ABOUT: Ra Medical, and its wholly owned subsidiary Catheter Precision, is an innovative U.S.-based medical device company bringing new solutions to market to improve the treatment of cardiac arrhythmias. It is focused on developing groundbreaking technology for electrophysiology procedures by collaborating with physicians and continuously advancing its products. For more information visit: https://www.catheterprecision.com

INTERVIEW TRANSCRIPTS:

WSA: Good day from Wall Street, this is Juan Costello, Senior Analyst for the Wall Street Analyzer. Joining us today is David Jenkins, Executive Chairman at Ra Medical Systems. The company trades on the New York Stock Exchange American, ticker symbol RMED. Thanks for joining us, David.

David Jenkins: Yeah, thank you, Juan. It’s a pleasure. So let me just give you a little bit of background. We’ve been a private company for several years. We’re in the field of cardiac electrophysiology. We were looking for some additional funding that would come through less dilutive manner to our shareholders than if we just went to venture capitalist, and so we were introduced by Ladenburg to this company Ra Med, I think it’s kind of a fallen angel that had really gone out, raised a lot of money, and had focused on a certain segment that I think they were scratching their head whether or not that was a good long term project for them. So we just did a reverse merger, Ra Med is listed in New York Stock Exchange American, and we completed that in January and now we’re kind of on our mission to really kind of exploit what’s kind of this growth area of cardiac electrophysiology. So as a little bit of background, this is my third cardiac electrophysiology company. The first one, our technology ended up with GE, that product is still out there, the CardioLab is still on the market today.

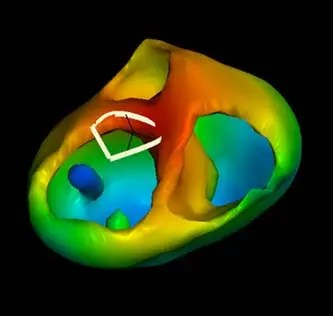

My second company, EP MedSystems that I started up, we sold that off to St. Jude Medical, which is now part of Abbot and we are kind of a mainstay of their product line for cardiac electrophysiology, and so this is our third company. We have really three main product areas. One that we started off with was a robotic arm, so that you can remotely control a catheter out in the control room. We put that on the back burner because we thought that was going to take a little bit more money to get it into the market but nonetheless we did have a CE mark and an FDA approval. That product needs to be updated, modernized a little bit and brought back to the market. On top of that, we ran into some technology that we think is in the big growth area for electrophysiology, which is the area of working on ventricular side of things. Most of the growth in the last 20 years has been in the area of atrial fibrillation and now you’ll see these places routinely done what we call A-fib and A-fib ablations on a daily basis, so it’s almost like a dentist now doing fillings for a patient. And we think the big growth area is going to be on the ventricular side, so people that have fast heart beats in the ventricle have what we call PVCs, Premature Ventricular Contractions, and all of those, the physicians have basically shied away because it takes a very long amount of time to do. So we have a technology that pinpoints where we think they should ablate for tissue in a ventricle, so it turns a four-hour procedure into something that’s less than an hour. And then our third product that we just introduced really last week is called the LockeT. So the LockeT device basically what it does is when you pull a catheter back out of the body, from a groin area, you’re going to have a little geyser of blood coming up, and so what do we do about that, right? So we can stand there and hold it with our fingers for 20 or 30 minutes, you can assist that by stitching it up just a little bit and then continue to hold it or you can put in a more expensive technology which was more of a collagen plug type device and be happy with that. So what we’ve come up with is a way to hold the sutures, so you do put in the sutures, and it holds it, you send it down kind of like the old cub scout putting his scarf up tightly around his neck, so this puts it tightly down and you lock it into place, if you want it tighter you can lock it down a little bit more and then the patient goes to the recovery room, you can remove the device and see if it still needs to stay on longer, tighter, looser, whatever you want, but easy for the recovery nurse to take off and just pull out the sutures. So there’s no knot, no sutures, no scissors required, so nobody is going to kind of what I would call screw up the wound site there and hopefully the patient is up and ambulating within a few hours and it’s doing its job. So that’s our three main product areas. They are unique. They’re different. One thing I’ve learned in cardiac EP is I don’t want to have our company really competing heavily with another ablation catheter against J&J or Medtronic or Boston Scientific or Abbot, right? I mean that’s a fool’s errand, I think. So what we want to do is make sure that what we have is unique, different and something that really aides the physician in bringing about better patient care at a lower cost.

WSA: So yeah, in terms of some of that recent news, I guess, we’ll focus on the LockeT device. Can you talk about that — your subsidiary or Catheter Precision, what are some of the basic highlights of the merger?

David Jenkins: Yeah, yeah. So focusing on that device, really, we just got it out last week. We’ve got one physician, on Monday he did four patients, so he used two of those devices on each patient. Each device sells for about a $150. If you kind of multiply that up times the number of procedures that are out there, I mean we have a half million A-fib procedures a year, we have a number of ventricular procedures and then other procedures, more simple arrhythmias like atrial flutter or atrial tachycardia, so there’s as much as a million procedures out there. And then on top of that, this thing can go well beyond electrophysiology to vascular surgery and to structural heart. So we’re quite excited with the potential. We’re going to sell this primarily through independent distributors so that we’re not focusing our direct sales guys onto what is a product that really needs to get out very quickly to a lot of hospitals and instead they’re going to focus on the VIVO product which is more technology oriented and takes a little bit more handholding and guidance with the customers to get them up and comfortable with it.

So the company itself, we had a couple of requirements, one, is that it was a listed company, and number two, that we ended up with some good amount of money on the balance sheet so that we’re not simply chasing money almost annually as some micro caps can do. So we’ll end up I think when the merger is settled there, there was around $13 million, $14 million. There was a number of kind of bills and change in control and kind of pass the little problems that the company have and then once we pay all those off we also want to bring in some additional funding. So we have an agreement in a pipe format to bring in some money in March and so by the end of the March we hope that will happen, it’ll be about $8 million, and so with that we should have more than enough cash on hand to last us a couple of years. And if the LockeT device takes off like we think it should, really, then there’s significant cash flow from that, and hopefully we don’t have to go back and tap the market.

WSA: And are these all patented products and do you have all the IP protection on the Lock and the VIVO?

David Jenkins: Absolutely. So the Amigo, the robotic device, we have 23 patents. On the VIVO product, in fact, we just got a notice that we have a new patent which will be issued on March 6th, we’ve got over 10 patents and I guess 12 or 15 patents on that VIVO product. And we have filed four applications on the LockeT device. And we’re comfortable with our positions on all of those.

WSA: And what are the key goals and milestones that you’re hoping to accomplish here over the course of the next six months?

David Jenkins: Yeah, sure, sure. So there’s a few kind of what I call administrative housekeeping things. Like, number one is bring in that $8 million. The agreement is all we are doing is waiting for shareholder approval and that meeting date is set for March 21. So we believe that should pass without a problem. We do have a number of our shareholders. They came in from the merger that we hope to kind of keep happy and keep them long term motivated. In fact, we’re only going to convert — it was done on a preferred stock, we’re only going to convert about 20% of that here this year and then the remaining amount won’t convert until at least the middle of next year. So the majority of stock that we have out there is going to be held back and you’re not going to see really much trading out of that. So that’s kind of our capital side of the position. If you look at our other kind of main goals here, one is to make sure that every one of our independent distributors is up and running is happy with the way our LockeT device is working. And I would say by the end of the second quarter that we’re starting to achieve revenue on that, by the end of the year we’ll achieve significant revenue to where we are well over $10 million going into next year, as far as the run rate and what we’ll do next year.

The next thing we want to do is probably — we are just in the process of hiring additional sales guys and clinical people and we hope to have them all trained up here within this first quarter so that we’re out there in the second quarter and that the VIVO product is going to contribute to revenue in the third and fourth quarters. So one of the goals for this year is to have 20 systems up and running in the US and so that we’re well on our way, so that by the end of next year we’ll have about 50 systems up and running. And with 50 systems we think that really proves out kind of the clinical model that there’s a substantial acceptance out there and that the hospitals are using it on a routine basis. We had one hospital last year, so that’s one of our very early ones that we brought on, they’ve expanded their patient base to where they’re doing a lot more ventricular cases and they ordered with the VIVO $100,000 in disposable product. So the product really has potential if everyone starts utilizing it in the same manner to where it can start achieving significant revenue.

WSA: Yeah, sure. And so perhaps you can talk a little bit more about your background and experience and who the key management team is there, David, as obviously there’s still some shifts there and some additions that need to be made, but ultimately what’s your skin in the game?

David Jenkins: Well, my skin in the game is I’ve invested over $25 million into this company, personally. So I’ve had success in the past, both in electrophysiology and outside of that. I’ve sold the company off to Medtronic. I’ve sold that one off to St. Jude. And so, I don’t ask any investors to put money into a company unless I’m willing to put in alongside them. So we’ve kept it private for quite a long time and now we’re kind of hitting those go-to-market phase and so now we think we’re kind of ready to rock and roll. My background, people say, well, do you have a science background, do you have an engineering background, you have some medical background? The answer to all that is no. My background actually started off in accounting back in the old days of big APE accounting, but I always knew that accounting was for me just a platform for me to do other things. In my gut, really, I’m an entrepreneur and so I look at things a little bit differently than others. And so, when you say where is your whole management team? We have very few people that we’ve had up until this point. We do have a Chief Commercial Officer, Patricia Kennedy, she’s been with us, or not with us, but she’s worked with me on another company and she’s been in the EP field for substantial amount of time. She can walk into any EP lab, talk to any doctor about our technology and sit down and run it with the patients. And I think that’s pretty imperative that we have people all that are in the field that are really conversant with our products, including myself. Beyond that, we have Missiaen Huck, she is our Chief Operating Officer and she really just handles everything, from marketing stuff to assembling product, inventory shipping, all of that type stuff, and that’s kind of the extent of our kind of management crew that’s there. We are seeking a CFO because the one that we’ve inherited from Ra Med he has always announced that he is a temporary CFO, he’s doing a pretty strong job, but we need somebody that’s coming in permanent. Right now, it’s helpful that my background is in accounting so I fill some gaps there, but my attention is spent more on, really assisting in sales, customer relations and shareholder relations and kind of overall strategy.

WSA: So while you’re on the Wall Street Analyzer, is there anything that you want to vent about the stock? Pretend you’re talking to your therapist about the stock price. Obviously, you guys were below the minimum bid a few months ago but you came out of that, so what do you think about the run rate the room to grow?

David Jenkins: Yeah. Well, stocks sometimes will do what they want to do. I think what people have to do is look at this whole cardiac electrophysiology area. If you’ve got something unique and different that fits in, it’s adjunctive to the therapies that the larger companies are offering these things are bought out for a lot, a lot of money, right? So Medtronic recently bought out a company for 960 million. No revenue, no approval, right, it was bought out. Lucent Scientific recently bought out a company, they have a needle that helps create a hole so that you can put a catheter in the other side, sounds relatively simple, $1.7 billion for this company, right? Boston Scientific bought out another new ablation technology here a little while ago for 600 million. So we used to look at this field and say, okay, let’s get something up and running, let’s prove out the technology and a big guy will buy us out for $200 million to $400 million and I think those — the area has grown so much, right? I mean if you look at the VASCADE devices, a closed device bought out for $510 million and I think they’re reporting that thing is growing at 35% a year. If you look at J&J, their quarterly report, they’re saying they’re always in the double digits growth and their subsidiary called Biosense which is their electrophysiology division. So I think what you have to do is kind of say, all right, do we have technology, do we have stuff that improve patient care, improves cost, right? I mean if you take our– if our VIVO product can take about three hours of cath lab time, right, I mean what’s — an hour worth at least $5000, so you’re saving $15,000 but more importantly you can squeeze another case in during the day, another procedure, well, now you’re getting more like $25,000. So the ability to really get it out there and make it happen creates value in our company beyond the stock price, it is something I think people can look at both short term and long term. And long term, I’ve got a significant amount of money into this but I know this field very well and it’s going to be something that I think I’m going to be very proud of. I do not fail in companies. I get them across the finish line and so if you’re tagging along with me or electrophysiology I think you’ll always be a winner. If you look at some comparative stuff out there, our stock price is a little bit low, and I think if you look at there’s going to be a very few of the outstanding shares that are actually going to be trading. I think that’s a good point. And then finally, our stock has had a terrific following, number of StockTwits and the volume that’s been out there, I mean we’ve had volumes as much as 20 million shares a day, which is ten times the outstanding shares. So we believe that there are people that are engaged, that are watching it and are going to continue to be with us.

WSA: Well. Good, yeah. Current share price is $2.86, market cap at about 8 million. So before we conclude here, is there anything else you’d like to add about Ra Medical about why investor should consider the company a good investment opportunity at this point today?

David Jenkins: Well, no, I think I kind of summed it up. I think this field of cardiac electrophysiology is probably one of the hottest growth areas for medical devices. We have a good experienced CEO and a couple of other people that are with us and we’ve got plenty of money to last through the next two to three years.

WSA: Well, we certainly look forward to continue to track the company’s growth and report on the upcoming progress, and we’d like to thank you for taking the time to join us today and introduce our investor audience to Ra Medical. It was great having you on and learning more about you as well as the company.

David Jenkins: Okay, great. I appreciate it. Thank you.