ABOUT: Citius Pharmaceuticals is a specialty pharmaceutical company dedicated to the development and commercialization of therapeutic products for growing markets. Citius products offer new and expanded indications for previously-approved pharmaceutical products as a means to achieve leading market positioning.

Citius is committed to developing therapies for unmet medical needs with cost-effective products in high growth categories with low developmental risk.

- Mino-Lok product has advanced to Phase 3 clinical studies.

- CITI-101 (Mino-Wrap) is a bio-absorbable film impregnated with minocycline and rifampin for reducing acute inflammation and microbial colonization of breast tissue expanders used in breast reconstruction surgeries following mastectomies. More information on this product will be coming soon.

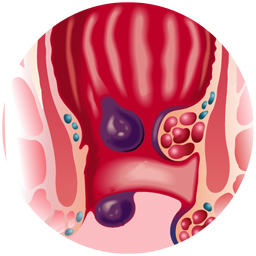

- CITI-002 is being developed for symptomatic relief of hemorrhoids. CITI-002 combines the high-potency steroid, halobetasol, with lidocaine.

- Citius has an experienced management team with demonstrated success in developing and commercializing novel pharmaceutical products.

INTERVIEW TRANSCRIPTS:

WSA: Good day from Wall Street, this is Juan Costello, Senior Analyst with the Wall Street Analyzer, joining us today is Myron Holubiak, President and CEO for Citius Pharmaceuticals. The company trades on NASDAQ, ticker symbol CTXR. Thanks for joining us today there Myron.

Myron Holubiak: It’s my pleasure Juan. Good to talk to you again.

WSA: Yeah. So for some of our listeners that may still be new to the story which we’ve done few interviews in the past here, but there might still be a couple of stragglers there. Can you give us an overview there of the company?

Myron Holubiak: Sure. Let me start at the very beginning but do it quickly. The company started as Leonard-Meron Biosciences at the end of 2013. Leonard Mazur, he was a serial entrepreneur. He had a lot of major successes in building profitable companies and I had retired from Roche Labs and I was participating on some boards; one especially relevant was BioScrip, which is an IV infusion, a specialty pharmacy company. Leonard and I had been long-term friends. He was at Cooper Labs and I was at Roche Laboratories. And Leonard was also responsible for reintroducing Minocin IV, which is important to our story back to the United States.

The Department of Defense had called him and basically let him know that there was an infection in our troops in Afghanistan and Iraq that was very resistant, it was Acinetobacter. And the only thing on the panel that seemed to be really potent was Minocin and there was no Minocin IV anymore, it has been taken off the market. Leonard had the oral form, so he went ahead and reintroduced Minocin IV to the United States. Today that happens to be a product of Melinta. But anyways my academic background back in those days and interest had always leaned towards infectious diseases.

So we met and we’ve known each other for a long time but we’ve met and decided why don’t we start something. And the first thing we did is we licensed Mino-Lok from MD Anderson. And Mino-Lok, the way we discovered that is Minocin IV was being used a lot at MD Anderson. We went down, they weren’t treating troops from Afghanistan or Iraq, but what they were doing was they were searching for a good antibiotic lock for catheter infections that cause bacteremia. And the best antibiotic that the team down there led by Dr. Raad, who is the Head of Infectious Disease at MD Anderson was Minocin.

So that’s how we connected with them. And when we saw some of their early data, preclinical data, we decided that we would license the product and that’s how we formed Leonard-Meron Biosciences. So we licensed Mino-Lok from MD Anderson and we funded all the activities through Phase II. Our Phase II was very successful, we had a 100% efficacy in salvaging infected catheters with no adverse events, and these were very, very serious infections with some of the worst organisms you can think of, so MRSA, pseudomonas things like that. And while we had a 100% efficacy, we had no adverse events.

The comparator which was removing and replacing the catheter, two separate surgical procedures had 18% adverse events and these are really, really sick people. So we were very excited and we decided to go ahead and start developing Mino-Lok as being our very first product. After we finished Phase II and after spending a lot of money and resources, we merged with Citius. Citius was a public company, and the reason we merged with them was to access the public funding because we were faced with the cost of the Phase III trial, which at that time was estimated to be more than $25 million.

Now that merger happened in mid 2016, then in 2016 we uplisted on to NASDAQ in August of 2017 and we have now developed Mino-Lok to an inflection point in the company’s value. I’ll take you through that in a minute. We also continued the development of Halo-Lido, which was an asset that Citius had which was a topical preparation for symptomatic relief of hemorrhoid. So that product is also in our development pipeline. So that’s really the history of the company and how we decided to do what we’re doing.

WSA: I appreciate that. So can you discuss some of the recent milestones that you’ve achieved since our previous conversation in May of last year?

Myron Holubiak: Oh, absolutely, and there have been many. So one of the things that we were able to do, we were able to amend the protocol to save considerable time and resources. We had changed our endpoint for Mino-Lok in our Phase III trial – pivotal trial to be 10% superiority to standard of care antibiotic locks, which was any antibiotic lock that institution used but primarily it was vancomycin and heparin. So anyway we were able to change that endpoint to trying to catheter failure, which was a major achievement.

In the recent time, the catheter failure – what it allowed us to do is to account for some – in our trial all cost mortality is considered a failure and of course we’re dealing with very, very sick people. So we do have rates of 18%, 20% mortality. It affects both arms equally but when you’re dealing with a simple superiority trial, while it affects both equally, it does increase the numbers that you need. So while we had talked with the FDA on a number of things as to how to get this trial going, we have a very supportive FDA, we finally came up with measuring the time to catheter failure.

So you not only measure the proportion of superiority that your agent Mino-Lok would have over standard of care antibiotic locks, but also the time that it took to get there – the time and – failures are based on things such as clots that have formed, cultures that continue to be positive, and mortality. So all those things go into the equation and they’re considered failures. So what we looked at was what is the time to catheter failure, and our endpoint which we’ve been working towards and have had a futility trial analysis done, is we’re looking at a catheter failure rate at the median for 21 days for standard of care antibiotic locks and more than 38 days for us, and that’s working out fine.

So we did conduct a futility analysis. When we reached the 40% completion we also have another analysis on superior efficacy that it will occur when we hit 75% completion of our trial. So that was one of the milestones that we achieved. The other one is we licensed Mino-Wrap from MD Anderson so we’ve become pretty good partners with MD Anderson Cancer Center. Mino-Wrap is a product I’ll touch on later, which is a gelatin wrap that you wrap around tissue expanders post mastectomy. It turns out there is a very high infection rate post mastectomy and we think we have a way to reduce that significantly.

And then finally the other recent milestone is we’re in a middle of our animal toxicity study for Halo-Lido. You may recall that we switched from hydrocortisone to halobetasol, the FDA was fine with that, we had our meeting. They basically asked us to do an animal tox study on the Halo for a month’s period of time and we’re in the middle of that right now. So that’ll be done and we’ll be able to start the – we’ll file an IND and we’ll start the clinical trial later this year. So those are major milestones that we’ve achieved.

WSA: Great, so can you bring us up to speed in some of the most recent news including that positive outcome there for the Phase III Mino-Lok trial?

Myron Holubiak: Yeah, the futility analysis was planned to be conducted at the 40% completion of the trial. We were able to hit that. At that point in time that data became available and are sent to an adjudication committee, which assures that everybody is categorized properly, then it’s sent off to an independent drug monitoring committee made up of experts in the field and they come from all over the country and are completely independent from us.

So they reviewed the data, of course we’re still blinded and they reviewed the data and their purpose is to make sure that the progress of the trial is on track, that we’re not — or some tweak has to be made or something like that. So we were very happy to report and I believe it was in December maybe this month but I think it was last month. We were able to – we’re happy to report that we passed our futility trial, and what that means is that the trial at least at the 40% level, is on track for both efficacy and safety. So we’re very happy to get those results. It’s really the first time an independent group has looked at our data and been able to opine on it. And again, I don’t know what the results are but it’s encouraging to note that it’s on track with the endpoint that we’ve been looking for. So that’s basically it.

WSA: Certainly. So what are the key goals and milestones that you’re hoping to accomplish here over the first half of the year?

Myron Holubiak: Yeah, there’s a few of them. Probably the biggest one, the most important one is the, what I alluded to earlier, which is the 75% superior efficacy analysis. And we expect that in Q2 – probably towards the end of Q2, and the reason it’s at the end rather than at the beginning, is that adjudication committee has to get involved with cleaning up the data and making sure the tables are right, it’s sent off to the DMC, we have to get them together and have a meeting. So that adds about a month-and-a-half to two months for the process. I think we’ll get the 75% patient in maybe later this month, I’m not meaning February – later February possibly in March, but the analysis will be done and we’ll be able to report on whatever the analysis is in Q2.

Now there is a possibility that we would stop the trial. In order to stop the trial, the superior efficacy analysis would have to show overwhelming superiority and that means that no matter how many more patients you added the last 25% is what I’m referring to. It wouldn’t change the results in terms of we’re superior. So that’s hard to do. I don’t expect that to happen but it’s a possibility, so I mention it. But if there is a no stop, we’ll complete the pivotal trial this year and we’ll probably complete it in Q2. So that’s possibly that we could have an NDA by the end of the year but probably early next. I want to remind everybody that we do have priority review and fast track so the FDA is ready to move this thing through once they get it.

So on Mino-Lok it really is a superior efficacy analysis and we’ll have that information in Q2. On Halo-Lido, which is our hemorrhoid prep, we’ll finish the toxicity which we’re doing now, we’ll file an IND and we’ll initiate the Phase II this year but we’ll file the IND in Q2. On Mino-Wrap, which is the product for post mastectomy tissue expanders to prevent infections, we’ll finish our preclinical work which is ongoing now and I believe we’ll have an IND meeting with the FDA in Q2 and that will determine the clinical development plan for this very exciting product.

WSA: Great. And so Myron, can you please discuss some of the current trends regarding adjunctive cancer care and critical care drug products and what are the main factors that make Citius unique from some of the other players around the sector?

Myron Holubiak: Sure. Well, the effort to reduce hospital acquired infections is ongoing and so much so that hospitals are getting penalized by CMS, which is Medicare and Medicaid. They’re getting penalized if their scores are below average, and the hospital acquired event that is at the top of the list happens to be CLABSI so that’s what we deal with. And it’s at the top of the list because it’s so deadly and so costly. So just to refresh, CLABSI is one of the central line associated bacteremia, and that is where is our product Mino-Lok [comes in]. So the search for an effective antibiotic lock has also become very important in children to avoid the need to remove – removing and replacing a catheter central line is two surgical procedures – these catheters are long-term, they’re sown in, and they go right to the tip of the heart in the superior vena cava.

So removing them and replacing them is quite a procedure, it’s pretty expensive, it’s very discomforting but it’s especially a problem in children. What I recently read and we’re pursuing is that St. Jude’s had put out a paper on CLABSI salvage. So salvaging the catheter and they had a 43% to 44% failure rate with 70% ethanol, which is a pretty potent solution. So we know we can do better than that. So we expect that one of the areas that we’ll turn our attention to ais pediatrics and we’ll probably do a study in that area. So the trend really is to reduce infections.

Today that rate – CLABSI rate is one per 1000 catheter days. In the rest of the world it’s two or three times that. So we’ve done a pretty good job and our ability to reduce that further while there is a lot of pressure to do so is getting harder all the time. So there is this baseline rate of infection that we’re going to be able to address, and so we’ll do that fine. The other area is the surprising levels of infections post mastectomy. I don’t think the public knows this. In fact very little has been published and what has been published ranges all over the place from 2% to 25%. What we’ve been able to ascertain from talking to several potential clinics that would be handling the Mino-Wrap clinical trial is that the infection rate is somewhere between 12% and 14%.

So that’s a very difficult thing to accept particularly after if you had your breast removed and you’re getting ready to get a breast implant. And you don’t implant right away most of the time because the tissue is just too thin. So you put in a tissue expander, you expand it over a three-month period of time and then you reinsert a breast implant. So the 14% rate is just way too high. So we’ve created a product with MD Anderson that we believe will do quite well. We’ve done a lot of preclinical work. We expect to have again as I mentioned, we expect to have our IND meeting in Q2, we’ll finalize our development plan. But those are the trends that are going on in adjunctive cancer care and kind of what our role is.

WSA: Yeah, I certainly look forward to some of those announcements. So you’re attending some of the investment conferences, what are the main company drivers that you’re sharing with investors?

Myron Holubiak: Yeah, I think the progress of the Phase III is the most important thing because many really believe it was too difficult to study and I really believe that that concern is what kept our market cap low, our share price low. But the FDA has been very helpful in providing guidance rule what’s acceptable for an NDA and we’ve been able now to achieve it. We’re halfway through the Phase III which is pretty exciting. And then the other thing I’ve noticed when we’re presenting is the excitement around Mino-Wrap, and I think it’s because mastectomies at breast implants have gotten a lot of attention recently with the lymphoma reports and things like that, so I think that’ll be interesting.

And basically we have a very novel way of addressing the infection problem in cancer. And I think that we’re starting to get some traction. The other thing I might add is that our message to them is that we’re a very underpriced stock, if you have a Phase III asset and the risk of not]finishing is really low, the risk of this trial going negative is very low, because we’ve gone through futility, we’re halfway through, our Phase II was surprisingly good. So yeah, it’s a fairly low risk, fairly high market potential worldwide as well as here, and we prove we can do it. So those are our main messages.

WSA: Right. And so once again joining us today is Myron Holubiak. He is the CEO and President for Citius Pharmaceuticals, which as mentioned trades on NASDAQ, ticker symbol CTXR, currently trading at $1.15 a share with market cap of about 35 million. So before we’re concluding here, Myron, to recap some of your key points why do you believe investors should consider the company as a good investment opportunity today?

Myron Holubiak: Well, I think first and foremost we’re developing unique products. There are virtually no direct competitors in any of the areas that we’re working in, so we’re going to have 505(b)2, which is a low risk development plan on products that really address needs that have no real competition. Again, our share price is very low for a company with a Phase III asset that’s very unique and has a large market. Our yesterday’s close was 1.13, I just heard you say 1.15, so it’s really underpriced. Another important point is management has invested significantly because we believe in this. We put $26 million my partner and I. And there’s been a lot of significant milestones reached this year, so this is a good time to invest in Citius.

WSA: We certainly look forward to continue to track the company’s growth and report on your upcoming progress. And we’d like to thank you for taking the time to join us today Myron and update our investor audience, it’s always good having you on.

Myron Holubiak: Well, it’s my pleasure Juan. Thank you very much.