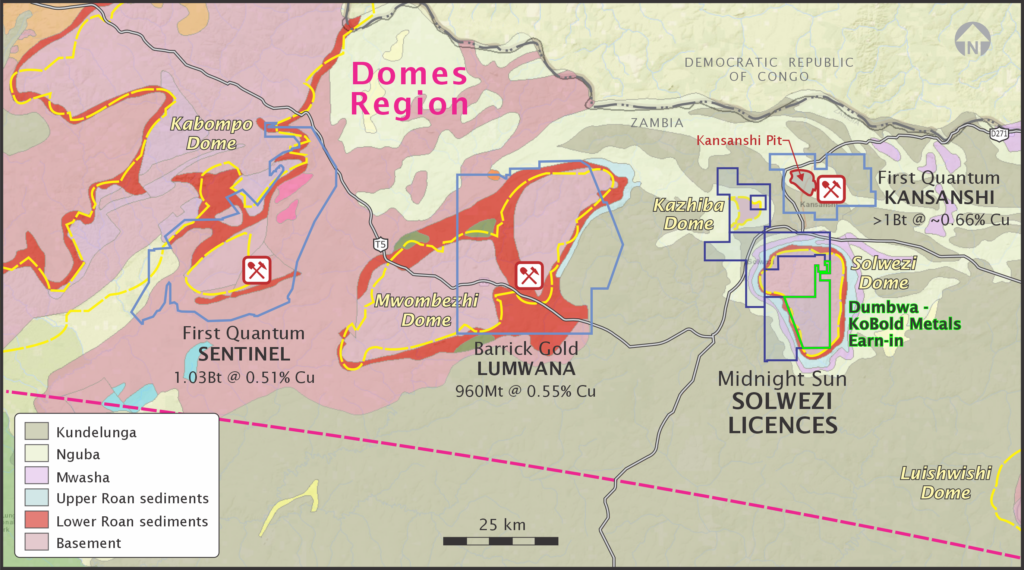

ABOUT: Midnight Sun is focused on exploring our flagship Solwezi Project, located in Zambia. Situated in the heart of the Zambia-Congo Copperbelt, the second largest copper producing region in the world, our property is vast and highly prospective. Our Solwezi Project is surrounded by world-class producing copper mines, including Africa’s largest copper mining complex right next door, First Quantum’s Kansanshi Mine. Led by an experienced geological team with multiple discoveries and mines around the world to their credit, Midnight Sun intends to find and develop Zambia’s next generational copper deposit.

INTERVIEW TRANSCRIPTS:

WSA: Good day from Wall Street, this is Juan Costello, Senior Analyst with the Wall Street Analyzer. Joining us today is Al Fabbro, CEO at Midnight Sun Mining Corporation. The company trades on the TSX venture, MMA, and over the counter MDNGF. Thanks for joining us today there, Al.

Al Fabbro: Yes. Thanks for having me.

WSA: Good to have you back on. I know it’s been about a year to year and a half, and for some of our listeners here that are new to the story, can you provide us with a intro and overview there of the company?

Al Fabbro: Yeah. Over the last year or so, we’ve made progress on two significant fronts. We’ve joint ventured our Dumbwa property to KoBold Resources, which is the new artificial intelligence mining exploration group out of California. It’s backed by some of the biggest billionaires in the world, and their science is leading edge, and we think that it will help unlock what we have at Dumbwa. So we’re excited about that.

WSA: Great. And so yeah, can you go over what your key operations there? Obviously you have the flagship Solwezi there in Zambia.

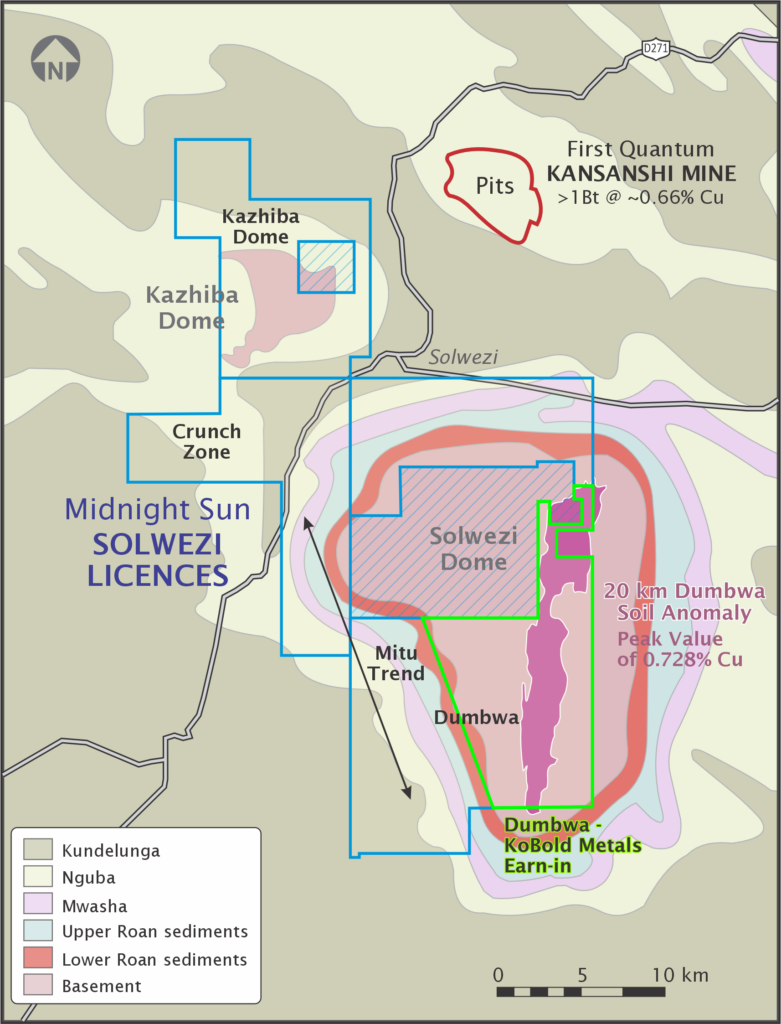

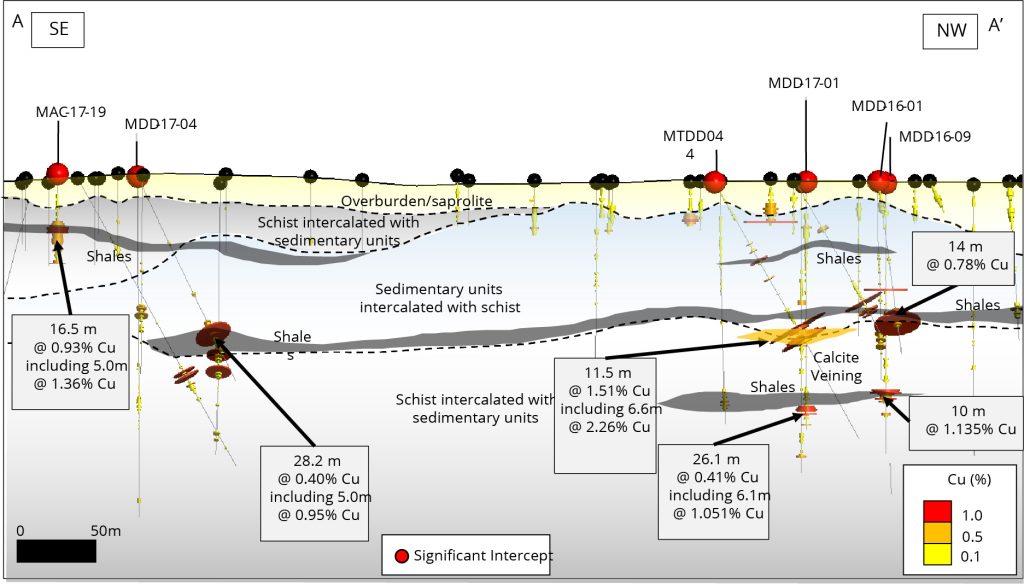

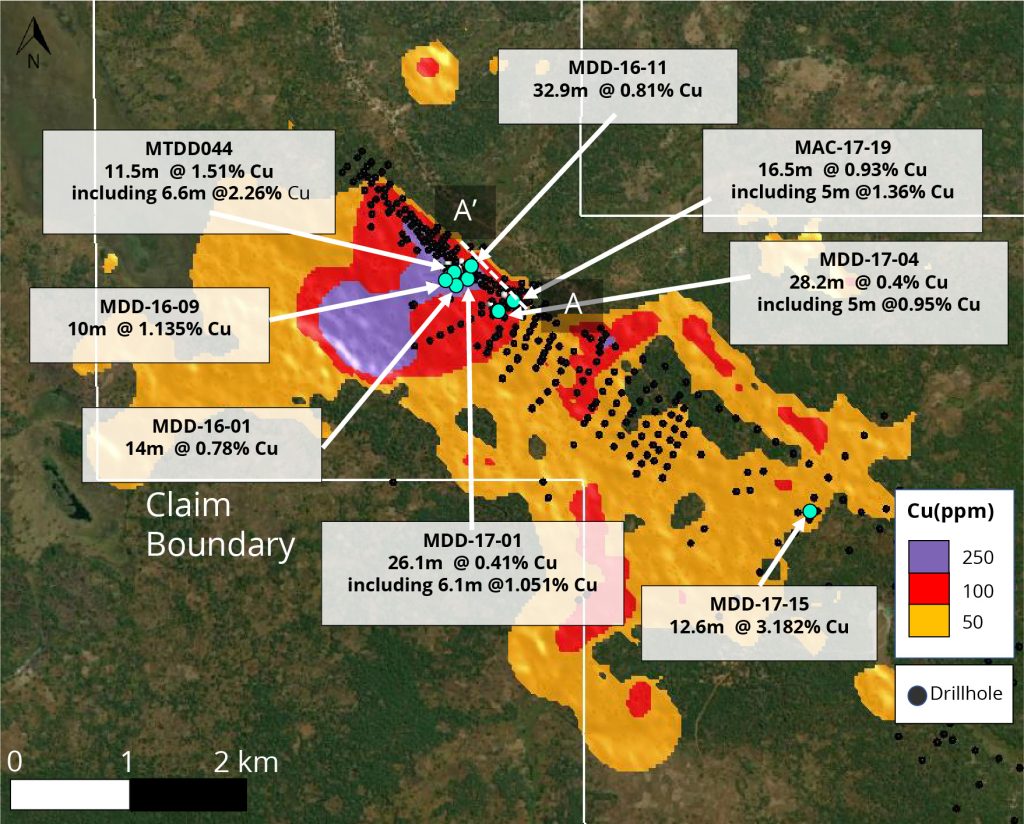

Al Fabbro: So this is the far eastern license. It’s one of three licenses we have. The deal with KoBold only concerns this license called Dumbwa. It’s a 20 kilometer long soil anatomy that we’ve got several ore grade hits on it, but we haven’t managed to develop continuity on the ore deposits yet. KoBold thinks they’ve unlocked it with their technologies, and they’re going to start a drill program within 30 days as part of a four and a half year 15 million US spend to earn 75% interest in that part of the license.

WSA: Right. And can you talk about your strategy when it comes to strategic partnerships, joint ventures, what sort of synergies you look for there?

Al Fabbro: Well, what we want from these is answers on these deposits. They’re complex, they’re complicated geologically, and throwing one or two or $5 million at these things usually doesn’t give you enough information to come to a satisfactory conclusion one way or the other. This 20 million Canadian spend that KoBold will do at Dumbwa should resolve this one way or the other, and we think it’s going to be favorable.

WSA: Yeah. That’s great. And so can you please bring us up to speed there on the recent news?

Al Fabbro: Well, we just closed a $10 million financing last month, so for the first time our war chest is well endowed. As part of that spend, we are going to focus on developing oxide resources on our Western licenses. We’re formalizing an agreement with First Quantum that we will develop oxide resources that will be processed at their plant using a tract from our property over to their plant. They currently have a 25,000 ton a day plant that is vastly underutilized. They also produce about 1.2 million tons of sulphuric acid a year from their smelter on site. Until this year that acid had always been used to process their own copper oxide ores. They’re currently out of copper oxide, ores or they’re down to the dregs.

We have two significant areas where we believe we can supply significant quantities of copper oxide ore to be treated at their plant. And we have an arrangement to revenue share on that. And the numbers look quite attractive. We will begin our drill program probably first week of August. We will start at the 22 zone, which is in the northern part of the property, that’s about eight kilometers from mine gate. And we’re about two kilometers from First Quantum Haul Road. So the development and infrastructure to develop this asset is going to be negligible. And we’re looking forward to producing some time around this time next year, we believe.

WSA: And perhaps you can talk about your background experience, Al, as well as the key management team as you’ve just added some new members.

Al Fabbro: We’ve just added Margot Naudie to our advisory board. Margot used to run the mining division of the Canadian Pension Plan. She’s a hall of famer on Bay Street. And she is a very enthusiastic advocate for Zambian geology and Zambian copper mining. She’s a very big fan of David Broughton, who is going to lead the exploration charge at Dumbwa for KoBold. David was VPX for Ivanhoe on those exciting discoveries up in the DRC. And David’s going to lead the program at Dumbwa. And then also we’ve been very fortunate to hire Kevin Bonel. He’s ex exploration Manager for Barrick at Lumwana. Lumwana has a lot of geological characteristics similar to Dumbwa. And he’s also has some copper oxide mining experience. So Kevin’s going to lead the oxide charge, and he’s going to be collaborative on the Dumbwa exploration. So those two key critical people involved in our deal now.

We’ve also hired Adrian O’Brien as our VP Marketing. Adrian has a 20 year background in marketing. He is well known. He is very knowledgeable and very enthusiastic, and he brings an aspect to our company that we have previously not had.

WSA: Good. And so what are some of the key goals that you’re looking at here over the course of the next six months that investors should keep an eye out for?

Al Fabbro: Well, we’re looking for discovery holes at Dumbwa and to guide next year’s program, which we think will be a very significant program. And then on the oxide front, we’re looking to develop a decent tonnage that we could begin mine planning for processing those plans. And we should have answers to both those questions sometime in October or early November.

WSA: Right. And so what are the factors that you feel make Midnight Sun unique from some of the other players there in the sector?

Al Fabbro: Well, one of the only juniors in Zambia, and we firmly believe that Zambia is one of the best places to be to find large high grade copper deposits. And we’ve got a two-fold approach now that we think is going to benefit our investors and de-risk it a lot. We do believe that we’re going to produce copper at a very high price now copper’s 4.50 or so. For years it languished in a — half that price. So we think we can create significant cash flow to our investors while we explore the rest of the licenses. And we still believe that there is significant sulfide mineralization on the Western licenses and the revenue generated from the production will allow us to give these targets the significant capital they need to develop.

WSA: What are the key trends that you’ve been seeing right now in the sector and is there anything perhaps you want to vent about, the way that the market’s reflecting the share price and stock?

Al Fabbro: No, I don’t. I think the stock’s fairly valued at this point. I think it’s going to go higher because I think we’re going to meet some critical goals through our drill bit. We’re excited about the revenue situation. We think if we can show proof of concept in that, then all of a sudden the whole story gets de-risked, and you have these significant targets that give you possible big upside, but you also have the safety net of this production from the oxide sources.

WSA: Right. So, yeah, right now current share price here in the US 29 cents per share and market cap, US market cap north of 60 million. So before we conclude here, Al, why do you believe investors should continue to look at the company as a good investment opportunity today?

Al Fabbro: Well, we do feel we host a generational mine on our license in Solwezi. And that now for the first time in our history, we have the opportunity to develop these assets with enough capital to give us the answers we need.

WSA: Well, we certainly look forward to continue to track the company’s growth and report on the upcoming progress and we’d like to thank you for taking the time to join us today and update our investor audience. It’s always good to have you on.

Al Fabbro: Good stuff. Thank you, Juan.

NOTES:

Midnight Sun & KoBold Metals Earn-In at Dumbwa Target

Signed in January 2024, the Dumbwa Earn-In Agreement allows KoBold Metals to earn a 75% interest in Dumbwa by incurring USD$15 million in exploration expenditures and making cumulative cash payments to Midnight Sun of USD$500,000 over 4.5 years.

Exploration expenditures under the Earn-In are as follows:

- Year 1– Completion of a minimum of 2,000 metres of diamond core drilling

- Year 2 – USD $4,000,000 of exploration

- Year 3 – USD $7,000,000 of cumulative exploration

- Year 4.5 – USD $15,000,000 of cumulative exploration

KoBold Metals Company, a US-based exploration and mining company, is advancing 60 active projects spanning 4 continents. Founded in 2018, KoBold is backed by world-class technology investors including Breakthrough Energy Ventures (initiated by Bill Gates), and Silicon Valley venture capital firm Andreessen Horowitz, as well as institutional investors such as T. Rowe Price and the Canadian Pension Plan Investment Board. KoBold leverages artificial intelligence through proprietary analytical tools and big data to improve and accelerate the exploration process.

KoBold has assembled KoBold has one of the top global sediment-hosted copper teams – including Chief Geologist, Dr. David Broughton, a world-renowned expert in sediment hosted copper deposits. Dr. Broughton is credited with leading the discoveries of both Kamoa and Platreef, as well as serving as Geologist and Project Manager for Kansanshi’s pre-feasibility project, which became Zambia’s largest producing copper mine and is adjacent to the Solwezi Project. KoBold’s team of top-tier geologists will work diligently to unlock Dumbwa’s potential.