Pasofino Gold Limited is a Canadian-based mineral exploration company listed on the TSXV (VEIN). Pasofino, through its wholly owned subsidiary, owns 100% of the Dugbe Gold Project (prior to the issuance of the Government of Liberia’s 10% carried interest). For further information, please visit www.pasofinogold.com

INTERVIEW UPDATE FROM 5/1:

We caught up with CEO Brett Richards to discuss news from our previous call and discuss company goals over the next 3-6 months.

INTERVIEW FROM 1/16:

INTERVIEW TRANSCRIPT:

WSA: Good day from Wall Street. This is Juan Costello, Senior Analyst and the Wall Street Analyzer. Joining us today is Brett Richards, he’s the new CEO at Pasofino Gold Ltd. The company trades on the TSX-Venture, (VEIN). Over the counter is EFRGF. And for our international listeners on the Frankfurt Exchange it’s N07A.Thanks for joining us today there, Brett.

Brett Richards: Yeah, thanks, Juan. Thanks for having me.

WSA: Yeah, so starting off, please provide us an intro and overview there of the company for some of our listeners that are new to the story.

Brett Richards: Yeah, sure. Pasofino Gold has been around for around five years, but it holds a project in Liberia called the Dugbe Gold Project. And there’s quite a bit of history with the Dugbe Gold Project. It was originally owned by Hummingbird Resources, which is a London listed company. And they remain our largest and major shareholder. But we transacted with Hummingbird in 2019 to acquire 100% ownership in the project. And we have advanced the development of that project all the way up through a feasibility study, which was completed in June, 2022.

DUGBE GOLD PROJECT FEASABILITY STUDY

WSA: So, can you give us a overview there, of the project, what the position is and what some of the findings have been in the past?

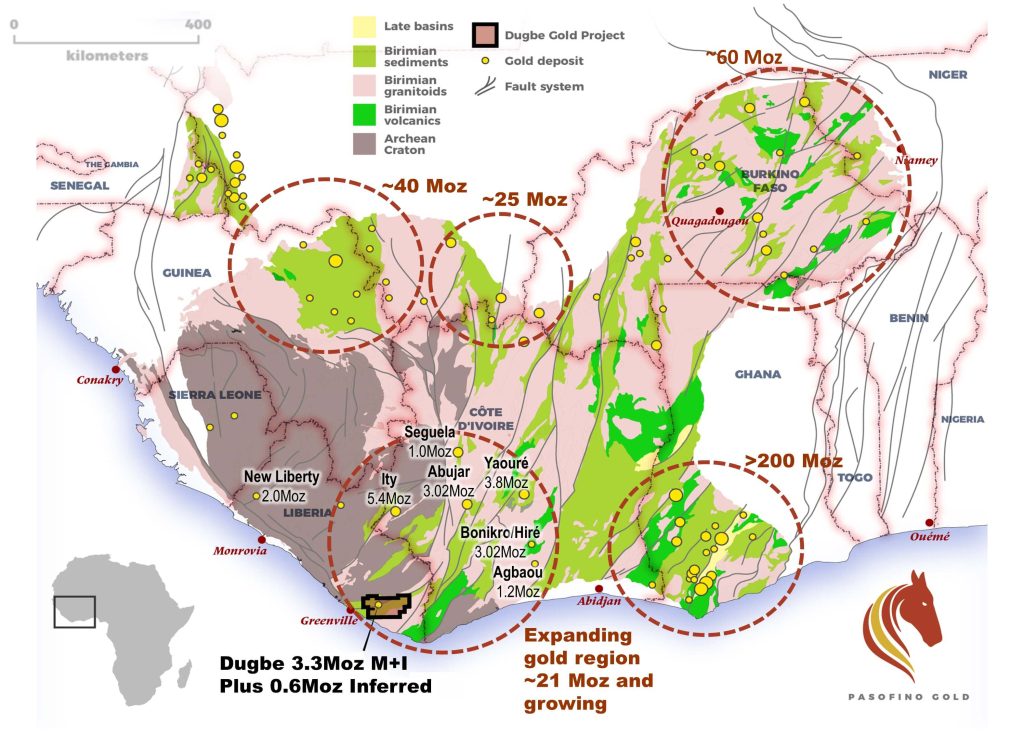

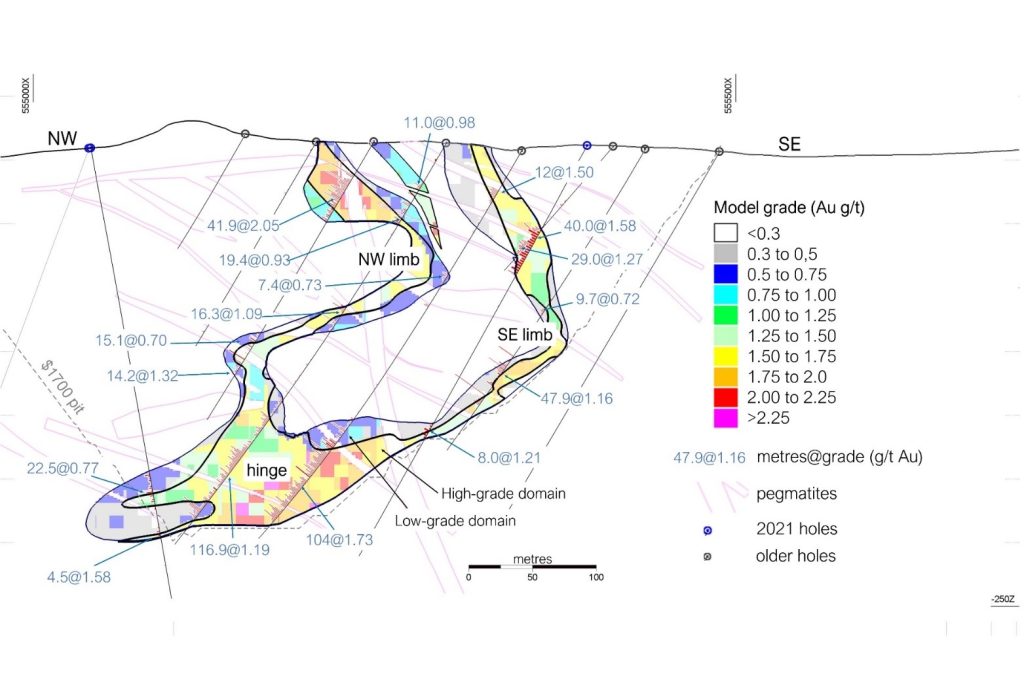

Brett Richards: I think over the past seven years and leading up to our acquisition, there’s been substantial amount of drilling done at Dugbe and over 150,000 meters in total in its history. And we have a resource of 3. million ounces at 1.3 grams. We consolidated that when we did our feasibility study in 2021 and into 2022 and we have a project now that has 2.3 million ounces of reserve over a 14-year mine life and it has a low-strip ratio, tremendous economics which I’ll speak about but this is a real project and it’s in a real, I’ll say, a favorable jurisdiction of West Africa it’s Liberia, there’s a heavy US presence and history in the country of Liberia. They use US money and quite frankly I think it is a low risk when it comes to the to Africa style risk but this is a very, very robust project with low CAPEX and tremendous economics.

WSA: Certainly and what are some of the key trends that you’re seeing you know right now in the sector and how is the company position with the project there to being able to capitalize.

Brett Richards: I’ve been in this space for a long time—too long to admit—you know one of the founders of Goldshore Resources which is a large asset in north western Ontario. I’ve followed this space for quite a while and quite frankly we’re seeing kind of a lot of the same from what we’ve seen in 2022, 2023, and into 2024, whereby we have strong commodity pricing in our sector in gold. Gold performed very well in 2024, over 25% performance in 2024, and continues to be strong. It does test the $2600 barrier and has seen in the high 2700’s as its high. So I think going forward, we’re going to see continued strength and continued support for another strong year in the gold price. However, when we talk about the junior gold mining industry, there is still a real disconnect from valuations on a per ounce basis in the ground, whether that be, measured indicated, whether that be resource, and we’re still seeing a strong disconnect.

We haven’t seen the appreciation of gold juniors and their evaluations increase along the likes of how gold has performed. And we haven’t really seen that consolidation that we’ve all talked about for five or six years, we haven’t really seen a tremendous amount of consolidation. There has been some. There’s been a lot of consolidation at the top of the market. The top projects in Canada and top projects in the US and many projects in Africa as well. It’s always started with size and scale and grade. And I think the M&A environment has now kind of pushed itself down to a project like what we have. We have a substantial asset with a long mine life and a feasibility study done on it, but we have tremendous exploration upside and this could be a generational mine in West Africa that could grow both in size and scale but also maintain a very strong circa two hundred thousand ounce per year gold production profile for a long period of time. So when I break these things down and it’s why I got invested and why I got interested in Pasofino is because there’s some strong people that have been associated with this and the feasibility study has a very high quality feasibility study and some of those are with Hummingbird today.

So the people are, and the board is what attracted me to this project to invest in it. But also the location jurisdiction, I’ve spent probably 15 of my last 20 years in Africa and in many jurisdictions including Liberia. And Liberia is one of the, I’ll say one of the most mining friendly jurisdictions in West Africa, if not the most mining friendly. And in Africa generally, this is a place that you can do business. There is a rule of law and rule of order and a mining code that is very stable. And a government that supports it very strongly. Liberia is English speaking. And quite frankly, our project is close to a lot of available infrastructure, rail, road, port. We’re just 76 kilometers from the Greenville Port. So the doability factor of actually getting a project like this across the line, getting it built and getting it into production is actually quite high. So I always look at projects from the people first, but then I look at, you know, location, jurisdiction, size and scalability and some near mine life opportunities. And then I look at kind of the mining and the metallurgy and the process and the grade, and are these robust enough that whether it’s strip ratio, whether it’s recoveries, whether it’s grade, are these robust enough that you can see this being in production?

And the answer to all those questions is positive and it is a yes. So I see this as a tremendous opportunity in a gold market that I don’t think has started to kick off yet. And I think we’re on the front end of a market that is going to get stronger for M&A, stronger for consolidation, which we haven’t seen happen. But I’m fully prepared to take this through stages of further development and get this into construction. I built three mines in Africa in my career. And I would love to build this mine. I think this would be one of the easier ones I have built in my tenor.

WSA: What are some of the key goals and milestones that you’re hoping to accomplish here over the course of the next six months?

Brett Richards: So we’re continuing to advance on the permitting and we’re preparing this to be, I’ll say, construction ready within kind of six to nine months, and there’s a number of things that we’re working on right now relative to the ESIA. It’s 90% ready to be submitted. We probably need another month to be able to submit it. And quite frankly, I see us being in a position to either be transactional, if we want to bring in a joint venture partner, if we want to bring in a partner, or we simply want to do a trade sale and sell the project for value. I think there’s a lot of upside here. We’ve been public about the interest. We’ve made it well known that there are nine non-binding offers out there. We’ve publicly disclosed that in our news releases. And I continue to work with a number of potential counterparties on their interest and getting a potential deal done, but that’s not the that’s not the only offer, that’s not the only outcome for Pasofino shareholders. I think there’s a compelling argument to take this out of the also what I would say the Lassonde Curve and take this up through construction and into production to create real value here.

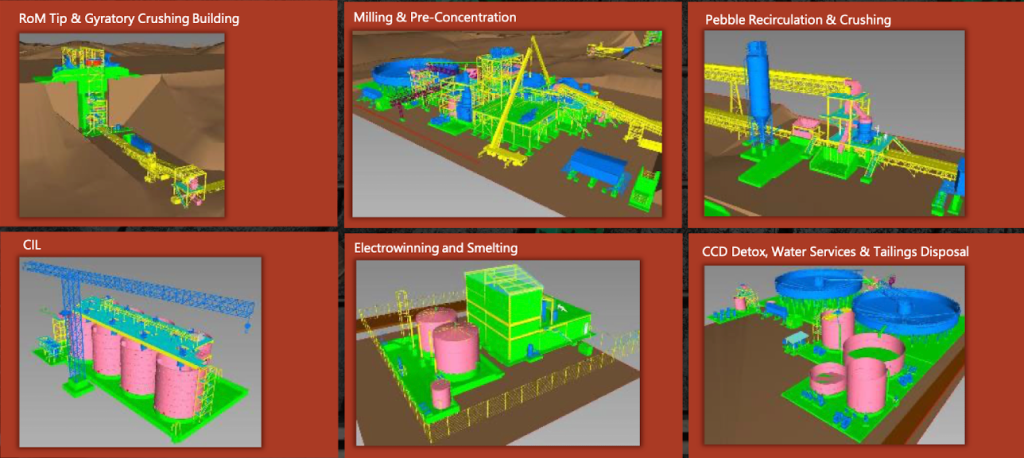

This is a project that has a manageable CAPEX, $435 million CAPEX. And that’s in 2022 [numbers]. If I sensitize that on escalation and inflation, it’s more like $450 million. The OPEX is just over $1,000 per ounce. And that leaves us a gross margin today of around $1,600. We ran the feasibility study on a $1,700 gold price. And the pre-tax NPV5 at $1,700 was $500 million. So just over a one-to-one ratio to CAPEX. But if we look at this from a $2,500 gold price, this has a post-tax NPV that is $1.4 billion. And it has a post-tax IRR at $2,500 gold of 56% and that is that is a substantial project in this environment so this sensitizes all the way down to a very low gold price which I don’t think we’re going to see anytime soon if at all and it actually sensitizes up to the current gold market and if you look at 21, 23, 25, $100 gold prices this is a real project that that generates well over $150 to $200 million of free cash flow per year depending on the gold price you use.

So this is a payback of two years, two and a half years in some cases, and a 14-year mine life with upside. So I really think the economics are going to support whatever avenue we go strategically. So yes, I’m taking the next steps to prepare this for to be construction ready. And we will continue to do that. And in parallel to that, we will see if there’s interested parties that want to participate in that project development in that project construction, or if somebody wants to do this on their own. So there’s a number, there’s a couple of permutations here that I think are going to benefit the Pasofino shareholders tremendously.

WSA: Sure, great, and so perhaps you can talk about your background and experience, Brett, who the key management there is.

Brett Richards: Yeah, absolutely. I’ve been in the mining metal space for about 38 years, and I have worked about half my career in Africa and half my career outside of Africa. I started with Ken Ross and lived in many jurisdictions. I lived in nine countries and I’ve worked on projects in over 30 countries. As I said, I built three mines in my career and I feel I know this space quite well. Our CFO, Lincoln Greenidge, is also a very experienced CFO in TSX and TSXB companies, and he has a great deal of depth in Africa as well. Our chairman, Dan Betts, who is the chairman of Hummingbird, Dan and I have known each other for several years. I was building the Inata Mine in Burkina Faso while he was building the Yanfolila Mine in Mali some 15 years ago, and it was at that point in time I went to the Dugbe project for the very first time and we looked at it and we looked at co-developing it ourselves back then and I went in a different direction with Avocet and then went in a different direction and acquired Carosue.

We have some other really strong candidates on our, guys on our board, Steve Dattels who’s you know he’s a seasoned entrepreneur and executive Bob MacIntyre, who’s a corporate lawyer and a former senior partner in a trial law firm. And we have one of our large shareholders is a director of [ESON], which is a Turkey infrastructure company. Our final director is Tom Hill, who’s the CFO at Hummingbird Resources. And this is what attracted me to the project, is these people and like minds and like experiences I think make for kind of project success. As I kind of left Avocet, I built a mine in Sierra Leone called Octea, a diamond mine, and before that I was one of the founders of Katanga mining in the DRC and was in the DRC for five years building the Kamoto project out and we were taken out by Glencore in 2009.So since that time, I have been a CEO of about seven listed companies, TSX and LSE juniors. And this is my sweet spot.

I like to develop big companies through stages of development. I like to build them, but ultimately it comes down to one thing. I like to make money and I like to make money for my shareholders. I’ve invested about three quarters of a million dollars in Pasofino because I believe in it and I believe in its, its potential. I believe in its economic delivery at the end of the day when in production and I take big swings and you know I’m a major shareholder of Midnight Sun Mining of which I have been involved with now for 10 years. I’m a major shareholder of Goldshore Resources which I have been as part founder and involved with since 2021 and I really put I’ll say my money where my mouth is when I believe in projects and these are all projects that are going to get into production one day and Pasofino and the Dugbe project is another one. So I consider myself an investor / mining executive because I am a heavy investor in our sector.

WSA: Right, and so you mentioned M&A activity and I don’t want to get ahead of ourselves too much, but yeah, what are some of the possible synergies that you would look for in a possible M&A activity?

Brett Richards: Yeah, I think the synergies at the end of the day are really about the disconnect from how we’re valued right now at $60, $65 million market cap in the markets. And relative to what I think this project is worth, when I look at transaction comps and you can look at Acino and you can look at Tietto Minerals and Cote d’Ivoire and you can look at a number of gold projects in Africa and other jurisdictions in the world, whereby you’ve got 3 million ounces plus upside, good grade, good metallurgy, low strip ratio, good infrastructure, and what I call, you add all that up, and I call it the doability factor, Pasofino has that, but the valuation doesn’t reflect it and I think that you know this project should be you know certainly nine digits certainly should be well over 100 million to 150 million dollars as far as its valuation today. It’s not I get that because of this disconnect in the market between valuations of ounces in the ground and actual gold price. I see that as compressing over the next year or two years and others will see that as an opportunity of entry. And that’s why I think it’s not that we’re vulnerable to M&A. I think we’ll be receptive to M&A, but we’re not going to be receptive to it at this valuation. I would rather build it at this valuation and work with a partner and a strategic partner to provide the initial equity and also work on the project financing together. I would say there’s more value to be had in building it than selling it at this level today.

So that’s why we’re running these parallel paths at the end of the day to try and extract the most value for our shareholders. And I’m one. So I’m doing this with all of our shareholders in mind because I’m certainly one of them. And our board have significant positions in the company as well. They have invested heavily over the years in Pasofino and in some cases at higher valuations of what we’re at today but they’re all major shareholders of this company. So it’s quite tightly held. We have very little liquidity unfortunately because it is tightly held and not everybody can fully understands the story. We have 117 million shares out today and trading at kind of 51, 52 cents But you know, we can see 10 or 15 cent swings in our share price with 10,000 shares traded. So I don’t put a real valuation to where we sit in the market today because of the lack of liquidity. And I think once we start to get some more liquidity once people start to understand the value in Pasofino then obviously it’s going to reflect in our share price, but there will still be even more upside later on for those incoming shareholders who get into our stock today.

WSA: Yeah, so current U.S. share price about $0.37. That’s on the OTC, market cap at about $44 million. Before we conclude here, Brett, why do you believe investors should consider the company as a good investment opportunity at this point today?

Brett Richards: Well I obviously [feel] it’s for a lot of the reasons covered on this call but this really does come down to me when I look at major investments in junior mining companies, I have to rely on the people to be the gatekeepers and they need to be the gatekeepers and the custodians of the company and they have to spend money properly, they have to spend money appropriately and hey I’m the furthest thing from a lifestyle CEO and you know hey let’s face it we all see them out there but I am doing this for blood, sweat and tears when it comes to making a good return for our shareholders as quickly as possible. And that’s why I see that this is a great entry point for shareholders.

It really starts with the people. Now, yes, it goes from the people to the location and the geography and then to the project. And you start and walk through those due diligence priorities and we tick every box when it comes to project quality, corporate quality, and like I said earlier, the doability factor of getting a project built here when you’ve got access to infrastructure on a good project. These are projects that are going to get into production. My job is to find a way how to do that and how to deliver shareholder value as quickly as possible and as reasonably as possible in this market.

WSA: Well, we certainly look forward to continuing to track the company’s growth and report on the upcoming progress. And we’d like to thank you for taking the time to join us today, Brett, and update our investor audience on Pasofino Gold. It was great to have you on, and it’s always good talking to you.

Brett Richards: Yeah, Juan, I appreciate coming on the show. Happy to chat anytime, and thanks to the listeners for tuning in.