Terra Clean Energy is a Canadian-based uranium exploration and development company. The Company is currently developing the South Falcon East uranium project within the Fraser Lakes B Uranium Deposit, located in the Athabasca Basin region, Saskatchewan, Canada as well as developing past producing Uranium mines in the San Rafael Swell Emery County, Utah, United States

INTERVIEW TRANSCRIPTS:

WSA: Good day from Wall Street. This is Juan Costello, Senior Analyst with the Wall Street Analyzer. Joining us today is Greg Cameron, he’s the CEO at Terra Clean Energy Corporation. The company trades on the Canadian Securities Exchange, TCEC, as well as on the OTCQB, TCEFF. Thanks for joining us today there, Greg.

Greg Cameron: Thank you for having me. I look forward to chatting.

WSA: Yeah, for sure. So please start off there by providing us with a intro and overview of the company.

Greg Cameron: Okay, perfect. Well, Terra Clean Energy is a microcap explorer and soon to be producer of uranium. We have assets in Saskatchewan and the Athabasca Basin in Canada, and we also recently have announced a foray into the San Rafael Basin in Utah, past-producing assets there that we’re very excited about.

I took the role as CEO here in January after a leading consortium of investors invested three and a half million dollars and restructured and recapitalized this company. The thesis at the time was we believe that there was significant upside in exploration drilling as we have a low risk shallow at-surface deposit in the Athabasca Basin. And we felt with the $10 million of prior exploration work and drilling done by Sky Harbor and Denison, that we could significantly enhance that asset. Also, at the time, it was our business plan to add other assets. And with everything going on in the United States as it relates to AI, electrification, cryptocurrency, and really the unsatiable demand for power, that we really wanted to add an asset base there. And I’ll talk a little bit about what we did in Utah this week, which in my opinion is completely game changing for the company. Having acquired nine past-producing mines with visible uranium at-surface, we think there’s a big opportunity there. But you know, our plan here over the next 12, 18 months is to drill out and work both properties and add significant value to the shareholders.

WSA: For sure. So, bring us up to speed there on the most recent news as you just announced, the earn-in for 100% interest in those 75 past-producing uranium claims.

Greg Cameron: Yeah, yeah. Perfect. Well just two days ago on September 16th, we announced the acquisition of 100% interest in 75 past-producing claims in the San Rafael swell in Utah. These are covering nine past-producing uranium mines that produced several hundred thousand tons of ore grading up to 1% uranium. It’s visible uranium, vanadium, copper, cobalt at-surface. You’ll see in that particular press release that our VP of Exploration took readings and there’s actually a press release of the actual readings. CPS counts over 21,000, which equate on an assay to approximately 0.22% uranium right at-surface, visibly there. All of these past-producing mines are in close proximity to major roads. They have good secondary access, there’s power, water there.

There’s strong government support in the US for nuclear power and uranium under the Trump administration. And it is our belief that these are assets that have a lot of upside to them. All of these mines have historic production from the 1950s, 60s and 70s, and it’s pretty clear to me in our research that these mines stopped producing in the 70s more because of the market collapse, not because they ran out of ore. There is a lot more opportunity and a lot more ore there that we believe we have access to, and we’re very, very excited for that to be our initial foray into the United States.

WSA: So, yeah. What are some of the key trends that you’re seeing right now in the sector, and how’s the company now positioned to capitalize?

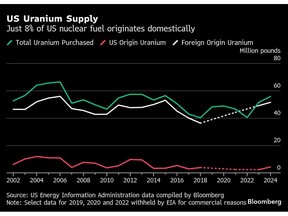

Greg Cameron: Yeah. No, it’s exciting time. So a little history on uranium. Early 2000s, there was a massive bull market in uranium. Went to about 2011, prices hit up to over $140 a pound of uranium, which they currently sit around $77 this morning on a spot basis. But in 2011-12, the accident in Japan, the Fukushima accident, everybody went dark on uranium, and that market collapsed. I believe spot went down to low teens at one point and really sat there for years. Nobody was building new reactors. Reactors were being closed. Nuclear was not talked about in any way, shape or form. And what’s really changed in the last three or four years and what’s really driven spot back to $77 and has been as high as $100 and firmly, I believe, based on the supply demand and the building of all the new reactors all around the world, you’ll see spot back up towards $140 at some point in the next couple of years.

But basically what’s happened is the unsatiable demand for power. Cryptocurrency, AI, and data centers, the amount of power required for these data centers that are being built all over the world to drive this demand for AI is just crazy. You’re starting to see Facebook, Microsoft, Meta, all the guys basically buying their own gigawatts of nuclear power, buying old reactors, investing into the sector because they know they need that power. That’s really the area that needs more investment. And under the Trump administration, they’ve decided to fast track permits on mills and mines to invest heavily in old uranium mines and nuclear power is really, as everybody believes, the cleanest, safest and most stable way to produce base load power for industry. And we’re caught in the middle of that.

And I think where we have a 7 million pound resource in Saskatchewan in the Athabasca Basin, which is on infrastructure. It’s 70 miles away from a mill. We have a power line off the end of the property, and we’re starting with 7 million pounds of at-surface lower grade uranium. But we believe and we saw this based on our winter drill program last year, that we can easily add pounds to that resource and more importantly, up the grade. And the four holes of the seven we drilled last year in Saskatchewan hit grades five and six times historical resource there. So we’re excited about the project in Saskatchewan. And then I just touched on earlier the recent acquisition of these claims and the San Rafael swell that really have had no work done on them in 40, 50 years, but there’s very clearly a lot of ore left there to be processed.

And at 77 and going higher, both of these projects are very economic and continue to get more economic. And we believe strongly that over the course of the next 12, 24 months, 36 months, that we’ll be looking towards either selling these assets to a producer because we think we’ll be that type of opportunity for someone who already has production or looking at putting some of these mines into production ourselves at some point. So very low risk way to play the sector, in my opinion, on a market cap of $7, $8 million today. And really that’s only because the company was just restructured last year under a former management team. They ran into some difficulty raising money and developing the assets. And the team I’ve put in place have changed that and will continue to drive these things forward.

WSA: And yeah. So what are the key goals and milestones that you’re hoping to accomplish?

Greg Cameron: Yeah. So specifically in Saskatchewan, you’ll see drilling either later this fall, or if we run out of daylight quickly, it’ll happen early next winter. But we’ll go drill another 2,500 meters following up on our winter program last year of 2000 meters. We’ve identified a new area of interest where we ran into 5X and 6X the grades, and we believe there’s a very good setup for us to find what I would call a basement-hosted unconformity uranium deposit, a high grade deposit of somewhere between 2% and 5%. So we’ll drill that in Utah. You’ll see us — first of all, we have to close this deal, probably be in another couple of weeks officially. And then we will add some more land to our package down there, and we will immediately get in and probably apply new mining technologies to that area. 3D mapping, some really easy stuff that we think we can really link what the opportunity is down there. And then some light drilling probably mid next year to really start to determine and bring the resource that’s there into present day standard.

WSA: And perhaps you could talk about your background and experience as well as the key management.

Greg Cameron: Yeah. So I’ll start with myself. I’ve been in the capital markets for approximately 25 years. I’m a former investment banker that retired in 2012. I worked at numerous Canadian investment banks, BMO Nesbitt Burns, Canaccord Genuity, Orion Securities, which became Macquarie when they bought us in 2011. And I sat on numerous boards. After leaving Macquarie in the investment banking side, I worked at a hedge fund called Salida Capital. We were the largest mining, oil and gas investor in Canada, one of the largest in the world I believe at the time. And we ran a significant portfolio of mining and oil and gas assets. So I have a lot of experience investing, building, restructuring, sitting on boards. And this is the first time I’ve actually taken the role as CEO. And the reason for that is I believe that the opportunity here is significant enough that I want to be involved in the early decisions and setup of the company, along with putting my own capital to work.

Beyond me, Vice President of Exploration is a gentleman named Trevor Perkins. Trevor’s a 25 year veteran of the uranium exploration business. He was VP of exploration at UEX, which sold for a billion dollars last year. And prior to that, he spent, I think 14 or 15 years at Cameco. He is credited with three discoveries in the Athabasca Basin, two for Cameco, the McArthur River North Extension, and a couple of others. Very, very knowledgeable, very experienced, and we’re delighted to have Trevor on board with us full time. And the rest of the guys we’re using at currently just to be economic, are on a consulting basis, all working for Trevor on the exploration side. And we have a strong board [compromised] of Tony Wonnacott, Alex Klenman, and soon others that all have experience in the mining and capital markets.

WSA: As far as the future growth, are you considering more joint ventures and strategic alliances, or are you just going to concentrate on this?

Greg Cameron: No, I think the plan right now is to develop the current assets we have, focusing on both Canada and Utah. You’ll see over the course of the next 6 to 12 months, you’re going to see drilling. We’re fully permitted to get in Saskatchewan right away. We have access through First Nations. So we can get in there as soon as applicable, hopefully this fall, but for sure early next year. And drilling those holes 300 meters in the ground. It takes two days to drill a hole. We have results pretty much immediately, and then the assays follow up several months later. So lots of news on Saskatchewan coming.

Specifically in Utah, you’ll see more property acquisitions as we build our portfolio and make sure that we grab all the better land down there, where we have the first mover advantage where the transaction we just announced those assets were purchased from an older gentleman who’s been sitting on these assets for 40 years. So we found those, we locked those down, and you’ll see a few more deals of assets like this and some even better with actual resource on them. And then we’ll get to work immediately there later this fall upon closing these land deals and do some initial mapping and then some drilling in Utah as well. So, plenty of news to come and particularly as it relates to the company. And then I think you’re going to see real interest in uranium this fall. I think the supply, demand curve, the US utilities in the market to buy uranium, the specific uranium trust, like the Sprott Trust, and there’s one listed in the US as well, that actually acquire pounds of uranium off the market to hold as an investment. You’re going to see a lot of demand for uranium and a lot of news coming, so really exciting times.

WSA: Right now current share price on the CSC is 15 cents a share, market cap at about 6 million Canadian.

Greg Cameron: Yeah, very cheap. Very cheap. The assets alone, Juan, on Saskatchewan that we owned, in 2011, Denison Mines purchased those assets from a company called J&R Resources at $1.65 a pound in the ground. So 6.96 million pounds of resource. They paid $1.65 for each of those pounds. That particular resource is the same and probably more pounds based on our drilling last winter. And today it trades at 30, 40 cents in 2011, spot price was $38 when they bought that asset. Today it’s $77. So there’s a major disconnect on value as it relates to this story, and it really stems from the fact that I restructured the company just recently, right? I took over as CEO in January. So I was quietly building the asset base, as you saw from the announcement in Utah this week and now it’s time to get out and actively market and tell the story. So I believe and you’ll see significant value appreciation in the assets and hopefully in the stock as we roll out the business plan.

WSA: Right. And the US price 10 cents a share. And so before we conclude here, why do you believe investors should consider the company a good investment opportunity today?

Greg Cameron: Well, as I just said, quick summary. We got a current resource that’s worth a lot more than the market cap of the company in Saskatchewan. We’ve added nine past-producing mines in Utah. You can see from our press release, there is visible uranium at-surface, along with cobalt and other minerals. As I mentioned, those mines were abandoned because of a price collapse in the market in the 70s and basically acquired by an older gentleman who’s owned them to the date.

They weren’t basically walked away from, because they ran out of ore, the market collapsed. So we think there’s significant opportunity in those assets and having purchased control of them for basically less than the 10% of the shares outstanding in the company and a half a million dollars US of cash payable over five years, I might add. We think there’s significant value in those as well. You got, as I mentioned earlier, an expanding uranium price environment due to electrification, AI, cryptocurrency, mining, and in both jurisdictions, Utah and Saskatchewan, all the infrastructures in place. So we think we’ve got all of the boxes checked as it relates to investing in the smaller type companies like ours. And now is the time to really get involved as we continue to announce things and add to the asset base.

WSA: Well, we certainly look forward to continuing to track the company’s growth and report on the upcoming progress and we’d like to thank you for taking the time to join us today, Greg, and introduce our investor audience to Terra Clean Energy. It was great having you on.

Greg Cameron: Yeah, thank you very much. I really appreciate the opportunity to come here and tell our story and I look forward to working with you following up as we continue to move things forward here.

Be the first to comment