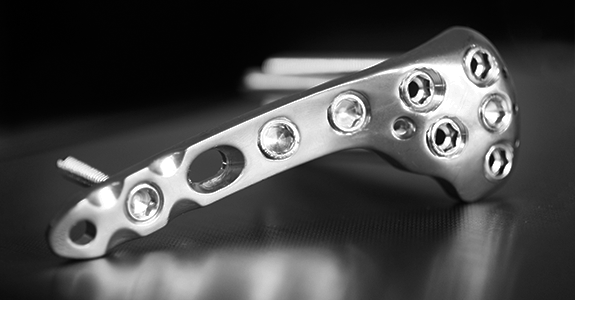

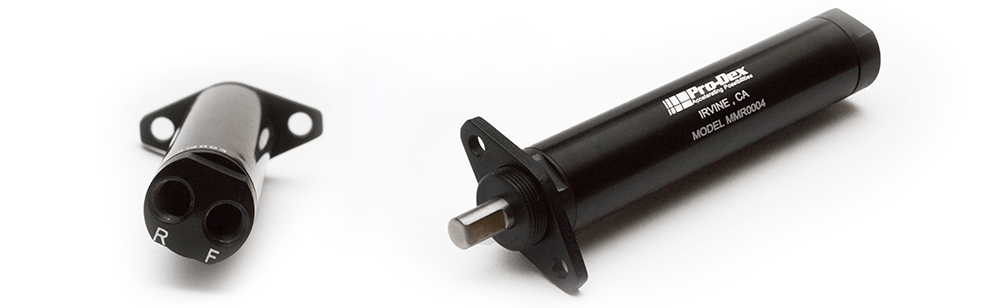

ABOUT: Pro-Dex, Inc. designs, develops, manufactures, and sells powered surgical instruments for medical device original equipment manufacturers worldwide. The company offers autoclavable, battery-powered and electric, and multi-function surgical drivers and shavers that are primarily used in the orthopedic, thoracic, and craniomaxillofacial markets. It also provides engineering, quality, and regulatory consulting services; and manufactures and sells rotary air motors to various industries. The company was founded in 1978 and is headquartered in Irvine, California.

INTERVIEW TRANSCRIPTS:

WSA: Good day from Wall Street. This is Juan Costello, Senior Analyst with the Wall Street Analyzer. Joining us today is Rick Van Kirk, CEO at Pro-Dex Incorporated. The company trades on NASDAQ ticker symbol P-D-E-X. Thanks for joining us today there, Rick.

Rick Van Kirk: Thanks for having me. I appreciate it.

WSA: Always good having you on, so please start off there by providing us with the intro and overview here of the company for some of our listeners that may be new to the story and not caught some of our previous calls.

Rick Van Kirk: Okay, yeah, great. Pro-Dex we’re in Orange County, California had been around 45 plus years, medical device manufacturing. We do both contract manufacturing and design work for people and also have our own products and technology that we like to supply as well. We’ve made a lot of instruments, power tools for the operating over the years, so to speak, and looking forward to doing that for a long, long time.

WSA: Certainly. And can you bring us up to speed there on your, you know, fiscal Q3 and the nine month results you just put out?

Rick Van Kirk: Yes. We’re very happy with the results. Our top line went over $14 million for the first time in the history of the company. So we’re very pleased with that. We had a bit of a rough second quarter margin-wise and we recovered that. All this stuff is in our filings. Inventory was coming down. So really happy with the results. I think they get a little murky because of now — so we have some investments and we have a particular investment that we have high hopes for, but it’s kind of volatile right now.

So there’s a number of quarters where there’ll be unrealized gains or losses that kind of muck up the bottom line where we had a really good quarter operationally, but with an unrealized loss, it looks like we didn’t do as well as we did. You know, EPS kind of concerns some people in the market out there, but if you adjust for that, it really would have been an excess of any previous quarter that I remember. So I think we did great, we’re happy with it. I just think sometimes the message gets muddled in the bottom line there.

WSA: Yeah, especially if you have certain like one-time expenses or things that, you know, you’re not rolling over.

Rick Van Kirk: Yeah, so we’re happy with where we are and the progress we’re making and then the growth is there that, you know, I’ve talked a number of times that we have aggressive growth plans and we’re sticking to that.

WSA: What are the key trends that you’re seeing right now in the sector and what makes products uniquely positioned to be able to capitalize?

Rick Van Kirk: Cost; everybody is concerned about cost, hospitals, our customers, our suppliers. So, you know, we have the benefit of having some long-term relationships with both. So we can form agreements that are, you know, kind of cost sensitive to everybody. We’ve also invested heavily in more sustaining engineering and continuous improvement programs to kind of keep up with that demand. Our products actually speed up the process in the operating room, which helps them save costs there. So we think there’s some things that we can do to contribute to the situation.

WSA: And so can you talk about the growth in the research and developments out of your business and as you’ve kind of been trying to ramp up and speed up that cycle?

Rick Van Kirk: Yes, I mean, the people follow us can see over the years we’ve invested more in R &D and we have a chart in there that shows some of the projects and they’ll see that we’ve actually added back to our road maps and products — branded products to help us grow the business and shorten the sales cycle. So we’re pleased to be moving back in that direction.

WSA: Right. So you’re doing that by trying to get your product back there with more visibility, maybe like a better website, being upfront about it, getting more feet on the ground?

Rick Van Kirk: Yeah, and then developing more products that we can show on the website or social media. And we’ve done that in the past, had some success. In recent years, we had customer funded projects that we focus our engineering resources on now. We’re able to do that as well as some products, catalog type products, I guess I would call it.

WSA: So in which ways are you looking to increase growth that you’ve done either in the past or that you’re going to do to increase that NRE revenue?

Rick Van Kirk: Our growth will come from some new products. We are investing in the capacity and the front end of the business. I think we’ve talked before that we have a second building now that’s fully operational and we effectively doubled our capacity when now frees us up to be a little more aggressive in the sales efforts and updating the website and doing some other things like branding, maybe we haven’t done before, now that we really have some unused capacity for the first time in a long time.

WSA: And yeah, perhaps you can talk about your background experience, Rick, and who the key management there is; how your current interests align with your current shareholders, as well as potential future investors.

Rick Van Kirk: I’ve been in the manufacturing world for about 40 years, 19 of them here with Pro-Dex. I started here as the Director of Manufacturing and somehow worked my way into this role. So it helps to have an understanding of what goes on, you know, in the shop floor in terms of making the products for people. A couple of other managers on the management team here have been here 10 years, 19 years, so we have kind of a good mix of experience and then some new director level people coming in with some new ideas, you know, in sports they call it a good mix of youth and experience, we’ve got something like that.

In terms of interests aligning with shareholders, I’m a shareholder, so I’m going to do all I can to increase the value for all of us. And we think we can do that by, you know, taking really good care of our customers and servicing them and making products that reduce cost, be operationally efficient and execute, be responsive to anything else our customer needs and take really good care of the employees here. And I think if we do all that, everyone ends up happy.

WSA: Yeah, and I know at the end of the day that we have covered it a few times, but it is a key point, how does the product help A; number one, the surgeon in the room and B; number two, how does that make it easier for the or more comfortable for the patient?

Rick Van Kirk: Well, it does, it speeds up the surgery. And in particular, our screwdriver products, it’s less wear and tear manually because our screwdrivers will seat screws very quickly without much extra effort and they seem to appreciate that. The patients are done sooner, the plates and screws that come into the surgery are probably placed more securely and safely. Our customers benefit because, they sell more plates and screws, so it kind of works out for everybody, I think.

WSA: Before we conclude here, why do you believe investors should consider the company as a good investment opportunity at this point and price today?

Rick Van Kirk: Well, I would suggest look at our track record. You know, the last nine or so, we’ve grown from 11 to 46 million. And as we pointed out in the last range release, tracking to continue that growth this coming year-end, we’ve invested in a second building at double capacity. We’re investing in, you know, people and equipment and training and all the right things. When we started this, the share price was a couple of bucks a share, now it’s 19 something, so I think we’ve been a good bet so far, and I expect us to continue to be one.

WSA: So right now, current share price, 1951 a share, market cap slightly north of 65 million, and yeah, we’d like to thank you for taking the time to join us today, Rick, and update our investor audience on our product. It’s always good having you on.

Rick Van Kirk: I appreciate it. Happy to do it any time. Thanks, Juan.