ABOUT: Kobrea Exploration Corp. is a mineral exploration & development company focused on the acquisition and exploration of base metal projects. Kobrea holds the right to earn a 100% interest in 7 projects totaling over 733 km2 in southwestern Mendoza Province, Argentina. The properties are considered highly prospective for porphyry copper and porphyry copper-gold deposits. Numerous porphyry copper targets have been outlined to date exhibiting multi-kilometre hydrothermal alteration footprints, anomalous copper ± gold ± molybdenum geochemistry, quartz stockwork veining, localized hydrothermal breccias and Miocene aged dacitic to dioritic porphyry intrusions. Kobrea also holds a 100% interest in the Upland Copper Project in British Columbia, Canada.

INTERVIEW TRANSCRIPTS:

WSA: Good day from Wall Street. This is Juan Costello, senior analyst with the Wall Street Analyzer, joining us today is Rory Ritchie. He’s the VP of Exploration at Kobrea Exploration Corporation, the company trades on the Canadian Securities Exchange, KBX, as well as on the OTCQB, KBXFF. Thanks for joining us today there, Rory.

Rory: Yeah, you bet. Juan, thanks for having me.

WSA: Certainly. And so can you please start off by providing a overview of the company for some of our listeners that may have not caught our call with your CEO on January 28th?

Rory: Yeah, sure. So, Kobrea Exploration Corp is a mineral exploration company focused on discovering copper deposits in Argentina, specifically Mendoza Province, which is where our projects, our flagship projects are situated. As you mentioned, we’re trading on the CSE and on the OTCQB there.

WSA: So the last call we interviewed CEO James Hedalen—You’re the VP of exploration—Can you explain what is your role and what being a porphyry specialist means?

Rory: Absolutely. So really, I’m the geologist in charge of running all the operations, and my goal is to acquire projects and make a discovery. So porphyry, as you mentioned, being a porphyry specialist, so just for the listeners, porphyry copper deposits are large bulk tonnage, low grade, relatively low grade copper deposits, but they supply about 70% of the world’s copper supplies. So these are very important deposits and they’re very valuable deposits if you’re lucky enough to find one of sufficient tonnage and grade. And really being a porphyry specialist, that’s, it takes years and years and decades of experience to be able to wrap your head around these deposits. They’re actually quite tricky to interpret and then obviously to find. And really myself, I spend most of my 19 years looking for and evaluating porphyry deposits, porphyry copper deposits. And our chief geologist, Paul Johnson, I would consider him a porphyry expert, one of the one of the leading porphyry geologists in the world. And he’s actually been a mentor of mine for over a decade. So, so between the two of us, we have a good, good breadth of knowledge with, with these deposits.

WSA: Great. So can you talk about the most recent announcement, which was the commissioning of the airborne magnetic and radio metric survey there at the Western Malargue copper project in Argentina?

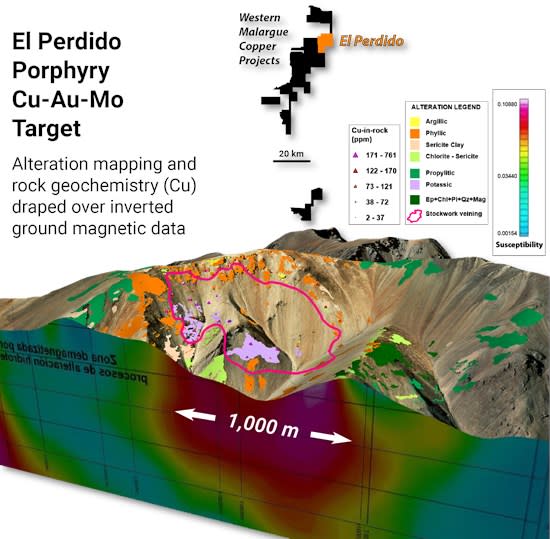

Rory: So that was just letting everybody know our current shareholders as well as potential shareholders that we’ve got a broad sweeping. It covers our entire land package, this airborne magnetometer survey. Our land package is 733 square kilometers. So that’s a big area, you know, you are in the Andes as well. So to cover that on foot would take you a long, long time. So this, the airborne survey, the idea. And it’s really, we get two datasets out of this survey. So it’s flown by a helicopter, we get the magnetic response, magnetic susceptibility of the rocks, which can tell you, you know, the geology, as well as what some of these porphyry alteration footprints look like. So it can directly detect porphyry systems, as well as faults and things that all play into looking for ore deposits. And then it’s also got another component. It’s called a radiometric survey. So we really collect two different datasets at once. And the radiometric survey is picking up essentially, well, radioactive elements. So potassium is really what we’re looking for. That can help you detect a potassic alteration, which is really the center of porphyry deposits. That’s where your copper is. So two-fold, but really the goal is to outline additional targets beyond the dozen or so porphyry targets we have to date as well as to better define those targets that we have already outlined.

WSA: Right. And so what’s the difference between that and the ground magnometer survey which was completed by the previous operator there at El Perdido.

Rory: Yeah, so El Perdido, for example, as you mentioned about 10 or 12 years ago, a previous operator completed a ground magnetic survey. So same idea, you’re measuring the magnetic susceptibility of the rocks. This is just a bigger scale. You know, if you can cover, let’s say, 10 or 20 square kilometers in two weeks time on the ground you can you can cover you know six or seven hundred square kilometers in two weeks time with a with an airborne survey so it’s slightly lower resolution but again it covers all the areas whereas ground magnetics you really you kind of have to pick you know in the case of El Perdido they had already outlined the deposit footprint. So this was, they knew where to put that grid, but, but the airborne magnetic survey can pickup potential deposits that you, you didn’t previously identify.

WSA: So yeah, what makes this project in particular in the Mendoza province unique from other projects and other copper plays that you’ve seen.

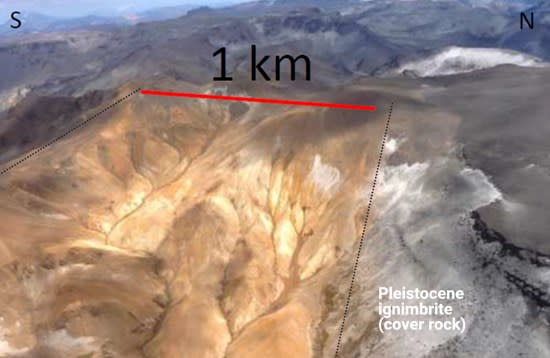

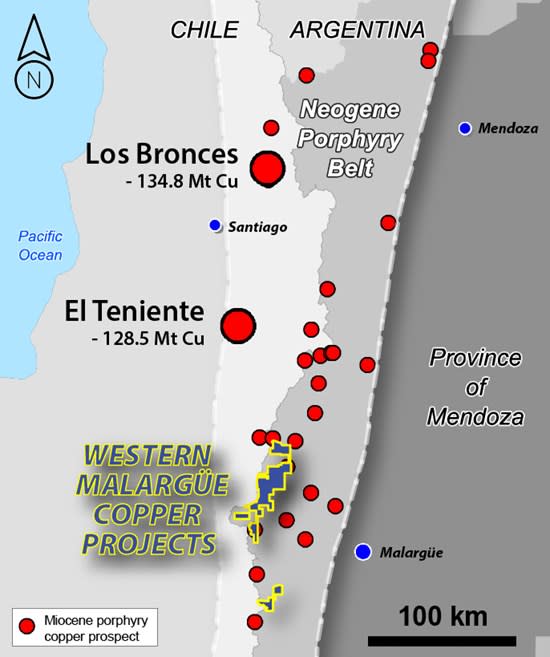

Rory: It truly is unique. The opportunity is pretty exceptional. The story, the long and short of it is Mendoza Province has officially just opened about this time last year, or about 10 or 11 months ago, open for mineral exploration and development, and specifically copper. So you’re in a world-class belt in the western portion of Argentina specifically Mendoza province, you know, for example, 80 kilometers to our north, which is just on the other side in Chile, just on the other side of the border, you have, you have the third, the third largest copper deposit in the world, hosted in pretty much the same rocks and the sage, these deposits are the same age as the ones we’re seeing on our, on our project. And then the world’s largest deposit or cluster of deposits in terms of contained copper is about 180 kilometers to our north.

So you have two to three biggest deposits in the world in this belt. We just happened to be on the Mendoza side, on the Argentinean side, and lucky for us, we were able to acquire the ground, which was available, which certainly wouldn’t have been available if it was on the Chilean side. Just in time, just before it was all kind of opened up and made public. So we got a bit of a head start. We acquired a heck of a land package with already defined porphyry deposits. They just have never been drilled. So our job is to go find the best targets. We already have two outline that are essentially drill ready and we’re going to try and find some more. And then, you know, you don’t really know what you have or how good it is in terms of grade and potential tonnage until you drill with the diamond drill. That’s how you get to the bottom of these things and that’s what we intend to do in the coming months and years.

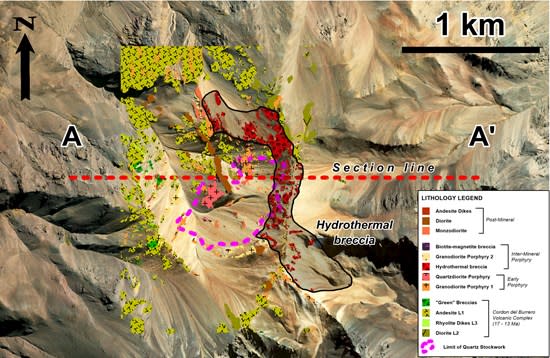

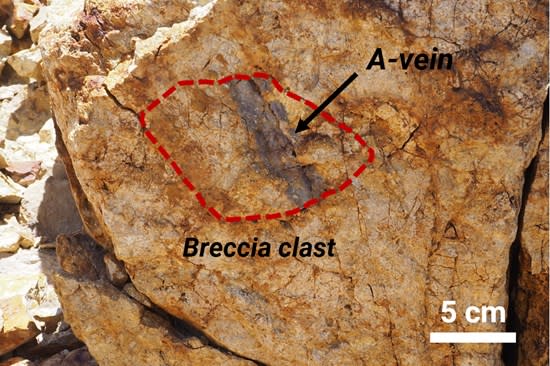

WSA: Great. And since we last spoke with you guys, you also provided an update on the project which includes a rock chip sampling and that was a previous unidentified breccias. They’re at the El Perdido. Can you provide more details on that as well as you know other key points of the update?

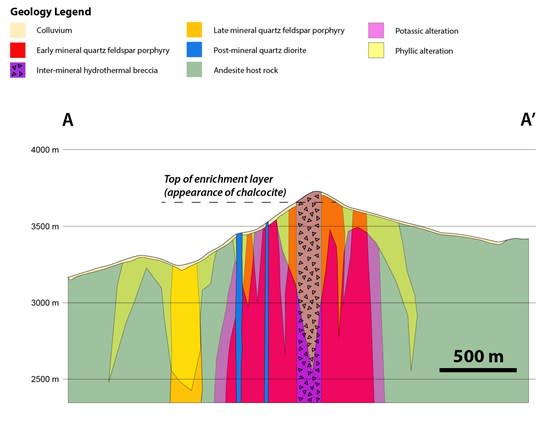

Rory: Yeah so we having this you know we started with El Perdido we did a fair amount of work there which included mapping and rock sampling really target evaluation and try to figure out where the center of the porphyry deposit is so that we know how to target it with the drill so that was all done and during over the course of that work we identified it’s probably more likely a series of [breccia] and breccia are explosive, it is essentially intrusive events where we have a bunch of volatiles coming up through the rock and breaking up the rock and bringing up chunks. And sometimes you’re getting a picture of what’s down below in these breccia pipes. They essentially are vertical escalators, if you will. But what they tell, what they speak to is the potential energy of the system. And this is all relates ultimately to the size, the potential as well as the grade potential.

So to see these breccias is very important, especially in this belt. Again, El Teniente, 80 kilometers to our north is largely defined by breccias as well as Rio Blanco, which is 180 kilometers to our north. That’s the world’s biggest. So a lot of the mineralization there is hosted in these hydrothermal brecias as well. So it covers a big area, roughly 1700 meters by maybe 250 meters across. Again, it more looks like a series of breches based on what we’re seeing in the rock. Some are kind of earlier than others and some have different, you know, matrix, if you will. But the long and short of it is, it really kind of opens up more room for exploration potential, as well as gives us a, we can have a direct look at what’s going on in depth, which when we looked at these chunks of rock in these breccias, we are seeing a veining and nice deveining and then some residual copper and as well as all the alteration you hope to see.

So we need to do more work defining those breccias and we need to do more sampling in which we’re getting to right now. But generally speaking, it’s a very good sign that just adds to the story it kind of supplements what we’ve already seen at El Perdido which is a big system copper bearing and again obviously a big part of the story it’s never seen a drill hole.

WSA: Alright yeah so the current price the Canadian is 64 cents a share and market cap you know looking at you know north of 20 you know about 20 million, about 22 million. So before we conclude, you know, why do you believe investors should consider the company as a good investment opportunity at this point today?

Rory: Yeah, apart from the team and the organization itself, it really comes down, at least to me, to the projects, to the land we have the mineral rights to, or at least we have the option to acquire 100% of the mineral rights over the next four years. And these, again, there’s over a dozen porphyry targets, but we already have two defined porphyry systems, which are very, very hard to find. They’re very rare. And when it comes time to drill, if you’re successful and you can prove up some tonnage and some grade, these are very valuable deposits because of their scarcity and because of the fact that, you know, the supply demand fundamentals of copper are very, very bode well in our favor moving forward. So that’s really it. We have a cluster of, you know, or a series of porphyry targets. We’re getting ready to drill. And if we have any success with the drill, which we anticipate, all of a sudden the share price, you really have leverage to the share price. And especially if you can find more than one deposit that looks good, all of a sudden the lever to that share price is highly significant. So it’s a good time to get in early on what will be a very kind of exciting story over the next 12 to 24 months.

INTERVIEW WITH CEO JAMES HEDALEN FROM 1/28

TRANSCRIPTS:

WSA: Good day from Wall Street. This is Juan Costello, Senior Analyst with the Wall Street Analyzer, joining us today is James Hedalen, he’s the CEO at Kobrea Exploration Corporation, the company trades on the Canadian Securities Exchange KBX, on the OTCQB, it’s KBXFF, and on the Frankfurt Exchange F3I.Thanks for joining us today there, James.

James: Thanks for having me, Juan. A pleasure to come on.

WSA: Excellent. So starting off, please provide us a intro and overview there of the company.

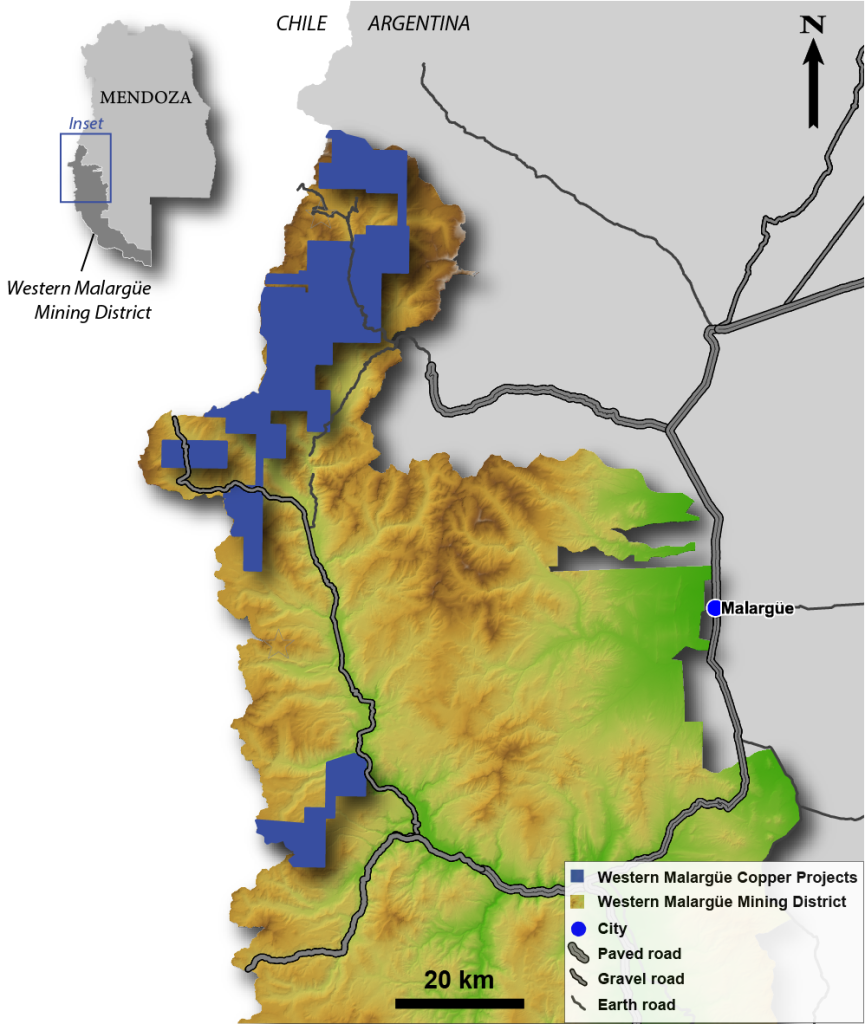

James: Sure. So, Kobrea Exploration is an Argentinean focused exploration company. We are currently working in Mendoza Province, Argentina. And we have, you know, a commanding land position of seven projects, 733 square kilometers of the Neogene porphyry belt on the Argentinean side along the Argentinean Chilean border. There’s a big part of the story is we wanted to be in a world-class copper district. We were able to negotiate the projects and we’ll get into a little more detail but we are the first company to receive approval to drill in this part of Mendoza.

WSA: Yeah, so can you bring us up to speed there on some of the most recent news? As you just said, you commenced the exploration there, you know, perhaps talk a little bit more about the project and you just completed a private placement.

James: Yeah, I’ll step back a little bit. I mean, a big part of the story is the province of Mendoza and they’ve been working for six or seven years to open Mendoza to mining and obviously you have to start with explorations so there hasn’t been a drill hole in Mendoza in over 30 years and in this particular region of Mendoza, there’s never been a drill hole. It’s not for geologic lack of geologic potential it’s just there was no real mining industry. So I should say a group called Impulsa Mendoza and the government of Mendoza has worked very hard over the past six to seven years and ultimately culminated with us and a number of other projects being permitted for exploration and approval to drill. So we were able to, on the back of receiving exploration approval, we were able to raise five million dollars in December and get crews on site the first week of January. It’s the first time crews have been on these projects in over a decade and our work will ultimately culminate with the first ever drill program on some of these, these very large targets that we’ve acquired.

WSA: So in terms of the property, like you said, it’s a next to historically good zones and it’s close to some pretty good infrastructure there in the area?

James: Yeah, so they’ve built a mining, what they’re calling the Western Malargue Mining District and it’s close to the town of Malargue. And the reason they chose it is, is it’s, there’s no competition for land or water. So there’s not much of an agricultural industry. So there’s no issues with water. They’ve done all the studies for local, you know, engagement, Malargue has an edge has actually has a school that graduates geologists. It’s only 60 kilometers away. And I should say the projects we acquired, they were, they were worked up, most recently in 2011 to 2013 by [valet]. So, they kind of gave us a green fields head start and they’ve mapped out some of these porphyry systems. Its seven projects, but we have about 12 to 15, you know, large alteration systems that need to be explored and subsequently drilled. So that’s, yeah, that’s really the background there.

WSA: Sure. Yeah. And what are the, you know, key goals and milestones that you’re hoping to accomplish here over the course of the next six months?

James: So it’s summer down there and it’s work season. So really, I mean, and this kind of goes into our investment thesis for investors that will be listening to this. It’s, we’re first movers into this world class, this portion of a world-class porphyry belt, and we’re going to be able to make and search for discoveries with drilling for the first time ever. And yeah, we currently have crews on site and that will culminate after some groundwork with the first ever drill holes on these projects. So that’s, that’s really what we’re working on right now and what our crews are down there doing and yeah, it should be a very exciting kind of well austral summer the South American summer exploration season and yeah, we look forward to you know getting some news out and keeping the market updated as to you know drilling and when we start drilling and other you know mapping and sampling at some of the other targets.

WSA: Yeah, sure. And so what are some of the key trends that you’re seeing, you know, right now in terms of copper and how’s the company positioned to capitalize and perhaps you can talk about some of the uses and applications there.

James: Yeah. So I mean, when we, when we founded Kobrea just over three years ago was a private company. We’ve been listed for about a year. Our goal was always copper. We took a look and we, you know, I don’t think copper is going anywhere. And one of the big reasons to focus, we focus on copper is, is not, I’m not going to get into the international demand and China demand for copper, which I think is not going to go away anytime soon. But in the M&A space, there’s not been a lot of kind of tier one discoveries. And if there is a drill hole or a discovery made in copper, it gets a lot of attention and a lot of eyes. So the junior space for coppers, it’s very difficult to find a good copper asset. And if you find something, if you’re lucky enough to find something, they sell for quite a premium. So that’s, that’s why we, you know, we went into an area that was not open for exploration and we were able to get better projects this way by taking the upfront risk, which is now being mitigated. That’s kind of our outlook for copper is there’s not been a lot of discoveries made in the last five, six years and subsequently there’s a gap in the M&A market, so the market is really hoping for a big discovery from a copper junior over the next little while. And, you know, I think copper juniors are poised to have a have a good run here.

WSA: Right. Yeah. And you were just at the roundup and some of the other conferences and shows that are going on, you know, around Vancouver this time of year. So as you’re speaking with investors and the financial community there, what are the things that you’re sharing about what makes you guys unique from and the projects unique from some of the other players there in the sector?

James: That’s a good question. So we had a kind of a meet and greet cocktail event for investors and companies interested in Argentina, which was very well attended and successful and was able to talk to a lot of investors. You know, what makes us unique is we’re the first public company to acquire any projects in these regions. And we’re the first company that’s, public company that’s received authorization to drill. In general, people are looking at Argentina, they like Argentina. Obviously there’s been a lot of big projects transacting in Argentina. Mendoza is kind of at the forefront of opening and we’re the first kind of company in there. So people are very interested in hearing about the story. They’re very interested in hearing about Mendoza. And yeah, Argentina is poised, I think, for not just copper, but a good run on various mining and exploration over the next cycle here.

WSA: Yeah, and perhaps you can talk to us about your background experience there James and you know who the key management there is.

James: Sure. So I myself have been in the juniors for about 12 years. So I’ve done everything from, you know, project management to operations, fund raising, investor relations, et cetera. So I’ve kind of, and I was actually a GIS guy early in my career. And then my business partner, Roy Ritchie is a geologist of 18 years, largely focused on porphyries. And the other key management would be Paul Johnson. So he’s our chief geo. And he was formerly had worked for Tech Resources. He was the chief regional Geo for South America lived in Santiago. He’s a porphyry specialist. So that’s kind of our technical team. And I’ve brought in a few advisors to kind of help on the financial and strategic side. And that would be Cal Everett and Darren Pylot.

Darren being the founder and chairman of Capstone Mining and Cal having been a mining financier and is currently the president or sorry, the CEO of Liberty Gold. So, they’ve kind of helped me in the financial side of things, and that’s really the team that we have set up to push the project forward.

WSA: Yeah, in terms of that the future growth, would you consider any kind of joint venture or strategic alliance, or is it mostly going to be organic, you know, M&A?

James: No, good question. I think it’s a little early right now, however you look at all opportunities. This, we do have I mentioned seven projects and, you know, 12 kind of very large alteration systems. So I think I would say everything is on the table. We will talk to everyone and make the best choice for our shareholders. This initial stage, obviously, we’ve funded organically and we will continue to do so at this point. But no, I think anything is on the table going forward.

WSA: Certainly, yeah. So current share price right now, its Canadian share price 62 cents a share market cap at about 22 million. So before we conclude here, why do you believe investors should consider the company as a good investment opportunity today?

James: Yeah, so I think if you have a look at the website and the presentation and the more geological side of things, really the key components of this is we’re the first movers into a world class or portion of a world class porphyry belt. We’re able to drill for the first time in this portion of the belt. There’s never been a drill hole here, and that’s not for lack of major companies trying to get a drill permit. And as it stands right now immediately, we currently have crews on site, which will culminate in the first drill holes on this project. So if you like us or if you like drill plays, I think we have them all kind of in one. And, and I think we can generate some returns for investors going forward. We have a lot of opportunity here. It’s a world-class opportunity and we were just slightly ahead of the curve and the fact that we got to Mendoza right as it opened.

WSA: Well, we certainly look forward to continuing to track the company’s growth and report on the upcoming progress and we’d like to thank you for taking the time to join us today, James and introduce our investor audience to Kobrea Exploration. It was great having you on. Hopefully you stay over that Mendoza line, right?

James: Yeah, yes thanks. Yeah, pleasure. No problem. And yeah, we’ll talk to you again soon.