About: Bitcoin Well offers convenient, secure and reliable ways to buy, sell and use bitcoin through a trusted Bitcoin ATM network and suite of web-based transaction services. On July 30, 2021 Bitcoin Well began trading on the TSXV under the ticker symbol “BTCW” and celebrated by ringing the opening bell on the TSX and TSXV. Visit us at https://bitcoinwell.com/rings-the-bell/ to learn more!

INTERVIEW TRANSCRIPTS:

WSA: Good day from Wall Street. This is Juan Costello, Senior Analyst with the Wall Street Analyzer. Joining us today is Adam O’Brien, CEO and President at Bitcoin Well. The company trades on the TSX Venture, its BTCW. Thanks for joining us there, Adam.

Adam O’Brien: Hey, Juan. Thanks so much for having me. I appreciate it.

WSA: Yeah, certainly great. And so can you please start off by providing us there with an intro of the company.

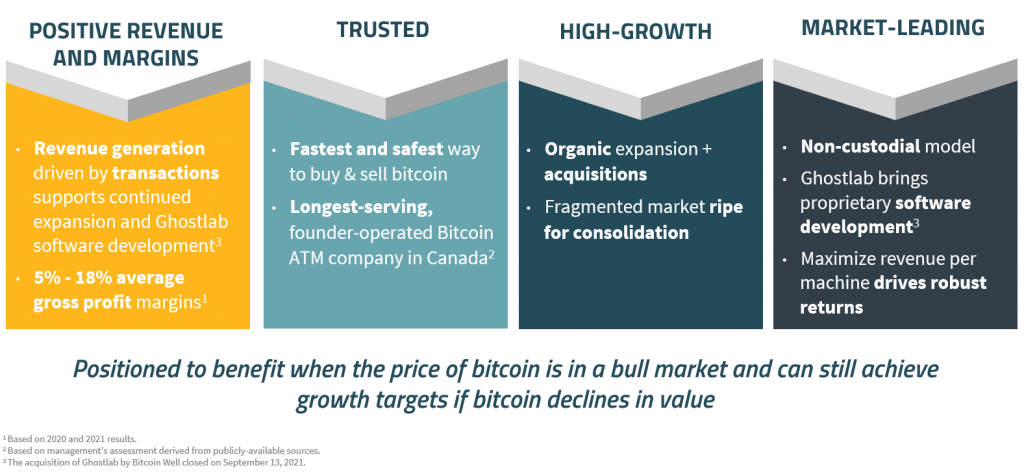

Adam O’Brien: Yeah, absolutely. So Bitcoin Well is primarily in the business of buying and selling bitcoins. Since 2013, I’ve been hyper focused on making sure that Canadians and in turn the world has the fastest and safest access to bitcoin and we’ve set out on a mission to do just that. For the high level, we buy and sell bitcoin via bitcoin ATMs, in-person and online. And then recently this year, we acquired an organization that’s kind of helping our mark into the technology development of developing technology to make that possible.

WSA: Can you bring us up to speed there on some of the company’s most recent news and activity on the market?

Adam O’Brien: I think most excitedly and kind of highlighting kind of our focus of the future as we just hired a new CFO and it’s a gentleman called Allen Stephen. He came from 10 years in banking and then recently is coming to us from a FinTech startup called Neo. They are a Neo Bank platform here in Alberta and I think that kind of highlights where our focus is kind of moving. We’re truly looking to offer the best experience for bitcoin users and really, really giving kind of adding usability concepts to bitcoin. So being able to buy and sell bitcoin, the on-ramp and off-ramp into the bitcoin ecosystem is obviously important. But we’re pretty focused on that usability piece that kind of tertiary piece to bitcoin and giving our users the ability to use bitcoin and giving them that security that bitcoin has but offering the same convenience as modern banking.

So I’m pretty excited to start bolstering the team that way. I think further from that is some recent financing vehicles that we have set up. And so we’ve got some convertible debt financing kind of ready to rock and preparing the next stages for that kind of growth and that technology development in the company. And really setting the stage to be a scalable user acquisition focused organization, which is pretty exciting.

WSA: Yeah, and what are the key goals and milestones that you’re hoping to accomplish here on the first half of 2022?

Adam O’Brien: It’s going to be a combination of our online and ATM kind of vehicles, so that in-person ATM customer, so really focusing on our partner ATM network. We have the ability to scale operations quite significantly for our ATM operations and we’re looking to partner with existing businesses to have them deploy bitcoin ATMs that we operate in a partnership. This alleviates lots of our scaling problems where we need to deploy capital and manage host relationships. So we push that into the partners and we do best, which is operate bitcoin ATMs. So really scaling up that partner programs and expanding on that. We have one of those in existence already with a company called Rapid Cash here in Alberta and that partnership alone is set to yield over 100 new locations this year, which is obviously great because that’s just hyper-scalability and no real hit to the balance sheet or to operations other than just operating the machines, which is pretty exciting.

And then next the online platform, so recently we deployed the ability to buy and sell bitcoin online with Visa debit and set up the account system. So it’s going to be really, really focused on user acquisitions for that platform and then further development and more payment rails of that platform really solving the non-custodial on-ramp into bitcoin, non-custodial being where the user ultimately holds and controls the bitcoin themselves, that is without question the safest way to hold bitcoin. And right now our platform gets users their bitcoin in less than a minute, which is deems the fastest way to buy bitcoin. So really blending those two worlds of security and speed.

WSA: Yeah, I was just going to ask you about what are the key trends that you’re seeing right now in the sector and what makes the company uniquely positioned to capitalize?

Adam O’Brien: Yeah, I mean certainly it’s no secret that more people are looking into bitcoin. This summer we actually did some market research, which was pretty interesting. So the last comparable market research we had was Bank of Canada Research from 2016 or 2017 where it showed that 3% of Canadians owned bitcoin, which was actually, to be honest, was a bigger number than I was expecting back then. But this summer we did some similar research with IPO’s and it showed that 24% of Canadians either own or intend to own bitcoin, which is a massive number. So it’s no secret that more people are looking for ways to get into bitcoin, but we also found that a massive barrier to getting into bitcoin was the education piece. And so our response to that was developing the bitcoin academy. We partnered up with Athabasca University, an accredited university here in Alberta and we designed and deployed the bitcoin academy that went live last month, which is a really nice kind of non-bias or unbiased way to look into and learn about bitcoin.

We go through bitcoin protocols, we go through a bit of the meme culture that surrounds our bitcoin and most importantly, the security and how to secure your funds. And then from there, our user has the ability to go in-person into one of our offices across Canada and learn about bitcoin. Set up a wallet and get it done in a secure environment with one of our bitcoin specialists kind of holding their hand along the way, which really increases the comfortability entering into this new space. And then from there, all part of the user experience, the user then gets engulfed into our ecosystem. And this ecosystem is kind of what I’ve been speaking about this on-ramp, off-ramp and then that third layer is that usability piece that we’re going to be developing — that we’re starting to develop right now but that we will continue developing on over the next two or three years really making it possible for users to hold bitcoin themselves making it super, super safe when it’s in self-custody, it’s bitcoin that they own and control themselves but giving them that same convenience within that ecosystem of spending as they please, which is pretty exciting.

WSA: For sure. And so perhaps you can talk about your background experience, Adam, and who the key management team is there as you just had some as you mentioned you had key additions and you’re a Co-Founder of the company?

Adam O’Brien: Yeah, absolutely. So I founded the company in 2013. I was very curious and interested in bitcoin, went to go try and find the bitcoin and had a horrible experience. I didn’t have that kind of same hand holding that now exists today through Bitcoin Well. So I set out on a mission to make it accessible and understood and those have been our key, key focus and drivers of the organization since day one. I started by deploying Alberta’s first bitcoin ATM in early 2014 and then Saskatchewan’s first bitcoin ATM in mid-2014 and from there we’ve grown a network of over 200 bitcoin ATMs across Canada and continuing to grow. And over and above ATMs in about 2019, I kind of first noticed what needed to happen in the industry. Bitcoin ATMs could do so much more than just buy and sell bitcoin. There was so much more opportunity than just buy and sell bitcoin on-ramp, off-ramp and that usability piece started coming into focus, which is when the software development kind of really entered my mind and that strategy of what more can a bitcoin ATM do, which led us to now acquiring this organization that develops proprietary bitcoin ATM software to give us the ability to really set the stage for what the bitcoin ATM can do.

And we envision a world where a bitcoin ATM acts as effectively a non-custodial financial terminal, really a bank in a box, a bank with that our user has access to thousands of locations around the world and that’s where we’re kind of moving towards. So my history from there, I’ve been a bitcoin user for nearly a decade. Dave, our Chief Revenue Officer, him and I have kind of been friendly competitors within our early stages in the industry. He has been in the bitcoin industry longer than I have. He founded what is known to be one of the first bitcoin brokerages in the world in ‘Bitcoin Brains.’ And him and I joined forces a couple of years ago as we started this go public venture and we’re bringing like over two years of bitcoin experience into this organization and developing a product that we know that we’d like to use as experienced bitcoin users and that we know have to be simple enough for the mass market to use. So blending that experience with our product knowledge is kind of our forte and what we’re good at.

WSA: So as far as investors in the financial community, do you think that they’re starting to better understand the company’s story and what the upside there is?

Adam O’Brien: Yeah, I think so. I think that they’re seeing that we have growth potential. And I think that we’ve spent a lot of focus on scalability over the last year or so. In 2016, before the company was of any kind of size, it was just a small business. It was just me. There was about 15 machines that we had in Western Canada mostly in Alberta and I didn’t really put a lot of time and focus thinking about the future of the organization back then. And as a result, I left a ton of money on the table when the Bull Run hit in 2017 and I vowed to myself to never ever do that again. I vowed to myself that I was always going to be focused on scalability and growth and building teams and structures and processes in place, so that when the bull market comes, we’d be able to capitalize. And that’s what we did this year. Obviously, bitcoin hitting new all-time highs this year we put those processes into place and we more than doubled our revenue. We more than doubled our machine count.

We tripled the number of stores that we have. We doubled the team to really set the stage for that next set of bull market, which is I believe that we’re kind of entering into right now where the mass market truly needs bitcoin. You look at inflation numbers actually just announced it’s like at the end of December today, inflation number is kind of coming out. You look at the US state of inflation at 6.8%, the highest since like 1980, the highest in 40 years. We’re seeing inflation and bitcoin as an anti-inflation tool, a hedge against US dollar inflation people are going to certainly be looking for ways to buy and sell bitcoin. And we’re positioned to grow and to scale to give them those three main on-ramp and off-ramps, the in-person service that are at our location, the ATM function to kind of get on board in a familiar way and then ultimately into our online platform where this ecosystem exists to buy, sell and use bitcoin. So I think that investors are starting to see that growth potential in the industry and starting to see kind of how what management with over two decades of bitcoin experience kind of brings.

I think from there, it’s going to be up to us and I’m super excited to show the world what we can do with our technology development. I know what I want out of bitcoin and because I was a layman that didn’t really understand bitcoin 10 years ago, I knew what I wished I had. And I had to teach myself command line, I had to teach myself how to build a node, I had to teach myself how to enter into the mining atmosphere and I had to teach myself how to use bitcoin. And I know what the product needs to look like in order to make it easier to do. We look at this of a standpoint of can my grandma use it? And if the answer is no then the product is not good enough. So I think that we’re really, really focused on creating that environment that makes users comfortable to again buy, sell and use bitcoin in the fastest and safest way possible.

WSA: Certainly. So once again, joining us today is Bitcoin Well CEO, Adam O’Brien. The company trades as mentioned at the top on the TSX Venture, BTCW. Current share price is $0.19 a share Canadian, market cap about $33 million Canadian. So before we conclude here, why do you believe investors should consider the company as a good investment opportunity today?

Adam O’Brien: I think we’re hittingboth sides of the coin so to speak. We’ve got this technology development that started and we’ve just deployed this early stage Visa debit platform, which has taken off quite well and we’re seeing great user growth. But we also have this existing cash cow that is the bitcoin ATMs. And we’ve got underlying revenue, we’re going to do — we’ve done I think over 80 million in revenue so far up to Q3 to date. And I think that we’re in good shape to kind of lean on those existing revenues while developing technology and investing heavily into that next stage of our user growth and of our user usage, which is that online platform.

WSA: Well, we certainly look forward to continuing to track the company’s growth and report on the upcoming progress and we’d like to thank you for taking the time to join us today Adam and introduce your investor audience to Bitcoin Well. It was great having you on.

Adam O’Brien: Thanks so much. It’s my pleasure. Anytime looking forward to coming back.