Canadian Gold Corp. is a Toronto-based mineral exploration and development company whose objective is to expand the high-grade gold resource at the past producing Tartan Mine, located in Flin Flon, Manitoba. The historic Tartan Mine currently has a 2017 indicated mineral resource estimate of 240,000 oz gold (1,180,000 tonnes at 6.32 g/t gold) and an inferred estimate of 37,000 oz gold (240,000 tonnes at 4.89 g/t gold). The Company also holds a 100% interest in greenfields exploration properties in Ontario and Quebec adjacent to some of Canada’s largest gold mines and development projects, specifically, the Canadian Malartic Mine (QC), the Hemlo Mine (ON) and Hammond Reef Project (ON). The Company is 32% owned by Robert McEwen, who was the founder and CEO of Goldcorp and is Chairman and CEO of McEwen Mining.

INTERVIEW TRANSCRIPTS:

WSA: Good day from Wall Street, this is Juan Costello, Senior Analyst with the Wall Street Analyzer. Joining us today is Michael Swistun, President and CEO at Canadian Gold Corp. The company trades on the TSX Venture, CGC. Thanks for joining us today there, Michael.

Michael Swistun: Oh, you’re welcome. I’m glad to meet you.

WSA: As well. So starting off, can you provide a intro and overview here the company for some of our listeners at a new the story

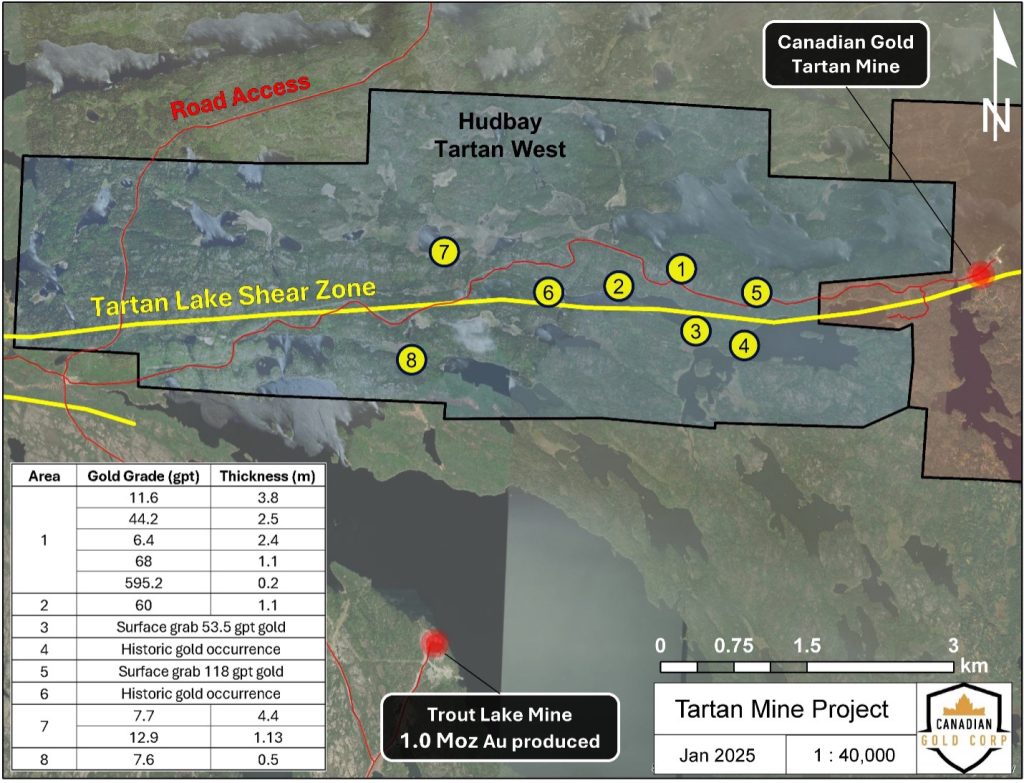

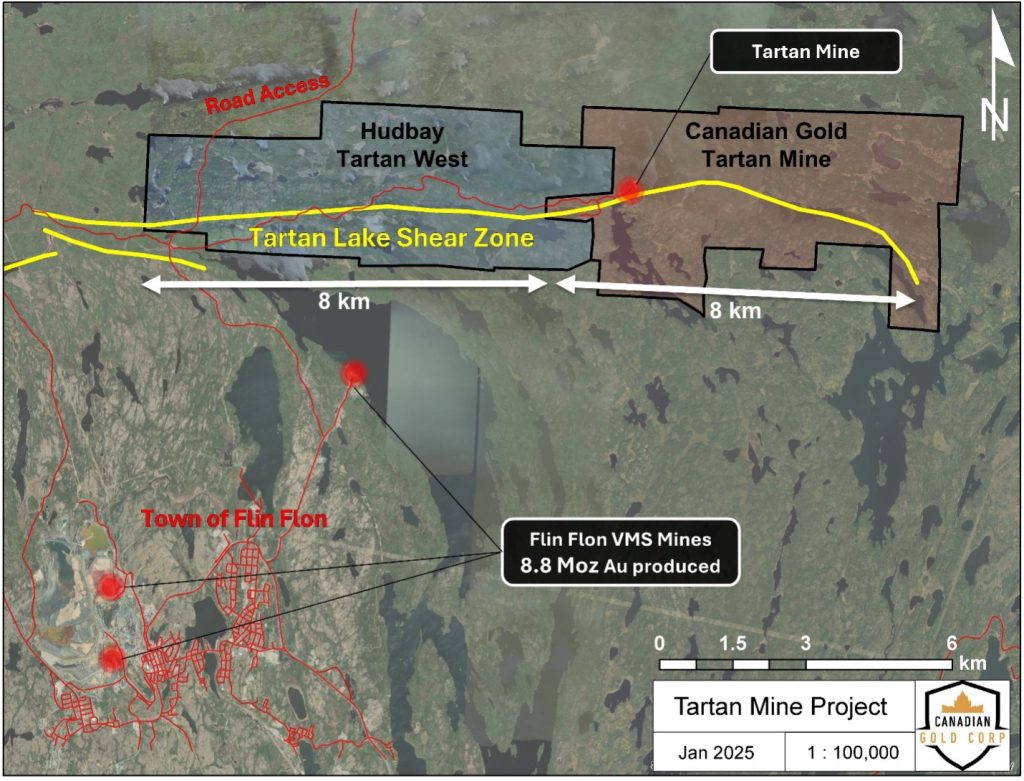

Michael Swistun: Sure. Canadian Gold Corp would be classified as a junior exploration company, focused on really our primary property which is the former Tartan mine in northern in Manitoba near Flin Flon, which is a prolific area for VMS and gold, which has been active for over a century. The mine itself and our property goes back, first exploration was done in the 1930s and in the 1980s. Late 1980s, a mine was established and it only ran for two years and then the gold price crashed and the business had a little bit too much leverage and so it shut down and remained dormant until back in 2017, Clote Resources ended up with the mine and they did a resource estimate that showed that it had at that time, about 277,000 ounces of gold, relatively high grade, average grade of 6.2 grams per ton, 6.3 grams per ton, my mistake.

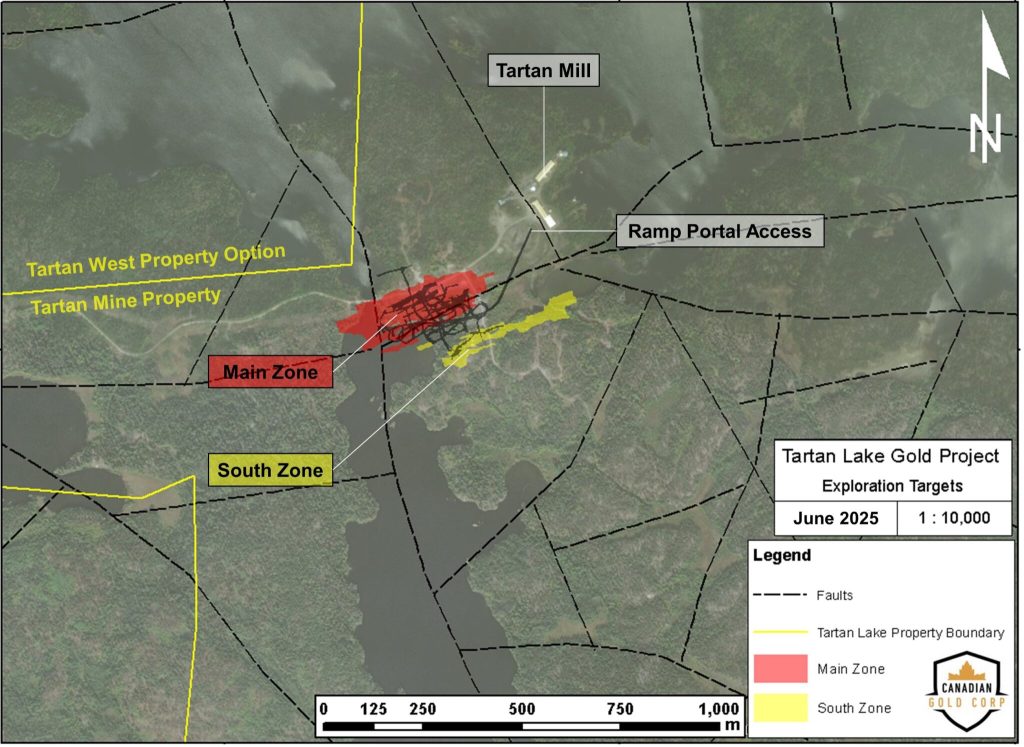

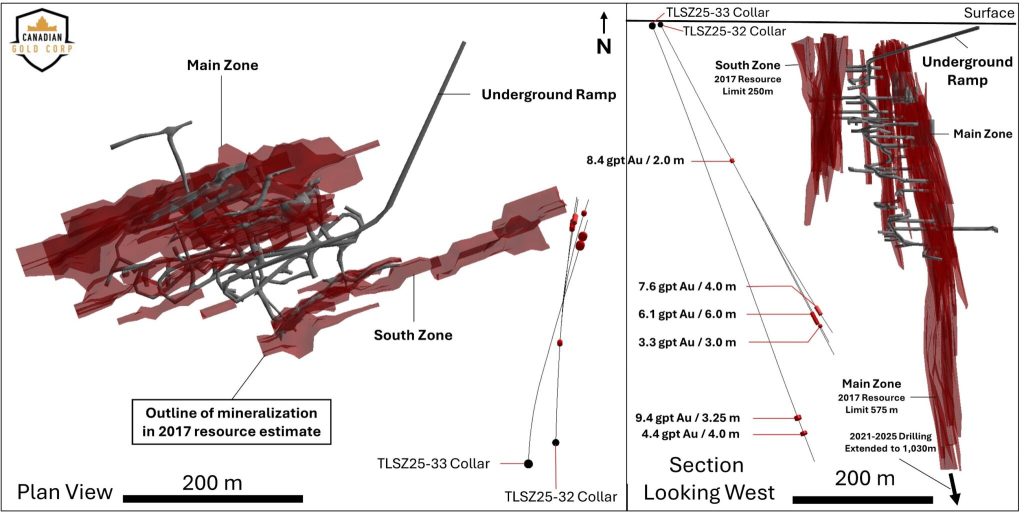

And they spun it off. Clote Resources was acquired, they spun off. The new company spun off this property to a company called Satori Resources. Satori resources started drilling the property and then about two years ago, Rob McEwen from Gold Corp, after he had exited Gold Corp through the sale to Newmont, he made an investment and bought about 34% of the company and renamed it Canadian Gold Corp. And since then we’ve been drilling pretty consistently. We’ve drilled 55 holes since the last resource update, you know, a total of 23,000 meters of new drilling. We have a tremendous hit rate. We have two mineralized zones, one we call the main zone, where the initial mining activity was done in the 1980s and a parallel zone separated by about 100 meters, we call it the cell zone. We have been focused primarily on extending the mineralization of the main zone. It is a organic gold deposit that you find in the Precambrian Shields Road, Canada. Very similar geology to Red Lake, Kirkland Lake and the island mine that Alamos gold has. So it’s familiar to a lot of gold investors.

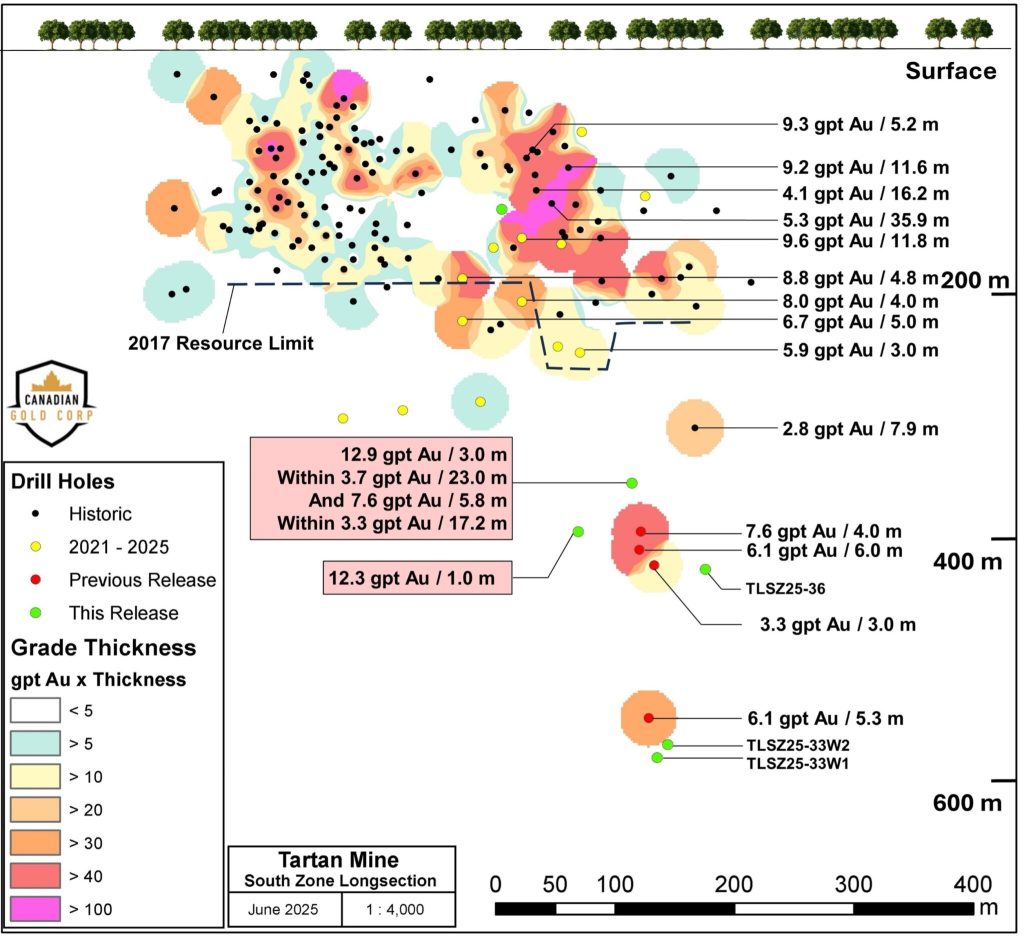

Again, what we’re finding when we get into it is as we’re drilling down, extending the mineralization, but let me back up a second, the 2017 43-101 resource estimate essentially, was to a vertical depth of about 574 meters in the main zone. Since 2017, we have been drilling down to the 1,000 meter level. What we found is continuous mineralization and as we are going deeper, we are finding higher grades of broader widths. So in some of the upper zones, we’re having widths and grades of 4 to 6 grams per ton over 5-6 up to 12 meters. When you down up to 1,000 meters we had an intercept that was 4 point meter ton over 53 meters. So what we’re finding is consistent mineralization all the way down. But our focus is in the immediate term is to continue to add ounces per vertical meter. Later this year we’ll be moving to an updated 43101 to take all of the data we’ve gathered from all the drilling and also do some more exploration on the Cell Zone. The last hole that we announced about a month ago just before PDAC in Toronto.

We had drilled a hole into the Cell Zone that was much deeper than the prior holes, most of the exploration drilling in the Cell zone had ended about 240 meters vertically. We had down 410 meters and we had again a broader intersect of high grade. So it’s very consistent, so we believe we have two parallel zones that can be easily mined and the nice thing about this project is, is that in the first iteration of this mine back in the 80s, the company that started it had spent over $30 million and $1980 developing the infrastructure. So the road is there, the power is there, it’s 22 kilometers away from the town of Flinflon, which has to restart this mine, you don’t have to build a camp, there’s a proper town there with a Walmart and everything else you’d like to see. So it’s something that lends itself well to a restart with a modest capital investment. And we can do it within the footprint of the former mine. So for us to revisit the existing mine permit that we have and amend it, will be relatively simple because it doesn’t disturb a single extra square foot of surface land.

WSA: So yeah, I guess that’s what you’re calling the hanging wall zone?

Michael Swistun: Hanging wall zone is an exceptionally high-grade zone that we hit. This actually separated, it’s adjacent to the main zone, separated by a few meters laterally, but that is a zone that we hit off of the main zone last year. That’s 23 grams per ton over 12 meters, 47 grams per ton over 5.8 meters, 30 grams per ton over three meters. So that’s on that particular property, on that particular zone, the main zone. On the south zone, we got a pleasant surprise recently when we drilled that we actually hit a new hanging wall zone adjacent to the south zone. So imagine if you will, there’s two parallel zones of mineralization adjacent to those main resources, we’re finding lenses of exceptionally high grade around them, which is something you often see in these organic gold formations.

WSA: Oh yeah, what are you hoping to accomplish over the course of the next three to six months?

Michael Swistun: Well, we just closed the $3 million financing with McEwen Mining, which is a U.S. listed company. And they became a strategic investor. I imagine you’re familiar with them. Well, McEwen personally owns 32%. McEwen Mining is a public company that he’s an 11% shareholder of that has now done his due diligence and made it’s own investment of 5.9 % of the company. So with those funds, we are going to continue on our, to complete our phase four drilling program. Which initially, like starting next week, we’re back on the property, we’ll be following up on our south zone results, which were again, very compelling, 6.1 grams over 6 meters, 3.2 grams over a 19 meter interval. And that’s at about 410 meters vertical depth. We’ll be going back and filling the gap between the 240 meters to the 410 meters. We’ll be drilling up to fill in that to make sure to confirm that there’s continuous mineralization and then be drilling below that to see if the mineralization continues.

We strongly believe that there is a plunder zone that’s similar to the main zone. We’ll also be doing a number of deep holes in the main zone to see if those broad intervals that we hit that were 50 plus meters wide at the thousand meter level are continuous and step out to both through the eastern side and the western side of the main zone. So for us right now it’s all about adding ounces per vertical meter, because we’re going to be feeding that data into an updated 43101 this year, that we’ll hope to have done prior to the fourth quarter. And following immediately on that is looking at a preliminary economic assessment, a PEA on what we have there. We believe that we’re on the cusp of having the economics and volume in place that would make a compelling case for a mind restart.

WSA: Right. Yeah, and as far as you know, you know your background experience can you talk about that and how you know the management’s Interests are aligned with shareholders and the financial community?

Michael Swistun: Sure. I’m not a geologist by trade. I can bluff my way along pretty well until the real geologist talks to me. My background is in capital markets, both private and public and in M&A and that’s been my career. Where I first became president and CEO last April, at the beginning of last April, was because I got to know the project and the company, because I had been the Secretary of the Economic Development Board of the province of Manitoba, the jurisdiction where this mine is. And one of my mandates was to make our jurisdiction more competitive for attracting mining investment. Through the course of that work, I was able to see all of the exploration companies and there was over 46 exploration companies working in Manitoba and got to have kind of a very good perspective of them. And I got to know Peter Shipp [who is] the Chairman and Jennifer Boyle, who’s a director and Alex McEwen, who’s also a director. And what became very clear to me in that process was that this was the what I described as the ripest apple on the tree. This is the, probably the of all of the juniors in the Manitoba space in our jurisdiction, I believe this is the one that is has one of the lowest capital costs requirements to get back in production and one of the most defined opportunities.

And again, that was April of last year and that was at a much lower gold price and a much stronger Canadian dollar. So in the interim year till now, you’ve seen the gold price continue to grow and the Canadian dollar continued to decline relative to the US dollar, which again just amplifies the rise in the price of gold. And it makes a very compelling case for being able to operate this mine. It’s not going to be necessarily the biggest mine in the world in terms of tonnage, but it’s certainly one of the very few high-grade deposits in Canada that isn’t controlled by a senior mining company or a senior operator. So it’s pretty compelling.

WSA: Yeah, great. And so current Canadian share price right now, 24 cents a share.

Michael Swistun: Yeah, we had a significant bump in the last couple of days since the financing closed.

WSA: Right. So yeah and as you’re speaking with investors and the financial community, like at PDAC, obviously with the gold price, do you think they’re able to kind of differentiate what makes you guys unique from some of the other players here in the sector and you’re not able to succeed?

Michael Swistun: Yeah, exactly. This is very much a low CAPEX opportunity because of the existing infrastructure that was already there. The underground infrastructure itself, the ramp, this was operated down to a depth of over 300 meters vertically. And they did some very smart things in the 1980s when they initially set this up. They set the ramp between the main zone and the south zone. They did a couple of drifts over to the south zone, but they never actually mined it. So there’s two resources that can be exploited simultaneously. The deposits are parallel and almost vertical. So it lends itself very well to a very efficient mining setup to be accessed by a ramp. And we believe the economics would make it possible for us to go down to 1,000 meters using that ramp in infrastructure.

WSA: Yeah, before we conclude here, Michael. Why do you believe investors should consider the company as a good investment opportunity at this point today?

Michael Swistun: Well, as I said, I think it is within Canada, certainly and possibly within North America, it is one of the ripest apples on the tree. In that the likely time between today and seeing production get this back restarted in production is probably one of the shortest durations. We’re in a mining friendly jurisdiction. To the north of us immediately this week, Alamo School just did a saw turning with a provincial premier on their Lynn Lake project, which is an open pit project that is starting construction right now, with a start date of production of in 2028. That’ll be 157,000 ounces a year mined. We have good neighbors in that snow at Snow Lake. We have Had Bay Mining and again, this is a prolific mining jurisdiction. This is a very analogous situation if your investors are at all familiar with the island mine that Alamos operates in Ontario. This is very much an analogous project to that, in that we believe that as we go once we’re back in production, as we go deeper we’ll probably be expanding the both the resource and the improving the grade. So we’re starting right now with an average grade of about 6.3 grams per ton. We believe that as we go deeper, we’ll be finding more resource at continue to find increasing widths of intervals of mineralization at higher grades.

WSA: Well, we certainly look forward to continuing to track the company’s growth and report on the upcoming progress. And we’d like to thank you for taking the time to join us today there, Michael and introduce our investor audience. It was a great having you on.

Michael Swistun: Oh, we appreciate, I appreciate that one. You know it’s funny, we are kicking off what will be a month of intensive marketing right now. So just to tell the story and we would love to stay in contact with you. We are expecting beyond the resource results that we’re doing, there’s a number of corporate things that we are doing right now engaged in and I would expect the next six to nine months are going to be pretty heavy for news flow from us. So I would encourage your audience to stay tuned.