and ultimately as I say, we think it may be of interest to others. So it’s certainly good to have an advisor queued up and ready to assist should we enter that discussion. I think that at this time, we’re probably a little premature as we’re now in the process of completing our earn-in to the Independence Project.

WSA: So yeah, can you give us an overview of the area as you know, it’s pretty historical and it’s adjacent to the Nevada Gold mines?

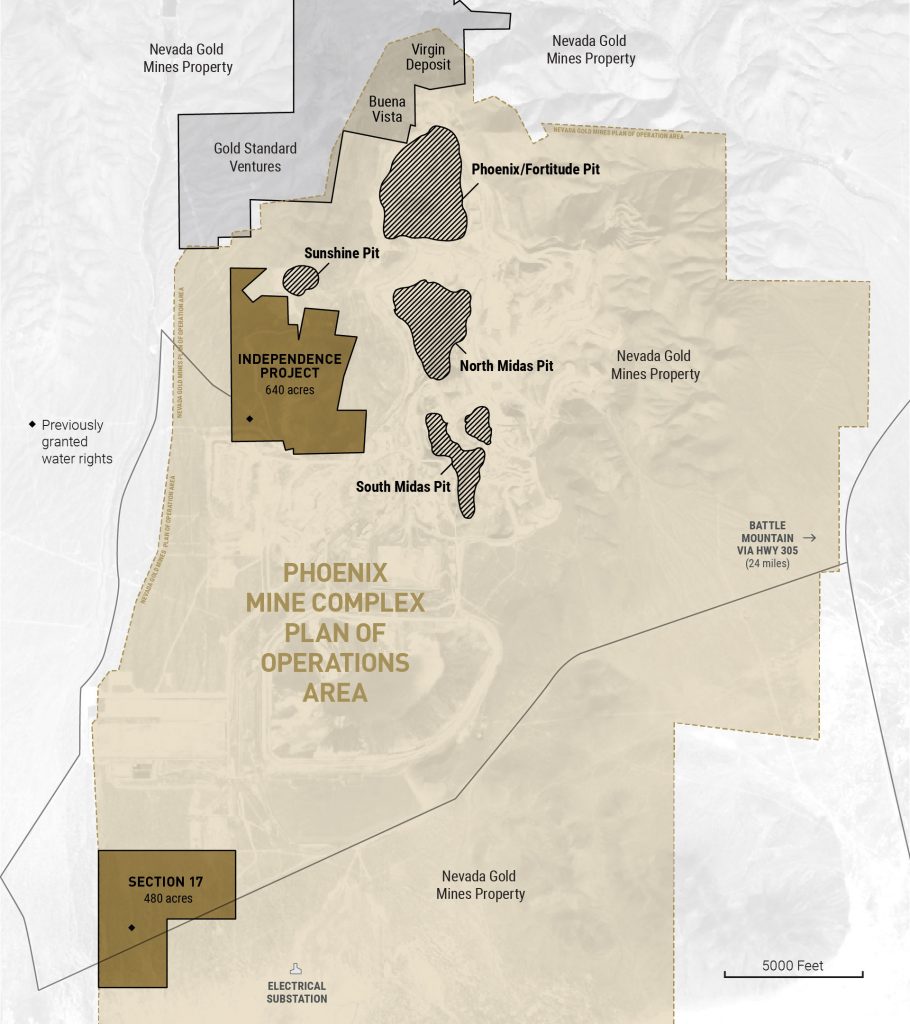

Christos Doulis: Absolutely. So the Independence Project is located very close to the producing Phoenix mine, which is operated by NGM, once again, the joint venture between Barrick and Newmont. Phoenix produces around 200,000 ounces of gold a year. And the whole NGM venture, a joint venture in Nevada produces over 2 million ounces of gold a year. So it’s a component of that joint venture. This project is about a mile by a mile in size. So it’s not the largest piece of land, but it’s only a mile away from the producing Phoenix pit. And it’s been tied up, as I say, in this private company since the ’60s. So when Newmont built the Phoenix mine and put it into production in ’06, they actually permitted all around this project. So we are — our property is located within what’s called the plan of operations of the Phoenix mine. It’s one of the differentiators for us because a lot of the baseline environmental and other permitting work has already been done.

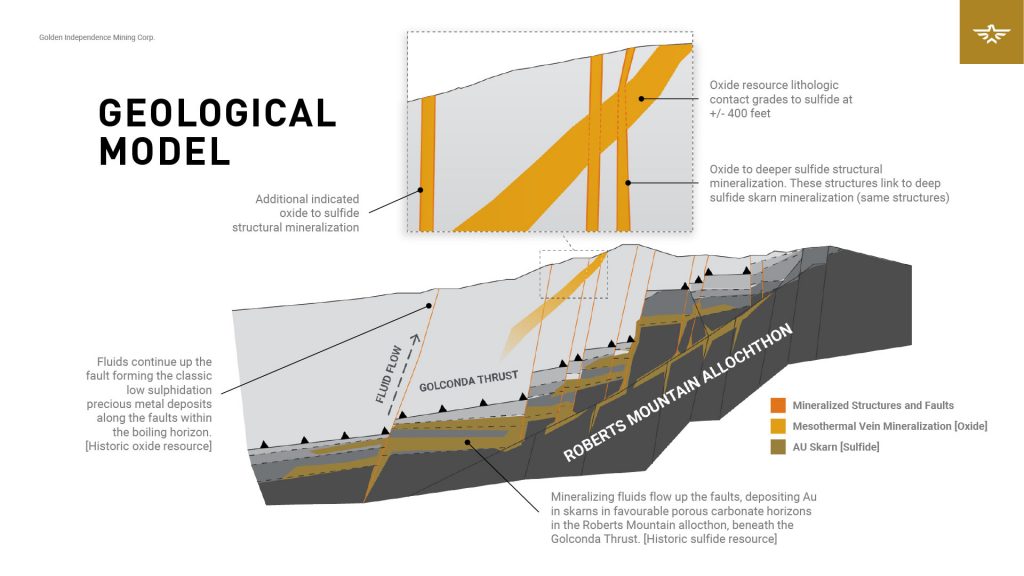

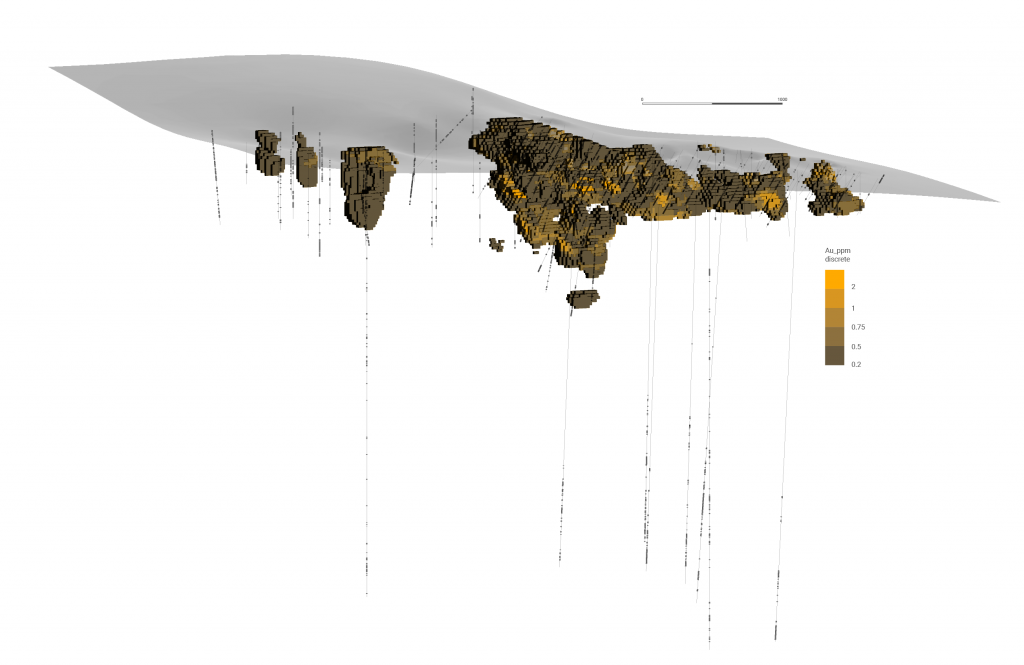

So we’re advancing this project under what’s called an environmental assessment as opposed to an environmental impact statement. Let’s say that’s about 12 months, it basically says, if you’re in the area of an operating mine, it certainly isn’t the same kind of permitting process as going through one where you’re on a new discovery. As I said, we have a historic resource of about a million ounces of gold. That resource was prepared in 2010, consists of both a near surface component of 276,000 ounces of gold and a deep scarring component much higher grades six and a half grams of about 800,000 ounces of gold. The near surface is what we’re focused on in the short term, well, in the near term anyway, given that we are kind of a junior mining company, it’s from zero to 400 feet depth. It’s low grade about a half a gram but it’s amenable to the low cost heap leaching. And for us in terms of defining it and expanding the resource, it’s very low cost to drill, we use RC drilling, we don’t go to very deep depths.

So we’ve done quite a bit of drilling since the fall about 25,000 feet. And we’re active right now on another 8,000 foot program. All of the work that we have done is being combined with historic work that has been done on the project, including 56 holes that weren’t released as part of that original resource calculation in 2010 that were drilled in around 2017. So we’re about to significantly expand the resource, and that resource statement should be coming up before the end of this month. So big gold growth story in a great jurisdiction, Nevada, surrounded completely by the plan of operations of an existing mine operated by one of the biggest — well, a joint venture between two of the biggest gold producers in the world. We certainly think that there’s a lot of of exciting things happening at Golden Independence as we continue to advance this project towards a production decision, and continue to delineate additional gold ounces.

WSA: Surely. And yeah, you had some recent intercepts there at Golden Independence as you had your next to last drill results for the year?

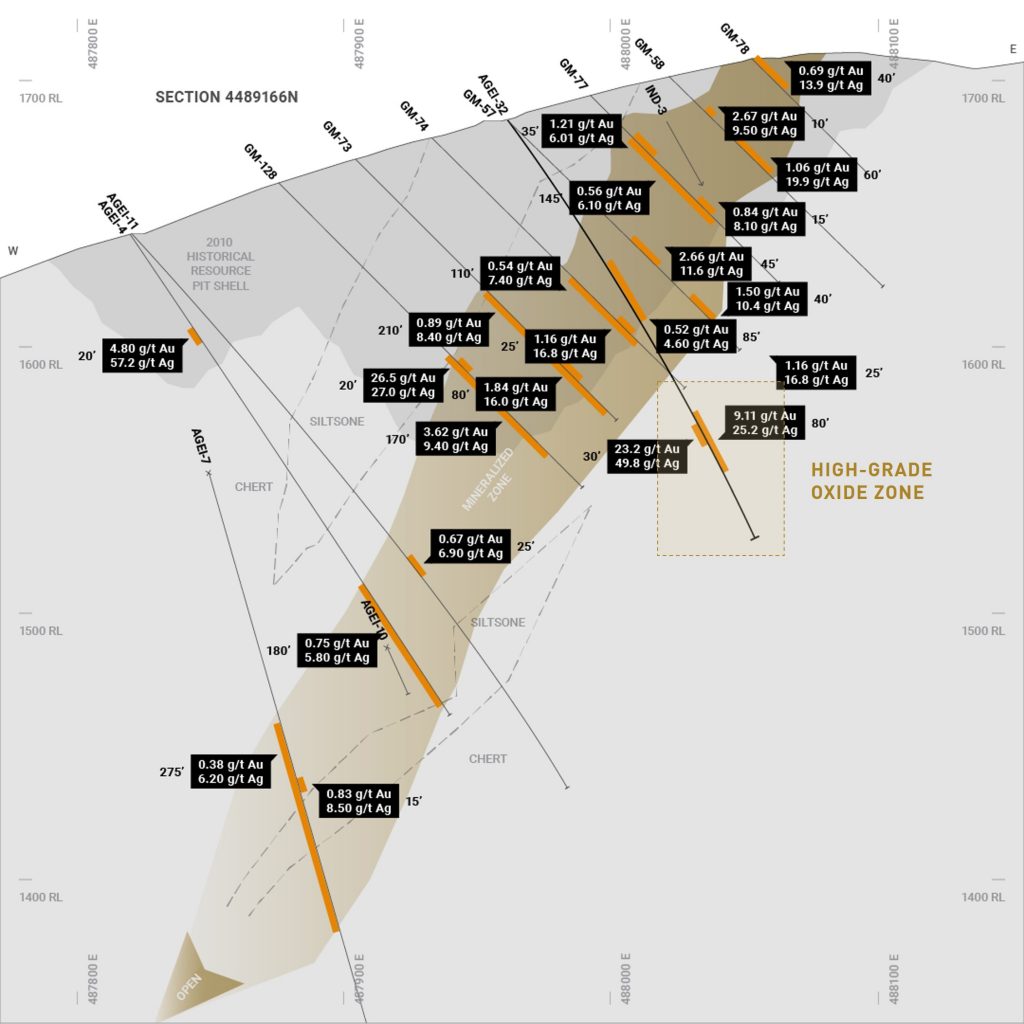

Christos Doulis: Right. We’ve been pretty active drilling since we took the project over in the fall. So we did about 25,000 feet, and then finished that up in January. And now we’re embarked on a bit of a smaller program, but still a meaningful one. In the process of that 25,000-foot drill program, which was really designed to verify and expand the existing low grade half gram resource that’s very near surface. In the process of that program, we did a little kind of punching through the, what’s called the footwall of the deposit. And we had some exploration success back in mid-March, we released an intercept of 80 feet grading nine gram gold and 25 grams silver, and that’s just below the existing footwall of the oxide deposit, so very near surface. That intercept was included in our resource statement, but given that it was only one intercept, it won’t have a meaningful impact. With our program that we have active right now, we’re going back into that area and doing additional drilling.

So when we table another resource, my hope is to include some significant high grade component of the near surface resource. So that’s been some great news but we’ve also had quite a bit of success drilling in the north of the project where, although it’s not as sexy we’ve returned significant intervals, for instance, hole 47 returned 530 feet grading half a gram gold and three-and-a-half grams of silver from surface, and so that adds meaningful ounces in the north of the project. And as I say the north still needs more drilling, so we think that over this — in this phase two program, and hopefully over additional programs that we can continue to add ounces in the north of the project. So yeah, we’ve had quite a bit of drilling success both on kind of what I call the run of mine material, which is that half gram material, but also in this recent high grade discovery near surface that we hope to build on with this current drill program.

WSA: Certainly. And so can you lay out the key goals and the milestones you’re hoping to accomplish here over the course of the next six months?

Christos Doulis: Absolutely. So in the very near future, we’re going to be tabling a new resource, 43-101 compliant resource for the project that is a compilation, as I say, of all the work that’s been done historically and recently. That resource is going to focus on the near surface component. And then we are going to then advance the near surface component of the resource to a PEA by the end of the year. During the summer, we’re going to be drill — ongoing drilling is going on. So hopefully we’ll add, while we wrap a PEA around the resource that we’re going to table soon we ultimately think that the resource may expand significantly as we continue to add ounces. So the first PEA that’s scheduled to the end of this year is likely not to be the be-all and end-all as it were the economic studies on this project, but rather a kind of an initial study that shows hopefully that we have a robust economic project here. So those are some of the kind of milestones. And in the remaining calendar year we completed a private placement back at the beginning of April to the tune of 2.8 million Canadian. And so that money will take us through to the end of the first half next year.

So we don’t need to raise any money right now. We’re just kind of keeping our heads down and focused on adding ounces, advancing the project to a PEA and continuing to fast track the development of this project under the fairly permissive regime given our jurisdiction. And so that’s the Golden Independence story. They say this asset has been kind of hidden in a private company for decades, we’re now bringing it to light. And we certainly think that, should there be the continued interest in gold and strong gold prices in this kind of $1,700-plus range, we think that this is going to become a very active and interesting project as well as the rest of Nevada keeping up too. So look out for continued drill results in the summer. That’s the news that we’ll have along with the continuing to advance on the permitting and PEA front in the fall.

WSA: So perhaps you can talk about your background and experience Christos, and who the key management team there is?

Christos Doulis: Sure. I’m an ex-research analyst and investment banker focused primarily on the sub-500 million market cap space. I did a lot of M&A work back about a decade ago. But my entire career has really been focused in kind of junior mining. I’m not really a technical guy, for the technical side, we’ve got Tim Henneberry, our President. He was brought in this last summer when we first were evaluating the project. And he liked it so much that he stayed on as our president and is really in charge of the project kind of at the C-suite level. And then on the ground, we’ve got Don McDowell, who is active at the project to kind of a drill bit level, he’s a great site geologist, plus he really knows everybody in Nevada. He was the guy who did a lot of the historical work on this asset back in 2017, so he’s very familiar with it. And so those are kind of some of the key people on our team.

One other gentlemen, I’d love to mention is Duane Anderson is our permitting guy. I’ve told you, we’re advancing the permitting process very quickly here, given our address. And Duane permitted Rosemont and Hycroft, so he’s very familiar with permitting in the US. It’s a lot of balls to keep in the air, when you’re dealing with the BLM, Nevada Energy, all those kind of stuff. So Duane is making sure none of those balls get dropped in that our consultants, EM Strategies, and Dyer and JUB engineering at Reno and Elko, Nevada. That they made sure — that he made sure that they meet all the timelines that we set in terms of fast tracking this project. So it’s a team effort, it’s myself and a big team behind this project is what I think I’m trying to tell you.

WSA: Certainly. And so as far as investors in the financial community, what are the main drivers that you share with them about what makes you guys unique from some of the other players there in the sector?

Christos Doulis: Absolutely. I think, guys have asked me, “What are the greatest challenges in the junior mining space.” And I’ve said, the first challenge is finding an economic ore body and the second challenge is access to capital. We are trading at a very low market cap here similar to the many exploration companies. And most exploration companies are hoping and praying to find an ore body of merit, just because you have a drill hole that have some gold in it, doesn’t mean that you have an economic ore body. We certainly believe that at the Independence Project with a resource in excess of a million — a historic resource in excess of a million ounces of gold, and given the six and a half gram grade of our deep resource, and the half gram grade of our surface resource, which there are many heap leach operations in Nevada operating at a half gram gold. We certainly believe that the greatest risk of discovering an economic ore body is not one that we face, so that’s a big differentiator for us. Access to capital, as I say, we closed a private placement back at the beginning of April, so no concern from that perspective for the next year or so.

We’ve got a real deposit, and we’ve got the money to advance it and unlock value. So I think, when you look at our market cap compared to a lot of guys who are active in these very interesting exploration camps, you know, they have great value — or sorry, they have great potential, I should say, but unless they actually discover an economic ore body, ultimately these guys are just all they are is drilling holes. So our holes add ounces, who knows whether the explorers ever find a meaningful deposit, and yet here we are kind of trading at the same value as these guys, a lot of these explorers out there. So from my perspective, if gold holds steady here with a robust price, and we continue to add ounces of the drill bit and show that this project is going to be a robust economic mine, I think that you’re going to see a lot of value unlocked by this company in the next year.

WSA: Surely. So once again, joining us today is Christos Doulis, CEO of Golden Independence Mining Corporation, trading on the Canadian Securities Exchange, IGLD, and on the OTCQB, GIDMF. Currently trading at $0.18 a share, that’s the US price. Market cap is about 10 million US. So before we conclude here, Christos, why do you believe investors should consider the company as a good investment opportunity today?

Christos Doulis: Well, we are trading at a very low market cap. But we have a very real deposit in a great jurisdiction, not just in Nevada, but surrounded by the plan of operations of an existing mine. This, as I say, this asset has been kind of hidden up until last summer when we started the process of getting it out of the private company into a more public venue. So this is a bit of a — from my perspective an undiscovered story right now. And I really think that there’s a bright future for gold mining in America over the next decade or so. And this Golden Independence is a company that’s going to benefit from a return to not only gold, but also to a focus on some of the political safety of operating a gold mine in the US as opposed to some of the more challenging jurisdictions out there. So here we are building a real mine in a great jurisdiction in the shadow of an existing gold mine, and yet no one seems to be paying much attention to what we’re doing. But I’m not that concerned, I’ve got the money to make sure that we can deliver on all the milestones. And as I say, I think we’re going to be a very different looking company a year from now. And I wouldn’t be surprised if we have a lot more value in our shares at that point.

WSA: Well, we certainly look forward to continuing to track the company’s growth and report on your upcoming progress. And we’d like to thank you for taking the time to join us today, Christos, and introduce our investor audience to Golden Independence. It was great having you on.

Christos Doulis: Juan, thank you so much for having me on your show.