ABOUT: Pro-Dex, Inc. designs, develops, manufactures, and sells powered surgical instruments for medical device original equipment manufacturers worldwide. The company offers autoclavable, battery-powered and electric, and multi-function surgical drivers and shavers that are primarily used in the orthopedic, thoracic, and craniomaxillofacial markets. It also provides engineering, quality, and regulatory consulting services; and manufactures and sells rotary air motors to various industries. The company was founded in 1978 and is headquartered in Irvine, California.

INTERVIEW TRANSCRIPTS:

WSA: Good day from Wall Street, this is Juan Costello, Senior Analyst with The Wall Street Analyzer. Joining us today is Rick Van Kirk, CEO at Pro-Dex Incorporated. The company trades on NASDAQ, ticker symbol PDEX. Thanks for joining us today there, Rick.

Rick Van Kirk: My pleasure. Thank you for having me.

WSA: Yeah. So you’ve been on the show several times, but still — I’m sure there is still somebody that might have missed some of your previous calls. Can you start off there with an intro/overview?

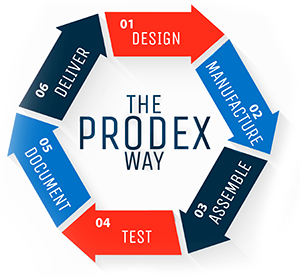

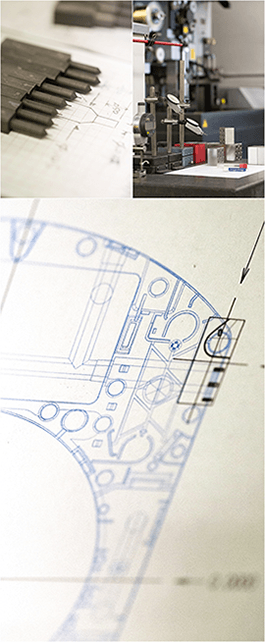

Rick Van Kirk: Yeah. Pro-Dex is a medical device manufacturer in Irvine, California. We actually have two facilities now, one in Irvine and one in Tustin, California. We make basically powered instruments, power tools for the operating room. The company has been around about 40 years. We’ve been doing the medical device, business about 25 years and deal with a lot of the major players out there and do kind of a combination of contract manufacturing, engineering services and have our own technologies and products as well.

WSA: So yeah, can you bring us up to speed there on some of the most recent news as you just announced record results and you’re also getting ready to close out the fiscal year at the end of the month?

Rick Van Kirk: Yes. We about a month ago announced our third quarter results, which for us ends in March. And you’re right, it was a record $13 million top line. We had never reached that amount before, so we’re really pleased about that. And some of the other numbers that followed that along, it was a really, really good quarter for us. So we’re really close to kind of busting loose here like we’ve been hoping. Our second building is operational now. We’ve completed the move, we’re doing our assembly and repair work over there. We’ve got a couple of projects in development, so we’re really optimistic about continuing that growth trend. When we finish our year in June, I’m very confident we’ll continue the year-over-year growth that we’ve seen and see no reason why that won’t continue in coming years.

WSA: Yes. As you mentioned you just moved this week, so you probably still have some styrofoam popcorn on the ground.

Rick Van Kirk: Yeah. Actually it’s outside now. I went by there this morning and it’s all outside in trash dumpsters and things. We rented to get it all cleared out. But yeah, for a while there it was hard to move around in the building. But now they’ve done a really nice job of cleaning and organizing and all the lines are moving over there. It was really cool to see.

WSA: Yeah. So obviously that’s keeping up with some of the continued demand that you have to be able to fulfill that. And also can you describe what the tools that you provide are, what the benefits are in the operating room and you’re kind of like a one stop shop. So even after you sell these products you’re also providing maintenance and customer service, right?

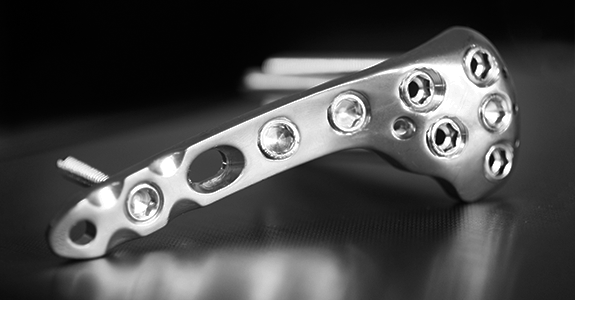

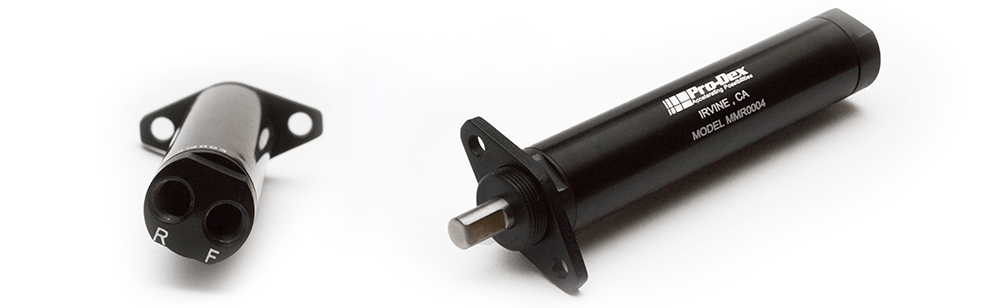

Rick Van Kirk: Yeah, exactly. We repair anything that we provide to people. In fact, we have a much larger repair area footprint now in the new building, so we’re able to do that. So that’s kind of after the fact. Our products have a reputation, they’re very durable, they last a long time. And in particular our screwdriver products that they’re using in cranial applications, thoracic applications, they have a technology called adaptive torque limiting that only we provide that basically makes it very easy for the surgeon. If you can imagine driving a screw and at the end of an operation they push a button and the screw will seat perfectly, it doesn’t stop short, we have to finish it by hand or go too far and the surgeons love it.

And what that does, it really enables our customers to sell more of their product, which is the plates and screws and things that are used at the end of these surgeries. So we really enable our customers to sell more of their product and it makes for a better surgical experience for the surgeon and then we think therefore the patients as well. So it’s kind of a nice trickledown effect we think.

WSA: Right. So you got all your salesmen telling them, it’s not only going to help you in the OR, but you’re also going to be able to get more of your own product moved and clients and customers are going to be even happier, right?

Rick Van Kirk: Yes, everybody wins. Patients, doctors, customers, products, shareholders, yeah, it’s good for everybody. Yeah.

WSA: What does the second half of 2023 look like?

Rick Van Kirk: Well, good. We expect to continue to grow. Like I said, we’ve got some projects in development that will be coming into production in coming weeks. So we’ll further utilize that building and we’re talking to other people that are interested in our products and technology and hopefully we can sign up some more friends to provide this stuff too. So we’ve never been shy about being open about that. We have very aggressive growth plans and so we expect that to continue into the next few months.

WSA: Yeah. And perhaps you can talk a little bit about your background and experience Rick, who the key management there is and what your skin in the game?

Rick Van Kirk: Yeah, I’ve been in manufacturing my whole career and the last 17 years here at Pro-Dex, eight or nine in this role. Our management team has got a nice mix of people that have been here a long time or some new to the company with new ideas, a lot of medical device history, company history. So we’ve got a lot of good depth in sports that we call it the combination of youth and experience. So we kind of have that here in the management team and we have a lot of people in the company that have worked here a long time, which means a couple things to me. We’ve got a lot of product and process history that people can help each other with. And it also makes me believe and I do believe this it’s a good place to work.

We try to have a good culture here and make it a place that people like to spend their days. And I think that helps just in turn make us a more productive company as well. So really nice mix of people. Very proud of the group here. They’ve had record shipments a few quarters over the last year and a half while at the same time working to commission this new building, which was a lot of work. And with the medical device we have a lot of validations and qualifications that we needed to go through. So people did all that. So we’re very proud of the team here and very lucky to have them all.

Juan Costello: Well, yeah. Good. So what are the key trends that you’re seeing right now in the sector? And obviously you’re always trying to look at where the puck is headed and what do you feel makes Pro-Dex positioned to be able to cap and unique to be able to capitalize?

Rick Van Kirk: Well, like everybody we’ve got a kind of a two edge sword challenge. On the one hand, there is still some supply chain stuff going on where lead times are a bit longer, but the pricing and cost of some of our materials are going up yet we deal with big customers that expect year-over-year price reductions. So it’s not unique to us. But that’s part of the challenge is to continually try to improve your processes to bring your costs down to mirror what your customers expect. And we try to listen to things they’re looking for beyond that whether it’s flexibility and deliveries or terms and things like that.

But we do think that we can help with the trend in terms of hospitals and medical facilities trying to reduce costs. We think our procedures can do that. We’re trying to come up with reusable battery products that will help reduce costs, because that’s one of the trends obviously. So those are some of the things that we’re seeing and trying to work with.

WSA: Great. Yeah. And so when it comes to investors and the financial community here as I’m pulling up your stock chart here 18.80 today, market cap doing pretty well over the last few months. So yeah, still I’ve never talked to a CEO that was like “Oh, you know, the stock is where it needs to be.” Is there anything you want to vent while you’re on the analyzer, have you on the couch talking to your shrink anything that you want to wish investors better understood about you guys, which would result in a possible higher valuation?

Rick Van Kirk: Yeah. I think for the investors involved with us, thank you for your support for those looking into us. Thank you for your interest. We’re pretty patient. We tend to focus on execution and hope that our results drive positive feedback and stock prices and things like that. I would just repeat that we have aggressive growth plans and if people are curious about products, I’d suggest look at our track record the last eight years where we’ve come from. Last year we were finished around $42 million in annual sales.

Eight years ago it was like $11 million or $12 million. So we’re going in the right direction. We’re doing the things I think that we’ve — I’ve been saying publicly with people like you for two, three, four years now. Yeah, during the last two or three years everyone had some challenges, so maybe our path slowed a little bit, but we’re still on that path and I think we’re a good bet and happy to talk to anybody who has got questions about the company. I’m pretty easy to reach actually.

WSA: Yeah, I could certainly attest to that. And so yeah, right now as mentioned, 18.80 a share that’s on NASDAQ PDEX, market cap at about $66 million. So yeah, before we conclude here Rick, why do you believe investors should consider the company as a good investment opportunity at this point in time today?

Rick Van Kirk: Yeah, a couple of things. I think our track record like I mentioned and we’re also very willing to and have demonstrated the interest and ability to invest in the company. We’ve probably doubled R&D spend over the last couple of years. We bought a building. We’ve bought the equipment that we need. We’ve brought in people, so we put our money and effort where our mouth is. So we’re not just saying we want to grow, we’re doing what we think are the right things to fuel that growth and I think people would enjoy joining us for the ride. Well, we certainly look forward to continuing to track the company’s growth and report on the upcoming progress. And we’d like to thank you for taking the time to join us today Rick and update our investor audience on PDEX. It’s always good having you on.