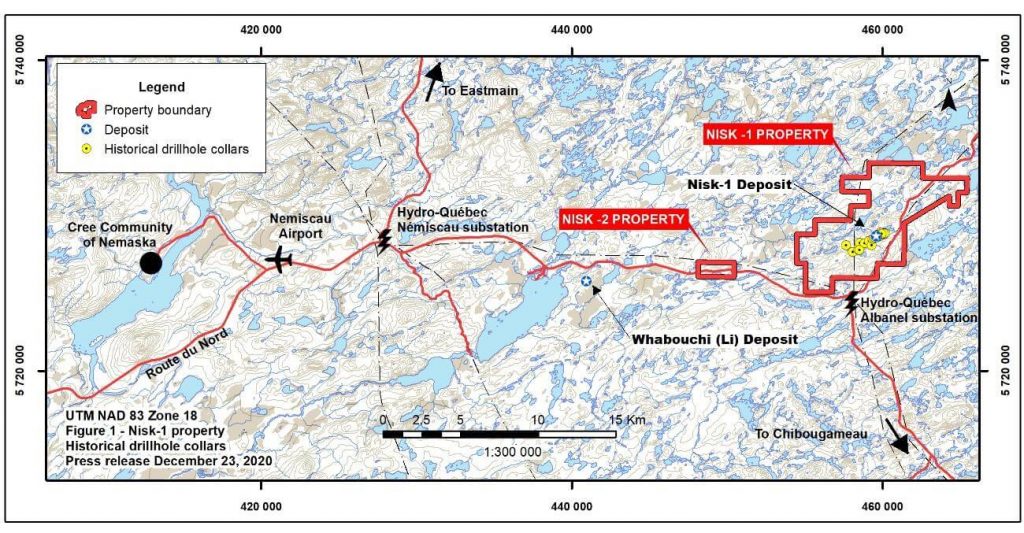

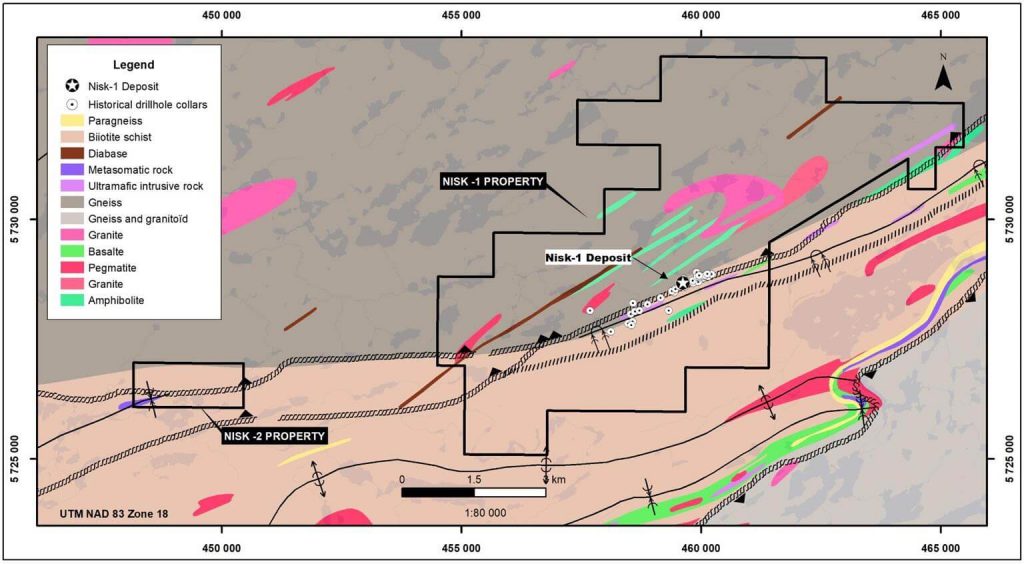

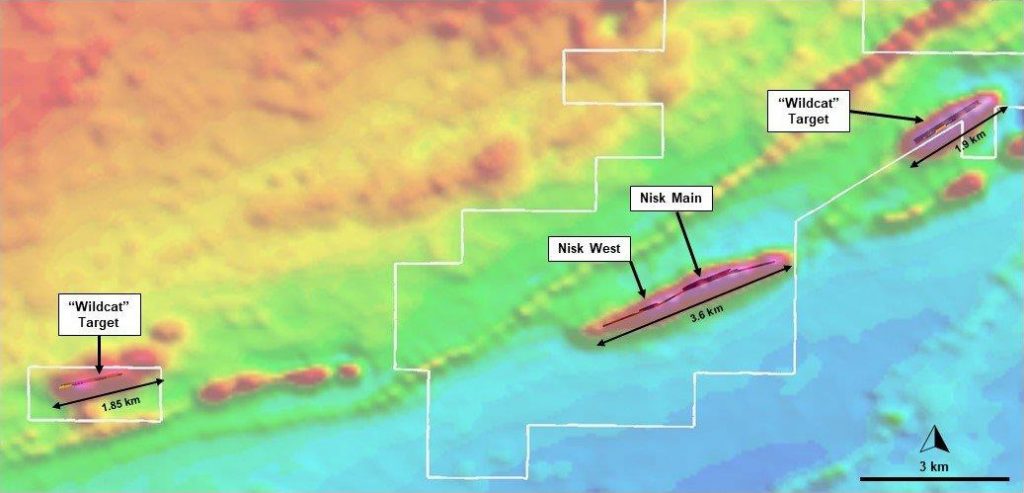

Power Nickel is a Canadian junior exploration company focusing on high-potential copper, gold and battery metal prospects in Canada and Chile.On February 1, 2021 Power Nickel (then called Chilean Metals) completed the acquisition of its option to acquire up to 80% of the Nisk project from Critical Elements Lithium Corp. (CRE:TSXV)The NISK property comprises a large land position (20 kilometres of strike length) with numerous high-grade intercepts. Power Nickel is focused on expanding the historical high-grade nickel-copper PGE mineralization with a series of drill programs designed to test the initial Nisk discovery zone and to explore the land package for adjacent potential Nickel deposits.

INTERVIEW TRANSCRIPTS:

WSA: Good day from Wall Street, this is Juan Costello, Senior Analyst with the Wall Street Analyzer. Joining us today is Terry Lynch. He is the CEO at Power Nickel Incorporated. The company trades on the TSX Venture PNPN and on the OTCQB, PNPNF. Thanks for joining us today Terry.

Terry Lynch: Great to be here Juan. Nice to see you again.

WSA: Yeah, sure. So can you please start out with an intro of the company for some of our listeners that may be new to the story, didn’t catch our interview, which was about four months ago?

Terry Lynch: Yeah, sure. So we’re basically based in Toronto and with our primary project in Quebec called NISK. It’s a nickel sulfide project and it’s very advanced. We’ve had some enormous success with the drill bit this year and we’re tracking to become Canada’s next nickel sulfide mine. And we think we’ve got some great results out today and we have some — just following up some other great results. So it’s a very undervalued play at the moment relative to other peers, and that nickel sulfide business we’re trading at probably I would say 1/6 to 1/20th of their value and I think our mine will ultimately maybe be one of the best. So it’s certainly time to be looking at Power Nickel.

WSA: Great. Now that we got the introductions out of the way. Can we talk about some of this exciting news and activity that you have going on…

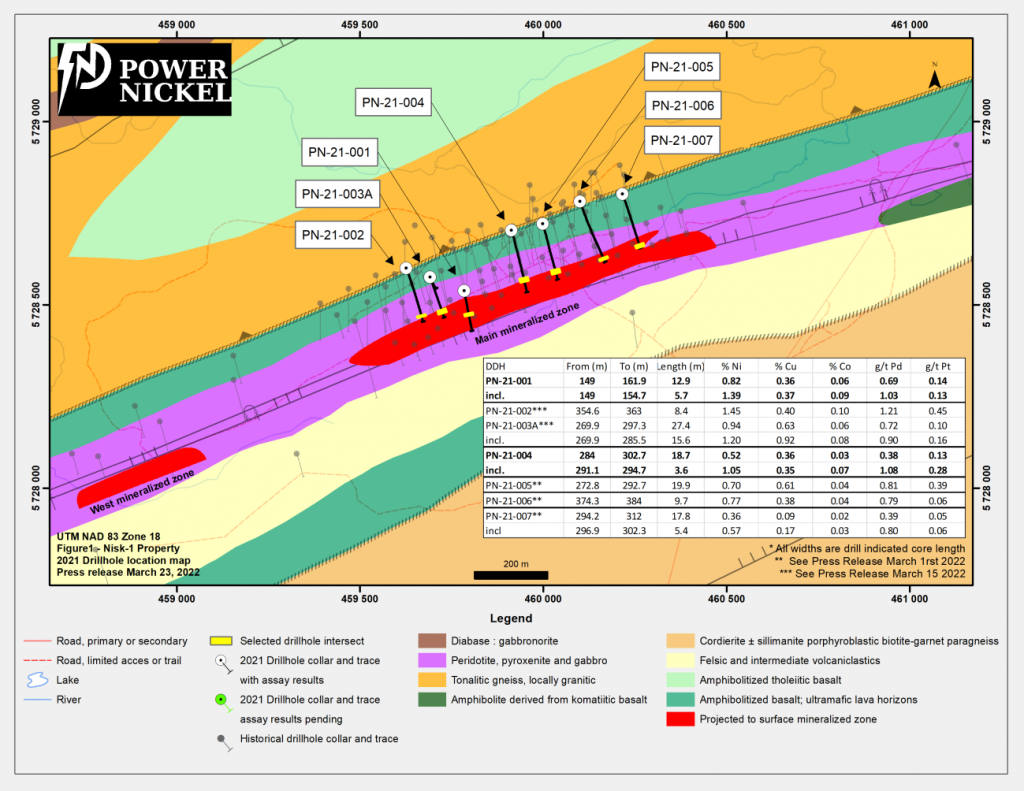

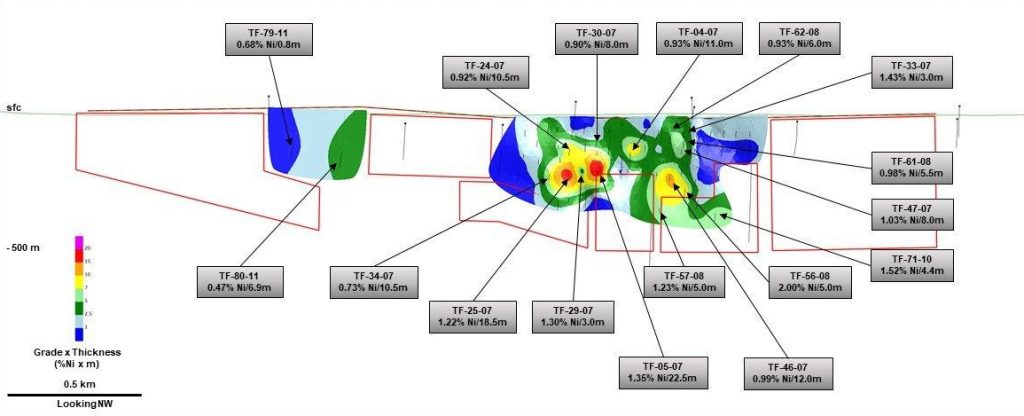

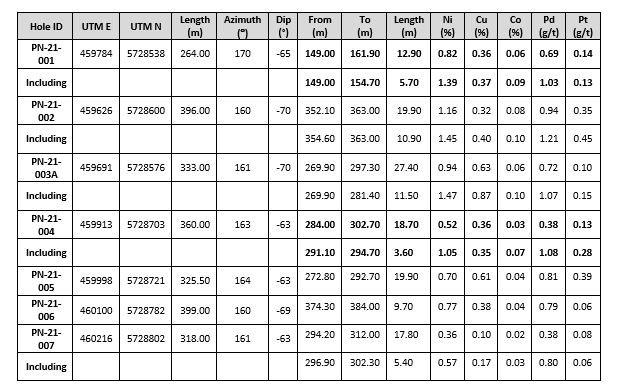

Terry Lynch: Yeah, I’m thinking since we last spoke, we’ve probably had three major assay releases. Each one has had — probably 60% of our holes have 1% nickel loss. And in the last three releases, we had one hole was 40 meters of about 1.6% nickel which would be a top five hole in nickel anywhere in the world. But then we followed that up with a 10 meter hole of almost 3% nickel EQ, and then today 60 meter hole of somewhere between 1.5% and 2% nickel EQ. So it just shows this river of nickel that we’ve sort of described in our press release is very discoverable and very robust, and it’s got a lot of great intersection.

So our feeling is that with what we’ve done historically and what we’ve been finding with the drill bit that we feel comfortable that we’re going to – when we update our 43-101 this summer, we’ll probably be getting somewhere between 8 to 10 million tons of about 1.5% nickel, and that’s a mine. And what is cool about that is that in the last month, that I don’t think people really appreciate what has happened financially speaking is that the Quebec governments and the Canadian governments have made some massive changes in their approach to critical minerals and they’ve basically committed to providing up to 55% of your capital costs as tax credits to build your mine, so that is amazing. So imagine some of these — if our mine would pass 400 million to get into the nickel wire powder and anode business which is like a high end nickel mine which is what we would be looking to build here. Imagine somebody is giving us $200 million and our market cap is 25 and we’re“knocking it out of the park” with our drill bits. So it’s like, I don’t know, somebody is missing something out there.

WSA: Yeah, we’ll talk more about that — maybe the project is a hidden gem. Talk about that next project, your position there in Quebec and what kind of grades you’re getting, and you have a pretty big strike length there.

Terry Lynch: We basically we’re working right now a kilometer of section, about a square kilometer, and the intersections have been ranging really maybe five meters up to 40 meters. So lots in the 10 to 25. So very good intersections for nickel and massive nickel sulfide. So that contains generally speaking a little over 1% nickel, usually like 0.5% to 0.6% copper, 0.08% cobalt and about 1.5 grams of PGMs and very PGM rich. So all that adds to a very high nickel EQ in 1.5-2% range, so super profitable rock. And it’s near surface, so it actually goes up to the surface and the average depth is probably 300 meters. So it’s very discoverable, very easy to get out, luckily because we’re in Quebec we’re blessed. We have tremendous infrastructure, we’re off a major highway. Across the road is a major Hydro Quebec substation. So this will be powered by green energy and this will be the greenest nickel mine in history I think, and we’ve really stumbled onto something fantastic here.

WSA: Yeah, and you also have a position in the Golden Triangle.

Terry Lynch: Yeah. Obviously our focus is on NISK at the moment, but our gold and copper projects in BC and in Chile, they probably historically used to trade at these levels. And now that the copper gold market is coming back, we’re actually going to spin these out and there will be some announcements on that in the next couple of weeks, and that will be a nice bonus for our shareholders. So for sure, yeah, there’s some very attractive projects there. What’s interesting, one of the techniques we’re going to be using at NISK, to find more nickel, is a technique called Ambient Noise Tomography and it’s from a company called Fleet Space Technologies and they’re basically out of Australia and they’ve been very successful in Australia. And also now with Talon Metals in Minnesota and Michigan area with the Tamarack deposit helping them find more nickel.

So that’s how we learned about it, is I guess probably Elon Musk brought it to Talon, I think he was the guy who put the satellites in the sky for Fleet. And what their technology is, it’s basically a sound mapping. So they send pulses down in the ground, it comes back as a sound map. They correlate that to your hard data once drilling has been accomplished, and that allows them to — within a few days tying in the IP and airborne EM, etcetera. With all this data they can visualize the deposit at depth, and it helps you in a number of ways. So for example, it would help us find the various twists and turns of a deposit, so you don’t leave any chunks of nickel, gold down there. And then it also set a signature so that nickel is quite often stacked, so we’ve got the first stack here up top, there could be a couple of other stacks underneath this. So that will help us to identify those and drill those and in a cost effective way. And then finally, we’re working just one kilometer of this section, and we got 45 square kilometers. The ultramafic sequence is five and a half kilometers. So, we’re going to be able to sort of see where on that ultramafic sequence this sound map correlates and drill that more aggressively. So it’s pretty exciting stuff.

And we look forward to getting at that. We’ve stopped drilling at this point in time for the year, for this winter campaign. We’ve probably got three more sets of assays to come. So lots of assays be every two to four weeks coming here. And then we’ll put that fleet technologies to work in early June and start drilling again in mid-July. And we’re fully funded. We just completed a $4.8 million financing, and we’re in good position cash wise until I guess 2024.

WSA: Yeah, that’s great. You mentioned Elon Musk, can you talk about some of the trends that you’re seeing right now as far as nickel and, what the market opportunity is? I mean, it’s really undersold right now.

Terry Lynch: Yes, it really is. Nickel is probably the most misunderstood right now, because lithium gets all the rage, but as important, I would say, is nickel in the batteries. And there’s two fundamental drivers to the nickel story, one is urbanization, and that’s, it’s basically stainless. 70% of the market for nickel is stainless steel. So as people move from villages to cities and towns and buy pots and pans, fridges and stoves, that’s stainless. So there’s that growth. But then the big one that’s really kicked in is the electrification, which is the battery side of things. And obviously, I think we’re doing about 10 million EV carriers right now. They’re expecting within four years that’ll be 40 million. So, right now EVs are about 10% of nickel, but expected to rise up to 50%. I don’t know if we’ll ever get that far, but that would have tremendous impact on the nickel market. And, not all nickels made are equal, so you have led rights and we have, low grade sulfites, and then you have the high-grade sulfites. So, the easiest way to get to class one nickels from a high-grade sulfate. So, that’s what we’ve got. And we think there’s a real demand, thanks to the Inflation Reduction Act and the governments of Canada and Quebec, you know, obviously, everyone’s focused on getting the supply of chains back to North America and to make sure that we have what we need to run our economy. So, couldn’t be a better time to be into high grade nickel. And that’s what we’ve got.

WSA: Yeah. Great. And perhaps you can talk about your background and experience, Terry, who the management is, and what’s your skin in the game?

Terry Lynch: Yeah. I’ve been an entrepreneur most of my life. I’ve been in the resource sector for the last I guess 10, 12 years. I’ve started a thing called “Save Canadian Mining”, where we advocate like the Wall Street Bets crew. And in fact, we started it before them about the predatory short selling, which often happens in this space. And our partners in that were Eric Sprott, Sean Roosen and Keith Neumeyer, some of the luminary figures in mining. Big names. And skin in the game? In the last two financings last November and now, the Lynch family has been the biggest single investor. So we put over $2 million in the last two financings. So, I guess we’re either insane or committed. I’ve been telling the world this is going be a mine and this is going be a great mine, and at some point they’re going listen to me. But I’m not sure when, but it’s coming, because the results are going to keep on coming.

WSA: Yeah, I look forward to seeing those announcements. And also, for our listeners, those will be available on our site here as we’ll continue to post your upcoming announcement.

As I’m pulling up your stock chart here, looking at US on the OTCQB as mentioned, PNPNF, 17 cents a share US Market cap at about 24 million. I’m not sure the market cap is right, on Yahoo?

Terry Lynch: But yeah, you know, it’s funny because it’s like a volume of like 7,000 shares, if you tried to buy half a million shares in the US the stock could be 25 cents probably, and then starting to head up. But when I look at it and I compare ourselves and we have a PowerPoint on our site. If people went to powernickel.com, you would find a presentation, and there’s comparables in there where we look at the other nickel sulfite mines in the world that are not yet mines that are — obviously have a perception in the market that’ll be commercial. Well, those mines are basically trading up between 150 million and 500 million. And we’re at 25, I mean, it’s just ridiculous. So that will change, I am not sure exactly when it’s going change, but it’s going to start to change soon. And it’s a great opportunity for investors to be picking up these fallen nickels, as I call it, Juan.

WSA: Right, like pennies from heaven but better. What about, you know, nickels from space? Well, I was actually kind of getting to what I was going ask you before you’re on the Wall Street Analyzer, so, pretend you’re on the couch, you’re talking to a shrink, what do you want to vent about the stock performance?

Terry Lynch: You know, what I think happened is obviously, you see it trending up there, it got to 35 (cents CD), and actually that’s when we released that 10-meter whole of 3% nickel, which is a rock star whole. But they knew that we needed money so that the shorts just pound you down. So we said, okay, better take the money. So, and do you know what we raised the money at Juan? We raised the money at 50 cents, my friend. $4.8 million at 50 cents. So, very accretive round for our shareholders, because in Quebec you can do these things, because the incentives are there. And this is not flow through that’s going to come back and hit us in four months, because the back end, we sort of bought it like myself, the top five shareholders bought 65-70% of this round, that stock is not coming back. So, I mean, it’s amazing to me that this thing is not rocking, but eventually it will, it’s just that people are a little, maybe they saw the down trend and say, “Hey, what, why is that?” They’re not really understanding that this is what happens when you’re financing. But we’re going to have so much good news coming over the next two months that eventually, and then we’re going to be updating our 43-101 in July. And I guess at worst case, maybe it happens in July, but in July, it’ll become quite apparent, that this is going to be a nickel mine and nickel mines certainly don’t trade down here. And honestly, we may never need to raise another dime, which is a bold statement. I mean, we’ll raise money, but not necessarily through the market, because we’ve got industry to the table now. And there’s other ways to skin the cat. We won’t be giving it away,

WSA: Are you saying you would take joint ventures and strategic alliances off the table?

Terry Lynch: Yeah. You see, I I think that what the interesting part is, you know, with the government being prepared to finance up to 50% of the mine, now it’s a question for us proving the mine is viable. So that would be do some feasibility study, et cetera, which is something that we’ll certainly be considering in the near future. And once that’s in place, then I think we’ve got people that would like to assist us in that exercise, some fairly major companies, then the financing could be done all sort of outside the market. So I think people have not really figured out the vast change in the nickel world as a result of these strategic, critical mineral initiatives and the financings that are available because of them. And there’s not just for power nickel, but there’s other, I would say high quality companies like in Quebec that are not, people are not understanding this huge benefit that’s going to create a lot of value for the shareholders that’s now been announced.

WSA: So, yeah. Before we conclude here, Terry, why do you believe investors should consider the company as a good investment opportunity today?

Terry Lynch: Well, number one reason is we are well financed. So we’re not going to be going back to the well there’s no dilution in the financing. We’ve basically delivered everything we said. We said, we’re going to deliver good results, we delivered good results. We got three more sets of assays to come. They’re more good results, folks, I’m telling you that right now. And we’re basically closing the gap on us and the other people that have commercially perceived nickel sulfide mines, yet we’re trading at a fraction of the price. So at the end of the day, we’re in the, probably the most politically safe jurisdiction or one of the peers in that space for sure. Canada is awesome. Quebec is the best place to be doing business right now in critical minerals, because you get two for one exploration and you get two for one, building your mine. So it’s really a sensational opportunity and I’m pounding the table hard, because the evidence is very compelling.

WSA: Well, we certainly look forward to continuing to track the company’s growth and report on the upcoming progress. And we’d like to thank you for taking the time to join us today here, Terry, and update our investor audience on Power Nickel. It’s always good having you on.

Terry Lynch: Juan, it’s been a pleasure to be here and it’s always great to see you and look forward, to chatting with you again as we put out some more assays and more news in the next few weeks.

RECENT NEWS: