About Arizona Silver Exploration Inc: Arizona Silver is a young exploration company focused on exploring underexplored gold-silver properties in western Arizona and now Nevada. The Company plans to continue to drill test the Ramsey Silver Mine property located a short distance east of Quartzsite, Arizona as time allows. The Company has recently received a positive Record of Decision on its Notice of Intent to drill an initial eight exploration holes on its recently acquired Silverton gold-silver property with carlin-type targets. Drilling there wil be scheduled as time and equipment allow. Please refer to our web site for all news and updated property information. www.arizonasilverexploration.com

https://www.stockpulse.com/Profile/AZS:CA/Article/8072060000081880

INTERVIEW TRANSCRIPTS:

WSA: Welcome back listeners to Wall Street Analyzer’s CEO Interview Series. Today we are joined by Mike Stark, CEO and President of Arizona Silver. The company trades on the TSX Venture, ticker symbol AZS and on the OTCQB AZASF, and Arizona Silver was just featured in our newsletter and has been actively putting out results over the last few months. So, it’s good to have you back on the show, Mike, and thanks for taking the time to update our investor audience.

Mike Stark: I’m glad to be here. Thank you.

WSA: So, please start off by discussing Arizona Silver’s most recent news, including your current intercepts and results at the Philadelphia property in Arizona?

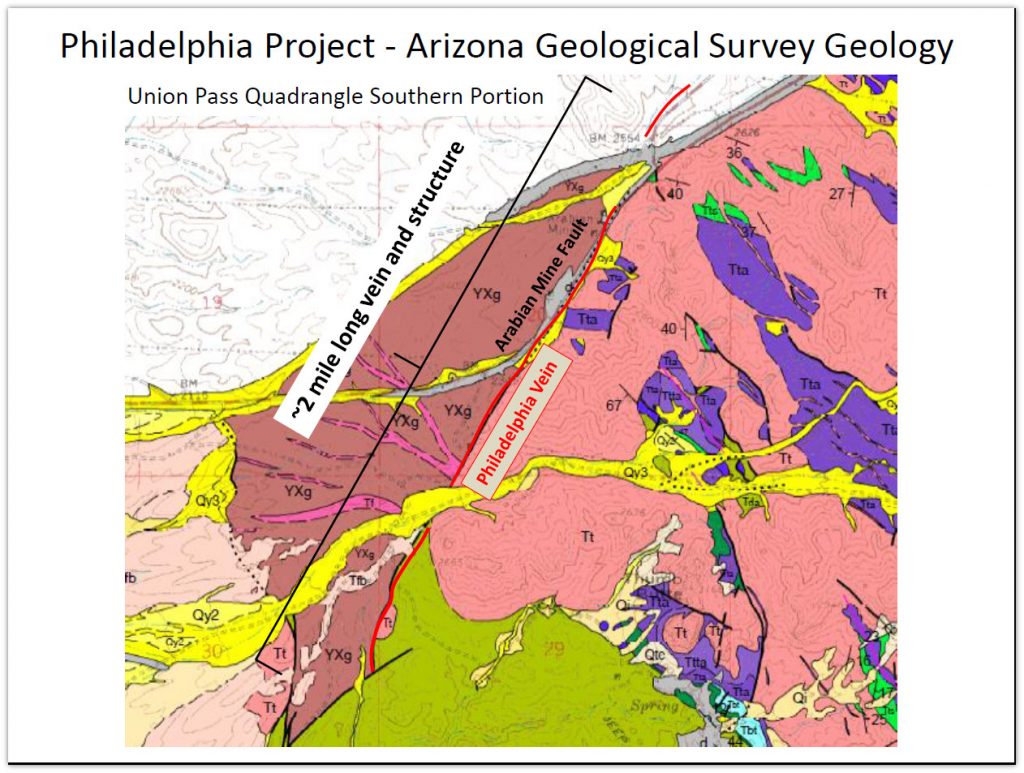

Mike Stark: Be glad to. We were extremely pleased with these results coming in at 33.56 grams gold and a little over 54 grams sliver, little over 7.5 feet or those that prefer 2.35 meters. This is a major hit and, again, one ounce of gold, that’s really exciting for this company. This further substantiates that we have a second vein, a high-grade vein and a low-grade vein, and this is very near surface as well, this is only 27 feet below the surface right now, so it’s an early start and we are working our way down that vein with the upcoming drill program.

WSA: Great, thanks and so can you give us an overview of your other land positions in Arizona and now Nevada, what’s the timeline as far as development and exploration?

Mike Stark: Well, as of right now, I mean we do carry three other properties, but our focus primarily now, because of these ongoing results and good results—we will stay focused here with Philadelphia and in the downtime, whenever that is, like, for instance, the crew has taken a break, we’ll maybe move ourselves up into the Silverton property, which is our newest acquisition. That one is a large-scale, open pit Carlin Trend type deposit. There is a lot of similarities to a property called Long Canyon and for that reason alone it should give investors good opportunity here to look at a large-scale property, but, again, the focus right now is Philadelphia with these type of results. These are substantial results in an area that is very good. Geographically we’re surrounded by three operating mines, so we are really well-positioned here with Philadelphia.

WSA: What makes AZS stand out from other companies in the sector, how is the company capitalizing on market trends and positioning itself for future growth?

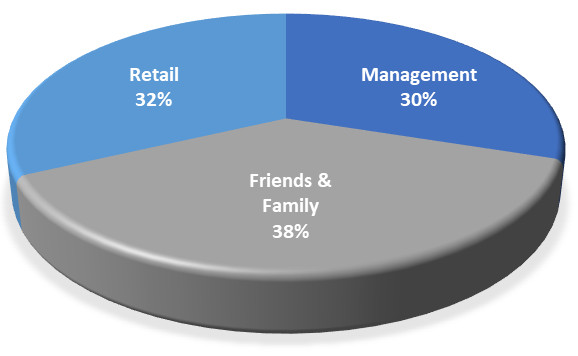

Mike Stark: Well, one of the best things that I can personally say is our structure. Management owns 30% of this company and I’m very flattered with that. That’s the direct five directors in this company own 30%, with family and friends that increases to a much higher number, to 68% and we have done very little advertising at this point, but we are now starting to make sure that more people get to find out about this. So, it’s a great opportunity on an early-stage company with a tight share structure, only 52 million out. I emphasize, 30% is held by management, so we have a lot of skin in the game our self and we’re making some very wise decisions right now. I look forward to what happens in the near future here, again, giving shareholder value.

WSA: What milestones can investors expect to see over the next 12 months, any near-term catalyst we should keep an eye out for?

Mike Stark: Yeah, I mean I’ll go right back to Philadelphia with that answer. The fact that we’ve only drilled, like, on the low-grade vein we did a little over 1200 feet and we’ve only done less than 200 feet on those high-grade vein you could see the potential for expansion here very rapidly. If we’re successful to go down to the 600-foot level and continue to hit these type of grades, ounces add up very quickly—obviously the grade is exceptional—it wouldn’t surprise me to be looked upon as, “hey, we gotta get involved with this company? Look what they got here.”

WSA: Do you believe your story is completely understood and appreciated by the financial community and if not what do you wish investors better understood about the stock?

Mike Stark: Actually that’s a great question and my answer is really simple. We are not in the public domain and noticed at this point. We’re a young company, very small, but advertising budgets are hard when our shareholders want us to spend money in the ground and I appreciate that, because that’s where your results come from. So, up until now we have done very little in the advertising sector. I believe with this little bit of help, you guys as well, we’ll get more recognition. People are going to see how undervalued we are at this time and hopefully they come in and take a small position and watch us grow because I do believe we’re on to a very significant opportunity here with Philadelphia and there’s much more blue sky yet to come with Silverton.

WSA: Yeah, and you touched on this already, but, maybe you can expand on it a bit more. In what ways are management’s position and interests aligned with shareholders and future investors?

Mike Stark: Well, I think any time somebody takes a look at a company and there were these zero shares owned by management why would you invest, I mean if management doesn’t believe then what’s the sense, I mean — and I’m not throwing mud at any other companies, I’m just stating a fact. Why would you invest in a company when the management doesn’t have any position in the company themselves?

WSA: Yeah, that’s certainly well said. So, once again, we’re speaking with Mike Stark. He is the CEO and President for Arizona Silver Exploration, which trades on the TSX Venture, ticker symbol AZS and here in the US on the OTCQB, AZASF. So, before we conclude here, Mike, to get a recap here of your key points, why do you believe the company represents a good investment opportunity today?

Mike Stark: Well, the fact that we’re undervalued is one of the biggest one. The fact that we have made potentially a very major discovery here in a very friendly jurisdiction, key components are all met, access is off a major state highway, we have water, we have power, so for future development all those areas are met. I believe it will take some strong interest from outside sources here in the near future providing we continue to hit the grades that we justexperienced on these last six holes.

WSA: Well, we certainly look forward to continuing to track the company’s growth and report on your upcoming progress, and we’d like to thank you for taking the time to join us today, Mike, and update our investor audience on Arizona Silver. It’s always good having you on.

Mike Stark: Thank you. It was a pleasure to be here. Thanks for your time.

WSA: And for our listeners that have been following the story, Arizona Silver currently trades at 0.25 a share US, market cap is about $13 million US and stay tuned for more news releases on our site from the company as well as future updates with management. Thanks again, Mike.

Mike Stark: You’re welcome. Thank you.

ProActive Investors Interview with Mike Stark 10/15: