ABOUT: Pro-Dex, Inc. designs, develops, manufactures, and sells powered surgical instruments for medical device original equipment manufacturers worldwide. The company offers autoclavable, battery-powered and electric, and multi-function surgical drivers and shavers that are primarily used in the orthopedic, thoracic, and craniomaxillofacial markets. It also provides engineering, quality, and regulatory consulting services; and manufactures and sells rotary air motors to various industries. The company was founded in 1978 and is headquartered in Irvine, California.

INTERVIEW TRANSCRIPTS:

WSA: Good day from Wall Street, this is Juan Costello, Senior Analyst with the Wall Street Analyzer. Joining us today is Rick Van Kirk, CEO at Pro-Dex Incorporated. The company trades on NASDAQ, ticker symbol PDEX. Thanks for joining us here then, Rick.

Rick Van Kirk: Thank you for having me. I appreciate it.

WSA: Yeah, you’ve been on the show a few times, but still for some of our listeners that may be new to the story or new subscribers…Perhaps you can start off with a brief intro there.

Rick Van Kirk: Yeah. Pro-Dex has been around about 40 years, the last 25 or so focused in medical device. We do both contract manufacturing and design for customers, and also have our own technology and products as well. So we think we have a pretty good infrastructure to support people in a lot of different things they might need.

WSA: Yeah. And can you bring us up to speed there on some of the most recent news including Q2 and six-year results?

Rick Van Kirk: Yes. Just recently we posted our second quarter results. We’re on a fiscal year that ends at the end of June. So we are continuing to grow our top lines. We’re very encouraged about that. And compared to a year ago both for the quarter and the halfway markets, it exceeds last year. The bottom line is fairly similar to last year. I think we’re facing some margin and cost challenges that a lot of people are, and also a couple that are unique to us that are kind of short-term. We could talk about that in a minute. But we’re pleased. The building that we’re about to move into is complete. So we’re going to double our capacity. We’ll be operating at two facilities then. I wasn’t real clear about that; sorry. And we’ve got some projects in development, so we expect the growth to continue here.

WSA: Right. Well, perhaps you can talk about your two main products and what they do and what some of those issues have been and how you’re now positioned to be able to overcome that.

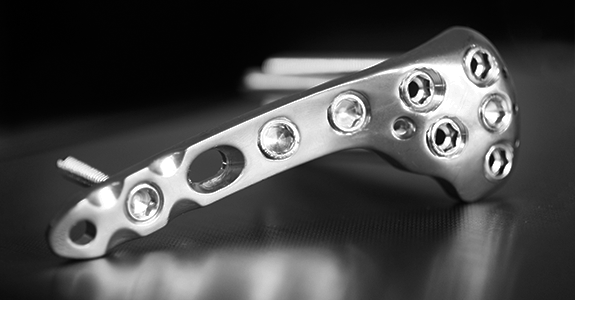

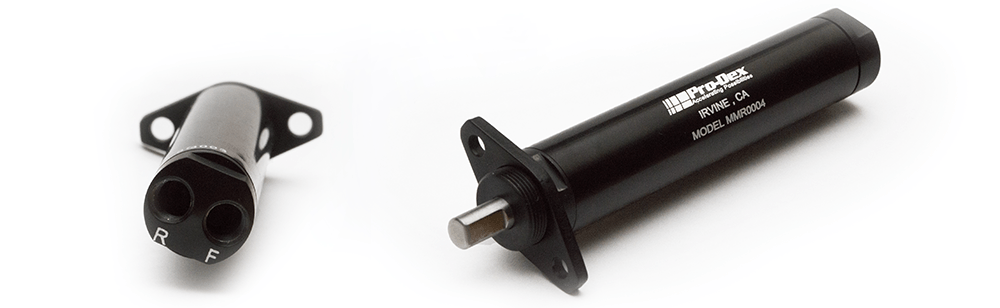

Rick Van Kirk: Well, we make power tools for the operating room basically. So one line is a line of screwdrivers basically for cranial applications and thoracic; and we’ve got a technology there, a torque limiting technology that no one else has. And surgeons really like that, which really enables our customers to sell more of their, let’s say their plates and screws and implants and things that they use our screwdrivers to put in place. So it kind of works out well for everybody. The contract manufacturing side, we do some cutting tools and arthroscopic shavers for some people that are used in surgeries as well. The challenges that are kind of unique to us in terms of the margins and bottom line; one, I mentioned the building that we’re moving into very, very shortly, and we’ve had to do a lot of validations as you might expect with a medical device business. You have to build a lot of product and test it and send it outside for more testing.

So what happened is, we used a lot of labor to build that product, but because it’s for validation and not necessarily for shipments, it doesn’t really apply towards, let’s say absorbing overhead. I don’t want to try to talk like an accountant because I’m not. But that affects our margins and it’s kind of a short term thing that should be wrapping up shortly. The other issue is we’ve got a very large customer that was in the middle of a product launch last year and made a rather significant change to the product, which would normally require a price increase, but there was not time to resolve all that and support the launch, so we agreed to make the change, support the launch because it’s important to them and us, and then kind of negotiate how to get compensated for that as we go.

So that’s in process. We’re confident that’ll get resolved. But for a couple quarters, that was a pretty significant hit to our margin. But again, we did in the spirit of good faith and supporting our launch, and they’ve committed to help compensate us for that and resolve the issue fairly and hopefully quite soon.

WSA: Certainly. And what are some of the goals that you’re looking at here over the course of the next six months and through the end of the year?

Rick Van Kirk: Well, there’s similar goals that we talked about in the past. We’ve not been shy about our growth plans. Getting into the second building will help with that. Finishing a couple projects that are currently in development will help with that. And then finishing off and processing the actual physical move. We’ve outgrown the current building we’re in, we’ll be able to spread out here, start doing some assembly and clean room workup in the new building, and we’re really excited about that. So things are going in the right direction. We’ve got some new projects, we’re going to have space to build them, and we’ve got some customers we really like that might have some more work for us to do as well.

WSA: Can you talk a little bit more about some of your current growth strategy and what makes you guys unique in the space and able to continue to grab market share?

Rick Van Kirk: Well, I mentioned the torque limiting technology. That’s a big advantage for us because no one else has it. We have some really good customer relationships. And when you do a good job for a customer, say for example with a cranial screwdriver, they’ll introduce you to the people in the thoracic department and the extremities department who might need a screwdriver as well. So that’s one growth strategy. We also are looking for new technologies and ideas, and one of the ways we do that is we like to partner up with doctors and/or universities that might have good ideas that maybe the larger companies don’t have the time for to work with them. So we’re working with a couple people like that to see if we can help finish off their development and design efforts, manufacture it for them, maybe commercialize it with them.

So we try a couple different ways or a number of different ways to grow the business. And we hit all the proper trade shows and call on people, and we try to do a little bit of market research in terms of what’s going on in operating rooms that maybe some of our technologies might apply to. So we’re trying a number of different things and we’re starting to gain some traction there I think. We’ve seen year-over-year growth consistently the last eight years, and we expect that to continue.

WSA: Well, good. And yeah, so while you’re on the Wall Street Analyzer, is there anything that you want to vent about the stock or something you wish perhaps investors better understood about the company, which would result in a higher valuation?

Rick Van Kirk: Well, I think — I always like to thank people that are interested in Pro-Dex and for their support. And then I would say we’ve been trending in the right direction, we’ve been growing, we’ve been adding capacity and people. We’ve invested a lot in R&D. I think like a lot of people, our progress got slowed down the last couple years because of pandemics and just things beyond a lot of people’s control. But it’s starting to come together. Like I said, we got a building coming online, some new products. So I think if people have been patient for a couple years while our growth slowed down, I expect them to be more pleased over the next two to three years as we start growing at an even faster rate.

WSA: Yeah, sure. So right now our current share price is at $15.94. As mentioned, trading on NASDAQ under the ticker symbol PDEX. Market cap is north of $55 million. So before we conclude here, why do you believe that investors should consider the company as a good investment opportunity at this point today?

Rick Van Kirk: A couple reasons; one, the track record. We’ve grown consistently. And the other thing I would point to is the potential with the technology, capacity, development programs we have in place. I expect, like I said earlier, the growth to continue and us to enter new markets and just kind of keep the ball rolling here.

WSA: Well, we certainly look forward to continuing to track the company’s growth and report on the upcoming progress and we’d like to thank you for taking the time to join us today, Rick and update our investor audience on Pro-Dex. It’s always good to have you on.

Rick Van Kirk: Thanks. It is my pleasure. Anytime, Juan; I appreciate it.

RECENT NEWS:

Pro-Dex, Inc. Announces Fiscal 2023 Second Quarter and Six-Month Results

MEDIA: