Clear Blue Technologies International, the leader in Smart Power, was founded on a vision of delivering clean, managed, “wireless power” to meet the global need for reliable, low-cost, solar and hybrid power for lighting, telecom, security, Internet of Things devices, and other mission-critical systems. Today, Clear Blue is working with its customers “On the Road to Zero Diesel”. Only thru massive cloud, data, predictive analytics and AI, can Telecom customers wean themselves off of dirty fuel generators. Clear Blue’s leading technology helps its customers achieve their Netzero objectives. Clear Blue has thousands of systems under management across 45 countries, including across Africa, the U.S. and Canada. (TSXV: CBLU) (FRA: 0YA) (OTCQB: CBUTF) www.clearbluetechnologies.com

INTERVIEW TRANSCRIPTS:

WSA: Good day from Wall Street. This is Juan Costello, Senior Analyst with the Wall Street Analyzer. Joining us today is Miriam Tuerk, CEO at Clear Blue Technologies International. The company trades on the TSX venture CBLU and here in the US over the counter CBUTF. Thanks for joining us today, Mam.

Miriam Tuerk: Thanks for having me, Juan.

WSA: Yeah, for sure. So can you please start off with an intro of the company there for some of our listeners that didn’t catch our previous call, which was in August, 2022?

Miriam Tuerk: Absolutely. So Clear Blue is a clean tech technology company. We help to deliver power and solar solutions to our customers in our marketplace. But we are a very unique clean tech company, very different from any other company in the market today. In terms of the marketplace that we focus on, we believe that the power grid is going to evolve into an infrastructure that is partially a wired grid and most significantly disconnected wireless islands of power.

And when you look at how that evolution happened in telecom over the last 20 years, today more than 80% of the world’s telecom infrastructure is a wireless, not wired. And we believe that’s what’s going to happen with power. We’re not going to be all connected to one power grid. In order to step up to that marketplace in technology, you need two key things. You need smart power electronics, the brains of every power system, and Clear Blue makes that hardware and that technology.

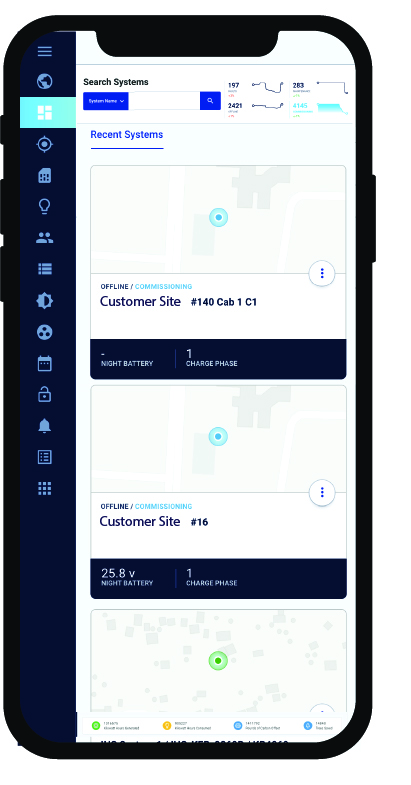

We include in that technology, edge computing. And then the second is you need a very strong comprehensive cloud management software that allows you to do predictive analytics and remote management and operational control. And that is what we do. So we don’t do big, large solar farms. We power the world’s industrial infrastructure. We do smart city projects like a Nevada Highway for an interstate off ramp like American Parkway in Allentown, Pennsylvania, like downtown Toronto. So we’ll do smart city, solar street lighting, smart off- grid, and hybrid solar off-grid and connected to the grid smart city infrastructure.

But we also do, and the biggest part of our marketplace is telecommunications, cell phone towers, satellite modems, Wi-Fi hotspots, and we’re doing a lot of that massive infrastructure across the emerging market in Africa and in Latin America. That particular market is moving away from diesel in a very aggressive way starting last year with major rollout in capital expenditure programs, and as a result to that, Clear Blue is seeing explosive growth. We had great Q3 our guidance to the market, which I’m happy to reconfirm, is a really strong Q4.

And our outlook for 2024 is more of the same. Every system we sell, we actually operate and manage for our customers. So recurring revenue and a managed ongoing service is the biggest part of what we do every day.

WSA: So, yeah, please bring us up to speed on your most recent news as you just mentioned the record Q3 results.

Miriam Tuerk: Yeah, so after a downturn in 2022 because of all of the capital spending that was frozen, we started to swing back as I said in Q2 of this year. And Q3 started to just show the great results that we see happening in Q4 and going forward for next year. We recorded 2.3 million in revenue. Our gross margin, our gross profit was 37%. And I have to tell you that when you’re selling a hardware solution to a customer, 37% especially when you’re a small company is almost unheard of.

Some other companies in the marketplace might get three or five percent gross margin. And the reason we get such high gross margins is because of the IP and the software and the predictive analytics and the cloud service. So we’re quite proud of that number and have been able to grow that strongly. And lastly, we were able to produce EBITDA that’s positive for the quarter. So our plan is to grow from there, continue to maintain revenue above 2 million, growing towards 3 million a quarter, which is a pretty high growth rate from where we’ve been in the last few years.

Gross profits in the 30% margin, 35% margin range and positive EBITDA positive cash flow for the company.

WSA: Great, and so yeah, Miriam, can you provide more insight into the recent partnership with Watt Renewable?

Miriam Tuerk: Yeah, so Watt Renewable is an up and coming service company that is really focusing on the replacement of diesel generators with solar infrastructure for telecom. In emerging markets and also now in developed markets like North America, cell phone sites have to be able to operate even when the grid is unavailable. And so diesel generators, which is probably the most expensive, very high cost, it’s become cost prohibitive for operators. So there’s a strong cost driver that’s driving this program.

And also, of course, the green energy and dirty aspect. You can’t get worse than a diesel generator on a telecom site. And so what is a leader in an up and coming leader in doing a replacement program by deploying solar in replacement for diesel and moving to hybrid systems? And they selected us as their exclusive partner for the technology solution because our predictive analytics, cloud computing, and edge computing in our hardware allows us to do energy forecasting and energy management to deliver more solar and less grid diesel than any other company in the marketplace.

One of the reasons why the partnership is happening now in addition to the market trend is that Clear Blue completed an acquisition in Q1 of this year of a Swedish company called Esite. And that technology product together with two additional products that Clear Blue has launched has really changed our product portfolio from what was really a one or two product company in 2022 to a five product company and the Esite acquisition that we did we’ve integrated it with our smart analytics and that product together it really kicks buttin the market. So they selected us as their exclusive partner, and we’re able to deliver performance metrics better than anybody else in the market as a result of the technology.

WSA: Certainly. And so what are some of the key trends that you’re seeing right now in the sector, and how is Clear Blue position with your Nano-Grid product to be able to capitalize?

Miriam Tuerk: So we’ve expanded the addressable market of our business upwards by taking our Nano-Grid and expanding it to our Esite and Nano-Grid’s offering and down market into our satellite and IoT marketplace with our new Pico-Grid product.

So we now have a Pico-Grid product for IoT and satellite Wi-Fi. We have our Nano-Grid product and we have our Esite product to give a much wider product suite to step up to the addressable market.

The trend in the market is get off of the grid in any situation where the grid is not strong or reliable. And that is in a lot of places in the world and where it’s not easy or costly to bring the grid to the site. And then secondly, even in the developed markets like North America and the US where the grid is really reliable and we’re used to having it, when you see the problems like what happened in Maui, all this cabling and distribution, it’s not really a good thing. And so if you don’t need to connect to the grid, and you can go off grid with reliable standalone solar systems, then it’s economic, it’s very green and it’s much more resilient.

And so those are the market trends that we’re really responding to. In North America people are investing more in solar, obviously across everything they’re doing, not just because of the Infrastructure Act and the Clean Air Act, but because of the cost benefits, it’s cheaper to do it. But then the second thing is, when the lights go out in Georgia or there’s a fire in Maui, these systems stay online. They don’t cause the fires because they don’t have the power lines that are being distributed and they stay up and running independently. And so those large trends in the marketplace which are really accelerating and there’s a lot of financial investment that’s happening in the market.

While it’s very difficult to raise capital today in the normal markets that we are dealing with and I think that’s going to change in 2024 because of the certain recent changes and the fact that interest rates are going to come down and the treasury, the ten year treasury is responding accordingly. So investment has been really hard, but in the clean tech world, investment and solar, there’s a lot of money available and companies are taking advantage of that capital and those are the trends that we’ve been responding to.

WSA: Yeah, certainly. And as far as the install business is concerned, can you talk about what some of the other possible opportunities are there and possible joint ventures?

Miriam Tuerk: Yeah. So Watt Renewable is only one of a number of companies that are investing significantly in this marketplace. And we are currently in discussion with a number of them. Some of them are much bigger than Watt and the projects we’re talking about are multi-year and quite large ticket prices, so while we haven’t closed any business at this point, of course we would announce it. If you look at our sales funnel, we see a number of them expected to close early in 2024 to have a material impact on our business in 2024 and 2025. And those opportunities are in the sales funnel, they’re maturing, and we expect to be able to make more announcements similar to what we did with Watt Renewable in 2024.

WSA: And Miriam, how are management’s interests aligned with the current and also potential shareholders?

Miriam Tuerk: Wow, that’s an interesting question. So there are three co-founders in the company and the management team around those three co-founders, our CFO, our head of operations and our SVP of sales are really invested in the company from a compensation perspective, but I would also say that in the last two years, we’ve really had to help the company out and not take paychecks, help to put money in, cover expenses, a little bit to bridge. And so, we’ve put our money where our mouth is. We’ve helped the company through the period. We obviously did cost reductions in 2022. But one of the big things we’ve done in 2023 is we really looked at the business and we made a strategic decision that it was not time to pull back. Companies that invest in technology and invest in markets through downturns have historically shown to come out of those downturns with a real hockey stick result.

And while many in the marketplace have had to pull back a lot more, we’ve been prudent, we’re not wasting our money, but we are spending more than 50% of our funds on R&D. We did an acquisition and we’re doubling down on the business. And I can tell you that, my future is, personal future is tied to how the shares are going to do. That’s my retirement fund. And we don’t hold too big a position. Sometimes, you know, if the founders own 50%, that’s not good. We own between, I think somewhere in the, if you take us all put together management and the founders we own somewhere in the 15 to 20% range. We’ve held our stocks and we’re ready for a great uptick.

WSA: Great and yeah so before we conclude here why do you believe Clear Blue Technologies represents a good investment opportunity at this point in time today.

Miriam Tuerk: So a couple of reasons. The first is as a fundamental business, it’s important to understand that today, Clear Blue has 12,000 systems deployed in 37 countries around the world. And we are operating and managing those systems for our customers on an ongoing basis. So for a company of our size and where the stock price is, when you look under the cover and you understand we have five products, we have Marquee Customers, Nevada Department of Defense, Allentown, Pennsylvania, Vodacom, Telecom, telecom services companies as an example, there are no other companies like us at our size that have the depth and breadth of technology products, customers and ongoing services. That’s one reason.

The second reason is that if you go and look at our Q3 earnings report, you can see the graph but starting in Q2, then in Q3 and our guidance to the market is Q4. Also, we’ve had a real upturn in our revenue as a result of the expansion from two products to five products as a result of the investment and the timelines and our customers continuing to buy with us. And so our outlook for 2024 is very strong cash flow, positive EBITDA with really strong gross margins and a high top line. Well lastly, I would add is that with the markets going the way they’re going at this point now is really the time to invest in small cap stocks.

WSA: Well, we certainly look forward to continuing to track the company’s growth and report on the upcoming progress. And we’d like to thank you for taking the time to join us today, Miriam, and update our investor audience on Clear Blue. It’s always good having you on.

Miriam Tuerk: Thanks so much, Juan. Wishing everyone the best of the season and a really great 2024.