Power Nickel Inc. September 6, 2023 In this article:

TORONTO, ON / ACCESSWIRE / August 22, 2023 / Power Nickel Inc.(the “Company” or “Power Nickel”) (TSXV:PNPN)(OTCQB:CMETF)(Frankfurt IVV) is please to announce that the step out hole testing the Nisk Main Deposit 300 metres to the south and east of previous drilling has encountered at a downhole depth of 457 metres about 25 metres of massive and semi-massive sulfides.

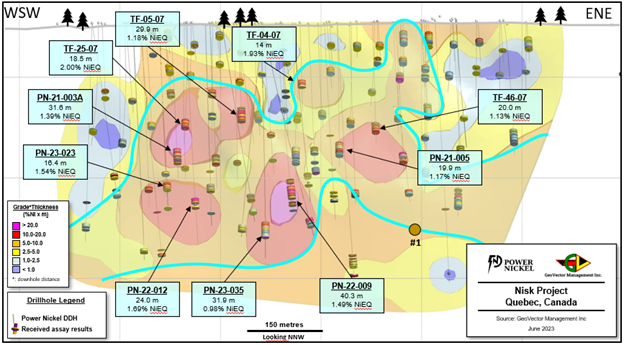

The hole, Number 1 in Figure 1 above, is testing at depth an area to the east of two of the best holes, PN-22-009 and PN-23-035.

“Pretty as a picture. The Scientific team has done a terrific job using both traditional scientific tools like Gravity, IP, Airborne and Downhole EM together with the newer Ambient Noise Tomography to guide us to an exciting new growth zone for Nisk Main. This SE Trend is one of three we have identified at Nisk Main and all look very promising at depth and along strike” – Commented Power Nickel CEO Terry Lynch.

The picture below presents a mosaic of the 6 core boxes containing the massive and semi-massive sulphides intercepted over 25m in this first hole of the fall drilling program.

“The SE plunge within the mineralized horizon is a compelling observation. Testing identified plunges at progressive deeper depths is the strategy behind these initial few holes of our fall campaign. Although the grade cannot be presumed now, successfully intersecting these massive and semi massive sulfides is a very encouraging start to our program” – commented VP Exploration Kenneth Williamson.

Qualified Person

Kenneth Williamson, Géo, M.Sc., VP Exploration at Power Nickel, is the qualified person who has reviewed and approved the technical disclosure contained in this news release.

About Power Nickel Inc.

Power Nickel is a Canadian junior exploration company focusing on developing the High-Grade Nisk project into Canada’s first Carbon Neutral Nickel mine.

On February 1, 2021, Power Nickel (then called Chilean Metals) completed the acquisition of its option to acquire up to 80% of the Nisk project from Critical Elements Lithium Corp. (CRE: TSXV). Subsequently, Power Nickel has exercised its option to acquire 50% of the Nisk Project and delivered notice to Critical Elements that it intends to exercise its second option to bring its ownership to 80%. The last remaining commitment to activate this exercise of the option is the delivery of a NI-43-101 Technical report which is anticipated to occur at the latest in Q4 2023.

The NISK property comprises a significant land position (20 kilometers of strike length) with numerous high-grade intercepts. Power Nickel is focused on expanding the historical high-grade nickel-copper PGE mineralization with a series of drill programs designed to test the initial Nisk discovery zone and to explore the land package for adjacent potential Nickel deposits.

In addition to the Nisk project, Power Nickel owns significant land packages in British Colombia and Chile. Power Nickel is expected to reorganize these assets in a related public vehicle through a plan of arrangement.

Power Nickel announced on June 8, 2021, that an agreement had been made to complete the 100% acquisition of its Golden Ivan project in the heart of the Golden Triangle. The Golden Triangle has reported mineral resources (past production and current resources) in 130 million ounces of gold, 800 million ounces of silver, and 40 billion pounds of copper (Resource World). This property hosts two known mineral showings (gold ore and Magee) and a portion of the past-producing Silverado mine, reportedly exploited between 1921 and 1939. These mineral showings are Polymetallic veins containing quantities of silver, lead, zinc, plus/minus gold, and plus/minus copper.

Power Nickel is also 100 percent owner of five properties comprising over 50,000 acres strategically located in the prolific iron-oxide-copper-gold belt of northern Chile. It also owns a 3-per-cent NSR royalty interest on any future production from the Copaquire copper-molybdenum deposit sold to a subsidiary of Teck Resources Inc. Under the terms of the sale agreement, Teck has the right to acquire one-third of the 3-per-cent NSR for $3 million at any time. The Copaquire property borders Teck’s producing Quebrada Blanca copper mine in Chile’s first region.

For further information on Power Nickel Inc., please contact:

Mr. Terry Lynch, CEO

647-448-8044

terry@powernickel.com

For further information, readers are encouraged to contact:

Power Nickel Inc.

The Canadian Venture Building

82 Richmond St East, Suite 202

Toronto, ON

Neither the TSX Venture Exchange nor it’s Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This message contains certain statements that may be deemed “forward-looking statements” concerning the Company within the meaning of applicable securities laws. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential,” “indicates,” “opportunity,” “possible” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance, are subject to risks and uncertainties, and actual results or realities may differ materially from those in the forward-looking statements. Such material risks and uncertainties include, but are not limited to, among others, the timing for the Company to close the private placement or the second Nisk option or risk that such transactions do not close at all; raise sufficient capital to fund its obligations under its property agreements going forward; to maintain its mineral tenures and concessions in good standing; to explore and develop its projects; changes in economic conditions or financial markets; the inherent hazards associates with mineral exploration and mining operations; future prices of nickel and other metals; changes in general economic conditions; accuracy of mineral resource and reserve estimates; the potential for new discoveries; the ability of the Company to obtain the necessary permits and consents required to explore, drill and develop the projects and if accepted, to obtain such licenses and approvals in a timely fashion relative to the Company’s plans and business objectives for the applicable project; the general ability of the Company to monetize its mineral resources; and changes in environmental and other laws or regulations that could have an impact on the Company’s operations, compliance with environmental laws and regulations, dependence on key management personnel and general competition in the mining industry.

SOURCE: Power Nickel Inc.