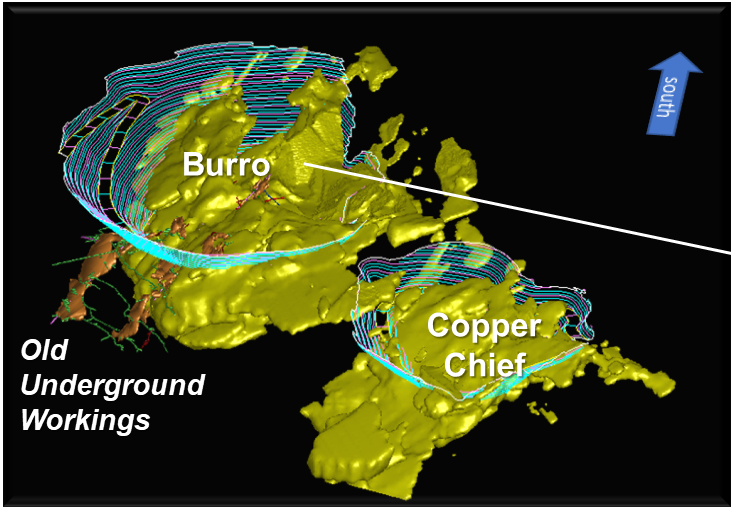

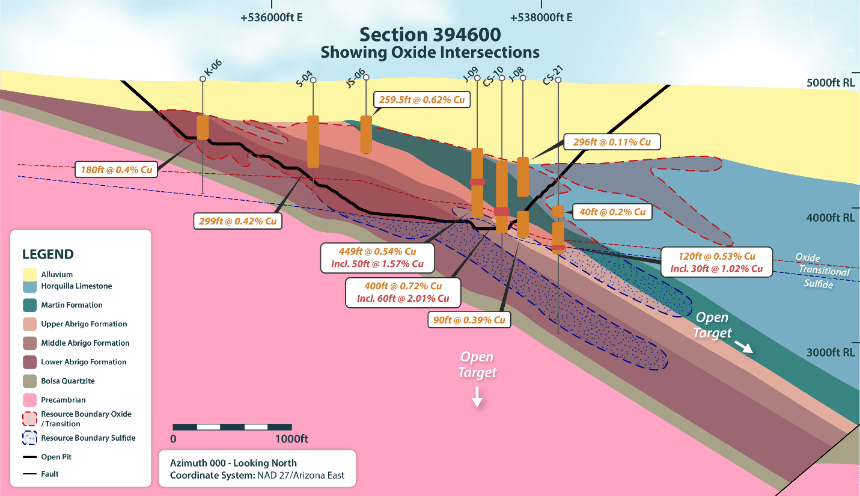

Gunnison Copper Corp. is a multi-asset pure-play copper developer and producer that controls the Cochise Mining District (the district), containing 12 known deposits within an 8 km economic radius, in the Southern Arizona Copper Belt. Its flagship asset, the Gunnison Copper Project, has a Measured and Indicated Mineral Resource containing over 831.6 million tons with a total copper grade of 0.31% (Measured Mineral Resource of 191.3 million tons at 0.37% and Indicated Mineral Resource of 640.2 million tons at 0.29%), and a preliminary economic assessment (“PEA“) yielding robust economics including an NPV8% of $1.3 Billion, IRR of 20.9%, and payback period of 4.1 years. In addition, Gunnison’s Johnson Camp Asset, which is now in production, is fully funded by Nuton LLC, a Rio Tinto Venture, with a production capacity of up to 25 million lbs of finished copper cathode annually.

INTERVIEW TRANSCRIPTS:

WSA: Good day from Wall Street, This is Juan Costello, Senior Analyst with the Wall Street Analyzer. Joining us today is Craig Hallworth, He’s a CFO over at Gunnison Copper. The company trades on the Toronto Stock Exchange, GCU as well as on the OTCQB GCUMF. And I’m Frankfurt at 3XS0. Thanks for joining us today there, Craig.

Craig Hallworth: Juan. So good to be with you. Good morning.

WSA: Yeah, good to have you on. So please start off there by providing a intro and overview of the company.

Craig Hallworth: Right. Well, Gunnison Copper, I think it’s a really interesting story. We’re a pure play copper developer and now producer. We’re located in southern Arizona, the best place in the United States to be mining copper. And we’re really excited because we just announced today our Johnson Camp Mine, which has been under construction for the last year with our partner Nuton, which is a subsidiary of Rio Tinto. We just announced our first production, the first copper coming out of the plant, and it’s a beautiful site. So I’m really excited, Juan, to tell everyone all about that today. But the other thing I’d like to just mention is our Gunnison flagship project. This is a big one. This could provide up to 8% of the United States’ consumption of its needs. It’ll produce about 80,000 tons or 170 million pounds of copper per year. It’s at the PEA level, it’s got robust economics, 1.3 billion NPV and a 21% IRR. So I’m really excited to tell all the listeners a little bit more about that today on the call.

WSA: Yeah, great. So yeah, bring us up to speed there on some of the most recent news. As just today– September 3rd—you announced the first copper production there from the Johnson Camp Mine.

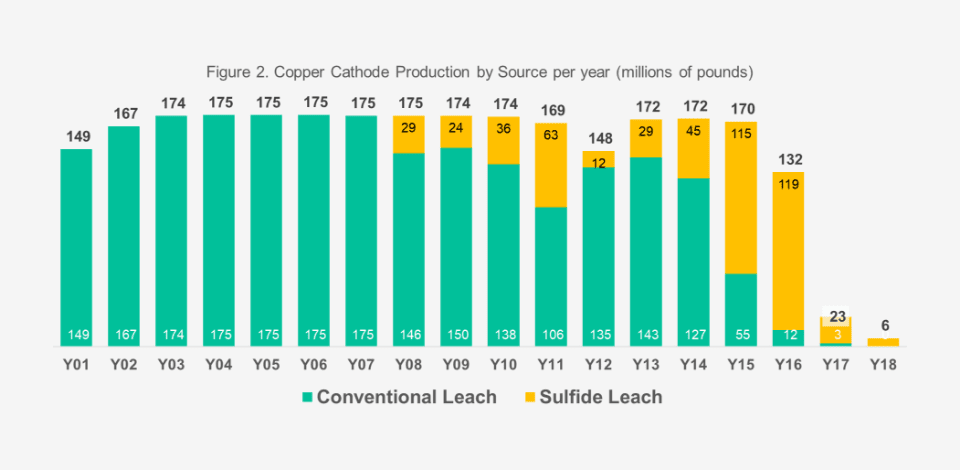

Craig Hallworth: Well, Juan, I was at the mine site last week and actually the first copper rolled out of the plant last week, and again, it was just a beautiful sight. I think everyone really loves a mine restart and that’s what we’ve got here because the Johnson Camp Mine, it’s been around since the 1970s. It was one of the first mines to ever use the SXEW technology, which I’m sure most of your listeners know. This was a revolutionary technology that allowed heap leach and processing of oxide copper into a finished product right here in the United States without the use of a smelter. So it was very exciting back then and we were part of that. And now today, fast forward to 2025 and we’re actually demonstrating what I think is the next revolution in copper processing technology.

Nuton LLC’s technology, it’s a sulfide leach now. So in the 70s, we were talking about oxide leaching. Fast forward 50 years, we finally are now unlocking sulfide leaching, and that’s going to allow us to make finished copper at the Johnson Camp Mine from sulfide ores, which you know, Juan actually comprise about 70% of the reserves in the United States today. And we’re going to do that a lot cheaper in terms of OpEx and upfront CapEx than you would be able to if you were producing a concentrate, shipping it over to Asia, smelting, refining, so on and so forth with all of that freight and penalties and TC/RCs. So it’s great that we’re able to take American ore and turn it into American copper, the finished product, not a copper concentrate, and we’re doing that right at the Johnson Camp Mine, and we’re going to be selling all of that copper domestically.

So that’s why it’s very exciting. And the second point I’ll just say is as we’ve been advancing this construction and restart, we’ve done a lot of work with our SX-EW plant, with refurbishments, with building a new leach pad, an 8 million square foot facility. It’s really quite breathtaking. If you take a look at our website, gunnisoncopper.com, you can see a time lapse video of the construction. We went from sort of an empty desert all the way to this beautiful leach pad all within about a year. And so what that’s done is really de-risk this, and we’ve demonstrated the de-risking with that first copper production. Now our goal is to ramp this up to the full capacity of 25 million pounds a year. And I expect that we’ll hit that mark by mid 2026. So if you take a look at the copper price, 25 million pounds a year, we should be north of 100 million in revenue by next year.

WSA: So yeah. What are some of the key trends that you’re seeing right now in terms of copper and how is the company positioned with your project to capitalize?

Craig Hallworth: Well, you’re seeing a big push from the federal government, right? Everyone’s seen it, everyone’s heard it. They’re talking about increasing the domestic supply of raw materials like copper. They want producers and developers like us, Gunnison Copper, to find and advance and start producing copper. They need this raw material because it’s part of the bigger program here to start making more things domestically, making them in America. So the fact that we’re producing the copper into a finished product in the United States, I already mentioned it, but I’m just going to say it again, it’s really important to helping the country meet this agenda.

And we’re seeing a lot of investments too, Juan. We’re seeing the Department of Energy, they’re giving out a lot of money for projects like ours. And in fact, they did give us money. They gave us 13.9 million, which I expect to receive and monetize in Q4 this year. We’re also seeing now the Department of Defense taking direct equity investments and other stimulus coming through various means. So the federal government is making sure there’s a lot of stimulus out there, a lot of programs. And I think Gunnison Copper is well positioned as a new producer and a producer of finished product in this country to get further stimulus from the federal government.

WSA: So, yeah. What do you feel makes Gunnison unique from some of the other players in the sector and some of the other projects that perhaps you’ve had experience with in the past?

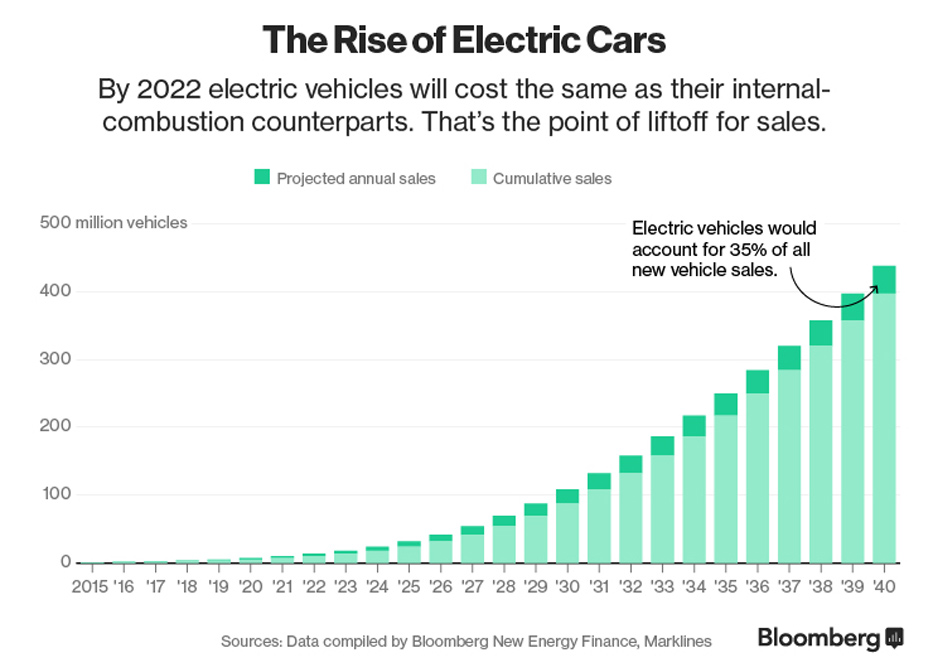

Craig Hallworth: I think if you take a look at the sector, you should be looking at Southern Arizona, if you’re looking to get into copper. If you want exposure to the metal as an investor, if you want leverage to the metal, you’re not going to be buying the metal, you’re going to be buying a miner or a developer of a project, because that’s going to give you that leverage to the copper price, right? Because those cost bases and the miners, those are fixed. So when the price increases, which we certainly expect it to, given increasing demand. I mean, take a look at artificial intelligence, take a look at the data centers. There’s about 27 tons of copper per megawatt of applied power in every data center. You saw announcements, massive announcements. You saw the Stargate program, that’s an open AI announcement, $500 billion.

You’ve seen other announcements, you’ve seen up to $2 trillion in the next five years on artificial intelligence, data centers. And there’s going to be so much copper, Juan, used in those data centers, especially in the United States. And that’s why we need the copper to be produced in the United States so we can control it and put it into those data centers. Now, coming back to your question is what makes Gunnison Copper unique? Why should investors look at this stock? Well, I think if you look at the possible vehicles, there’s not that many that are pure copper. Gunnison Copper is a 100% copper play. Of all of our revenue, not a single dollar is coming from something other than copper. So if you really want to play copper and get leverage to the copper price, you’ve got to buy Gunnison Copper.

Now on top of that is, we have something that the other projects out there don’t have, right? We have our Gunnison flagship, and this has got scale. Like I’ve said, it’s about 550 million tons of ore, about 0.35% total copper. It’s going to make 170 million pounds a year. That’s got scale. That’s important to the country. There’s a few other projects out there, good projects that have similar scale, but what those vehicles don’t have is a producing mine. We’ve got the Johnson Camp Mine. And I think that’s a real differentiator for us because it says to people, look, this company has a track record of building and operating, producing mines successfully. And that’s what we’ve done with Johnson Camp. We’ve spent over 100 million dollars fully funded by Nuton, our partner, and we’ve now brought it into production. So we’ve successfully constructed something and brought it into production, and now we’re going to be ramping that up and we’re going to be generating a lot of cash flow from that by the time we ramp it up in 2026.

So I think in addition to sort of buying the stock today for the Gunnison flagship, you’re also getting exposure to this operating mine and all the free cash flow that can come from that in the future.

WSA: Yeah, sure. And so what are some of those key goals and milestones that you’re hoping to accomplish here over the course of the next six months?

Craig Hallworth: So, in terms of the Johnson Camp we talked a lot about that, and rightly so, given it’s the newest producing mine in the country today. We’re going to be advancing that, as we said, ramping it up, we’re going to get up to full name plate, it’s going to be good information. We’ll have some earnings per share next year, free cash flow. But what I want to talk about a little more depth now is the Gunnison project. I think that’s where the real value is for investors coming into stock today. If you take a look at some rules of thumb, what should this stock price be trading at for a big open pit safe jurisdiction, traditional technology? 90% of the value in that pit is oxide ore. So that’s not even using new sulfide leaching technology, that’s using traditional technology that’s been around for 50 years.

It’s just simple mining, an open pit, stacking, heap leaching and our SX-EW plant to turn that into finished copper on the site for sale into the US domestic supply chain. That’s traditional technology. So it’s a very simple flow sheet, and it’s something that I think investors understand. They understand how to value that. And if you look at a PEA level study, a preliminary economic assessment, that’s what we published in the market back in December of 2024. You’d be expecting that to trade at something like a 0.2 or 0.3 price to net asset value. If you look at our stock today, we’re trading at about a 0.1. So I think that shows a valuation gap versus a traditional valuation methodology. And that’s something that investors could look towards as a re-rating potential as we’re able to further advance and develop this open pit plan.

Now part of that, Juan, I mentioned earlier, is we’ve been doing some studies. We think we’re going to be able to add by-product revenue. We think we might be able to add as much as a billion dollars in additional revenue to the life of the mine of the Gunnison open pit. In addition to that, we’re looking at some opportunities to reduce the initial capital and also to reduce the operating expenses. So we’re going to be publishing at around the end of the year, possibly into January of 2026, an updated PEA study on the Gunnison open pit that I think is going to show remarkably better economics, even better than the really good economics that we’ve already shown for it. And I think investors coming into the stock today are really going to benefit from that as we’re able to show the market all these great improvements that we have planned in the next sort of four months.

WSA: Yeah. And of course, it’s all fully funded through 2026 as you just announced an offering last month.

Craig Hallworth: That’s right. So, far this year, Juan, we went to the market twice for — we did two equity raises. The first one was funding our high value add work program. That’s the studies I was talking about that can add value to the Gunnison project. And then really, we weren’t even looking for money, but back in July we had a lot of strong investor interest. And so we thought we would take advantage of that and raise additional capital at the time. And that’s given us a runway now to mid 2027 on our Gunnison project. So we’ve got a runway, a very stable platform here to keep advancing it. And we’ve got money that we’re able to do all of these high value studies, we’re able to come out with a new PEA and we’re also starting now the pre-feasibility study. That’s the next big step for Gunnison. That’s something that we are aiming to complete by the end of 2026.

The pre-feasibility study, that’s going to allow us to go up to a reserve level confidence on the ore body, which is great. And in addition to that, we’re also doing permit amendments. This mine, due to its history, it was previously operating the Gunnison project and it was actually permitted already as a previous project. So what that means today is that we only need to do permit amendments to get this thing fully permitted to be an open pit mine. And so that gives us another unique advantage or differentiator to some of our peers is that we have a more streamlined path to permitting for this project because it’s actually already permitted. So all we have to do is these permit amendments.

So we’ve got enough money to sort of start advancing that. And some of our long lead work, like metallurgical testing, we’re now starting that, our permitting strategy, we’re starting that too. So we’re in a good position from a funding point of view where we’ve got a very stable base and we’re able to progress some of these value adding opportunities. And we’ve got enough money to get us to mid 27 on our G&A, but in addition, we have enough money to publish this updated PEA sort of towards the end of the year that I think is going to add significant upside on the main project.

WSA: Well, good. Yeah. And so perhaps you can talk about your background and experience Craig, and who the key management is there and which way are your interests aligned with that of shareholders?

Craig Hallworth: Well thanks so much for asking. I’m the CFO here at Gunnison Copper. I’ve been with the company for about a year. I was previously working with Hudbay Minerals for 13 years. The last five and a half of which were as the CFO of their United States operations including the Copper World Project just near Tucson, Arizona. And so that gave me the opportunity to really get to know this region, to really get to know Arizona. I moved my family here, my wife, my three sons. We love Arizona. We consider ourselves Arizonans now. And this is the place to be for copper, Juan. This is the place. Like, this is copper State, and we’ve got a lot of projects, a lot of activity. We really know copper here. And all of our senior team is based here.

We’ve got Stephen Twyerould, he’s our CEO, he’s got over 30 years of experience. He’s a PhD geology background. He’s led advanced and sold two other companies before he founded this company, Gunnison Copper. So he’s been with us a long time. Rob Winton, another very experienced guy. He was with Hudbay, my former employer for almost 20 years. He was head of their Manitoba business unit. He’s our SVP of operations. He’s the one leading all the operations on the site. He’s the one that built the Johnson Camp Mine and he’s now operating it. And he’s been here in Arizona for over six years. And finally there’s Roland Goodgame. He’s our SVP Technical Services and Business Development. He’s also a career sort of geology background, decades of experience in mining. So we’re all very, very committed to this company, we’re all invested in it, we’ve all been buying the stock. If you take a look at the public disclosures, you can see us over the last sort of nine, 10 months since we pivoted our main project to the open pit approach. We’ve all been buying the stock and we’re regularly buying the stock.

So we’re big fans of the stock and we are all very invested in this.

WSA: Great. Yeah. And so before we conclude here, first off, right now the current US share price on the OTCQB is 19 cents a share, market cap is about 70 million. So yeah, before we conclude why do you believe investors should consider the company as a good investment opportunity at this point today?

Craig Hallworth: So, I think again, it comes down to our upcoming catalyst, and also our relative valuation. Those are the two big biggies for me. And just to talk first about the relative valuation. This is the number one reason I left Hudbay and came to this company because it’s very clear to me how you should value an open pit project, safe jurisdiction, traditional technology. There’s very clear historical trends, guidelines, comparatives. Take a look at the peer group. The peer group’s trading at about a 0.4 price to NAV. If you look at comparable projects in Arizona, we’re trading at a 0.1. That’s a big valuation gap, and that’s a gap that I think we’re going to be able to close on as we continue to advance this Gunnison project. In addition to the Gunnison project, we’ve got the Johnson Camp Mine, I mentioned it earlier. But that’s something that the other projects don’t have. They don’t have a producing mine. They don’t have free cash flow from a producing mine, and they haven’t necessarily shown that they can build and successfully operate a producing mine. So I think we have that as a differentiator.

And now getting back to the second point is upcoming catalysts. Like I said, we’re working on an updated Gunnison open pit, PEA, we’ve got non-traditional by-products. I didn’t talk much about that today, but we’ve got limestone, we’ve got gravel. We think that could be worth in the hundreds and hundreds of millions of dollars over the life of the mine. We’ve got two third party independent engineering firms working on the valuation of that. We’re going to be adding that to the project. We’ve also got some great ideas on how to reduce upfront CapEx and operating costs that you’ll be seeing very soon. These are catalysts that we’ll be press releasing the next few months.

And then ultimately they’ll all roll into this updated PEA study, 43-101 compliant that it’s got good data, it’s got good information behind it. We’re going to be going to the market with that in January of 2026. And so these are big time catalysts. Ultimately, the next step up after that though, Juan, is going to be, as we complete the PFS, that’s the pre-feasibility study, the next level of engineering. As we get ourselves up to a reserve level on the ore body under open pit, as we get these permits advanced and amended, I think by around the end of 2026, we’re going to have that PFS completed. We’re going to have all those permit amendments completed, and we’re going to be in a great position. Because you don’t see too many open pit safe jurisdiction with scale projects that have a reserve that are fully permitted, that are sitting there ready to go into construction. So I think that’s the position we’re going to be in at the end of 2026 and I think that’ll be the second big step up in the valuation in the foreseeable future.

WSA: We certainly look forward to continuing to track the company’s growth and report on the upcoming progress. And we’d like to thank you for taking the time to join us today, Craig, and introduce our investor audience to Gunnison Copper. It was great having you on.

Craig Hallworth: Thank you so much, Juan. So good to be here with you.

Be the first to comment