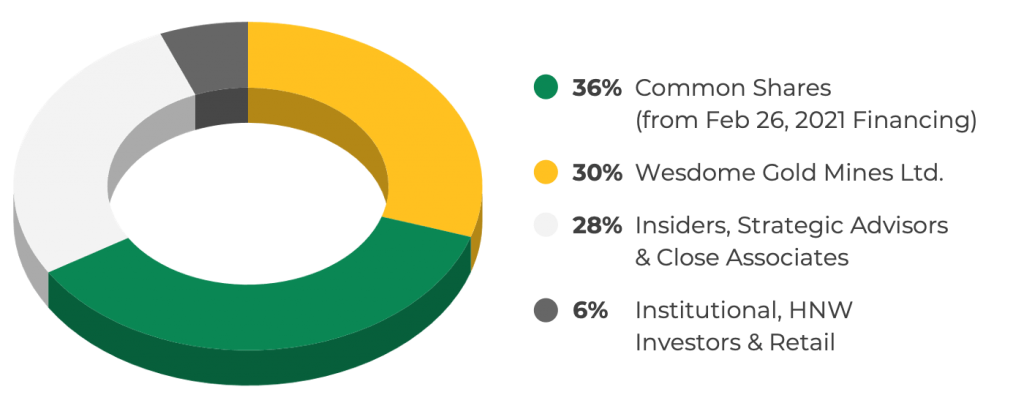

About: Goldshore is an emerging junior gold development company, and owns the Moss Lake Gold Project located in Ontario. Wesdome Gold Mines Ltd. is currently a strategic shareholder of Goldshore with an approximate 30% equity position in the Company. Well-financed and supported by an industry-leading management group, board of directors and advisory board, Goldshore is positioned to advance the Moss Lake Gold Project through the next stages of exploration and development.

INTERVIEW TRANSCRIPTS:

WSA: Good day from Wall Street, this is Juan Costello, Senior Analyst with the Wall Street Analyzer. Joining us today is Brett Richards, President and CEO at Goldshore Resources. The company trades on the TSX Venture, GSHR and over-the-counter, GSHRF. Thanks for joining us today there, Brett.

Brett Richards: Yeah, thanks Juan.

WSA: So yeah, please start off with providing us with an intro of the company.

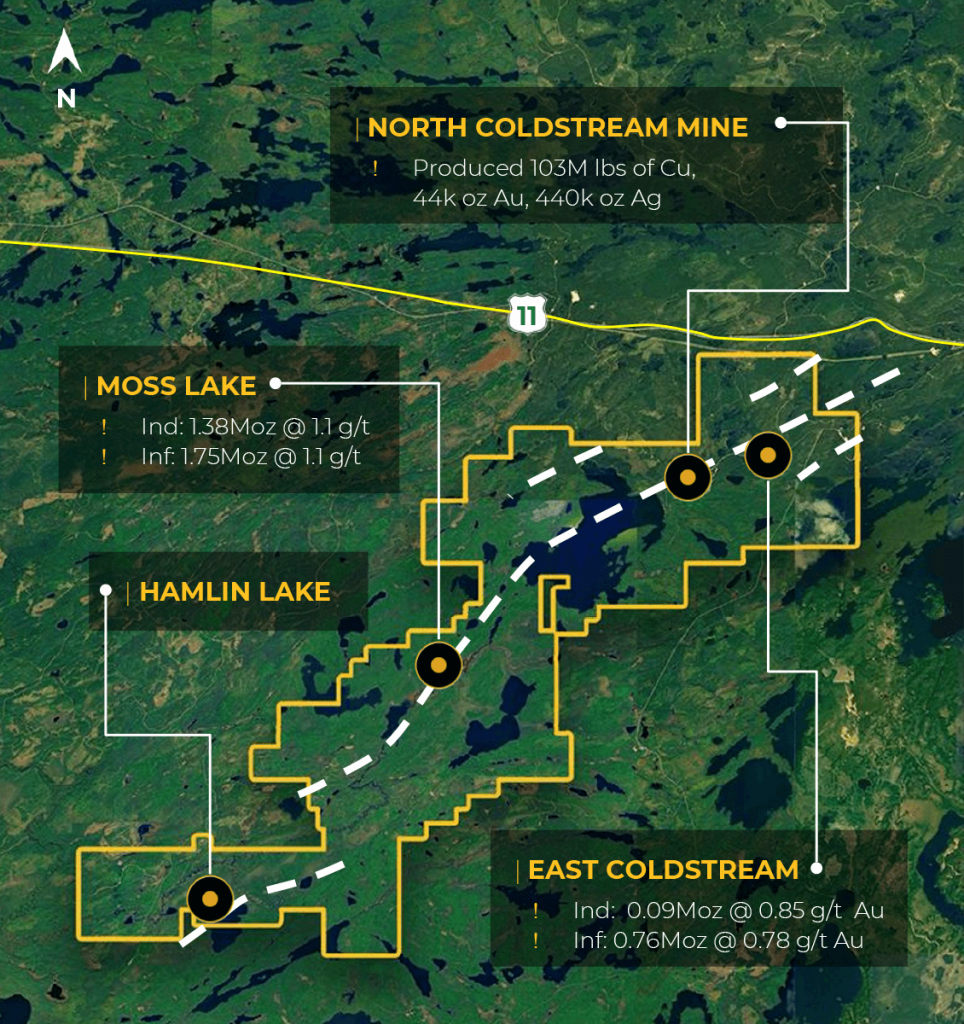

Brett Richards: Yeah, Goldshore Resources is a fairly new gold company. We acquired the Moss Lake Project from Wesdome Gold Mines back in January of this year. And concurrently at the same time, we put together a $25 million financing. And once those transactions were approved on May 31st, we started trading on the TSX Venture on June, the 4th. And we’ve had an interesting ride since we started our listing and started trading. A little bit as a result of kind of macroeconomic environment in the sector and generally in the markets. The project is in Ontario, so it’s 130 kilometers northwest of Thunder Bay and the project we acquired from Wesdome has a historical resource of right around 4 million ounces.

WSA: So, bring us to the speed on some of the most recent news as you just commenced the 100,000 meter drill program there at Moss Lake and you also completed the VTEM Survey.

Brett Richards: Yeah. So a lot of the preliminary work we did leading up to listing was really getting organized, getting some capacity on the ground to commence the big program. We announced a 100,000 meter program back in June. We have mobilized a drilling company to start with drilling. We’re just on our second hole. First hole was quite successful and we hope to have the results of the assays back fairly soon probably it won’t be until later on in September. But there has been quite a bit of work done on the ground just setting up so that we can manage a program of this size both infrastructure, people capacity, those types of things. And we also flew a VTEM Survey, so a magnetic survey over the entire land package. And we did it at 100 meters line centers and we flew the deposit on 50 meter line centers. And what this will do is give us a pretty good road map along with all of the historical drill data and along with the other historical exploration data to start putting together really high impact drill targets over the next 12 to 18 months. Like I say, we’ve started. We’re very early on in the program. We hope to ramp up to a second rig in September.

And as we get closer to the winter time, we’ll move up to kind of four rigs on the ice over top of Moss Lake and in the vicinity. But I think the early takeaways from the VTEM Survey and the early takeaways from putting all of this information together, which is quite exciting is that this is a real project. And with a base of a resource like we have and yes, there will be some verification drilling and there will be a coupleof twin holes drilled early on. But the scout targets that we are looking at and looking at in the context of the VTEM Survey are quite appealing as well. There is a historical copper mine on our land package called North Coldstream. It was run by Extrada and Miranda back in the 80s for about 12 years. And we got a lot of I’ll say a lot of magnetic resonance off the VTEM Survey illustrating kind of some really, really interesting kind of copper targets we’re going to have as we do some scout drilling. So this is a gold story but there is some really, really exciting copper opportunities as well, which will most likely be copper gold.

WSA: Certainly, and so what are the key trends that you’re seeing right now in this sector, what makes the company uniquely positioned to capitalize?

Brett Richards: Well, I think when we started our listing back on June 4th, I look at this and I compare ourselves to some of our peers in this sector. Typical companies that are in a Tier I jurisdiction like the Ontario, Quebec, the Maritimes and/or you know the US. And they look at their stage of development and we put together kind of a peer group as to where they are positioned in the market relative to Goldshore. And when we entered, we were trading around $16 an ounce, which is at the bottom of the fourth quartile on a relative basis from market cap to attributed resource. And we had quite an early run up of our share price from $0.65 where we raised money, quite a decent run up to mid 90s. And then when gold pulled back, all the gold companies pulled, most of the gold companies pulled back as we did. And we have pulled back and we’ve settled under our listing price around $0.57. So when I’m looking at trading comparables now and yes, our peer group have pulled back as well, we’re still trading multiples below our peers at this stage of development.

So I see this as a buying opportunity. I see this as a tremendous entry point for new investors to come into the stock. Our peers, if we’re trading at $15 an ounce today, our peers are in the 30s, 40s, 50s and even higher in some cases and looking at a mean of around $55 an ounce. So I see that as once the market is able to calibrate Goldshore to its peers and we get some, I’ll say, we get some awareness out there and we get the story out there a little bit more mature as we get drilling, I can see the market recalibrating kind of Goldshore’s market cap to our peer group. So I think that’s an exciting entry point, an exciting investment opportunity for new investors. And then come the fall from September kind of October, November, December and carrying on, we’re going to have a pretty steady stream of news flow as we go forward. So that’s only going to enhance the value for investors or for new investors coming in.

WSA: Right, so yeah, what are the key goals that you’re hoping to accomplish over the course of the next six months?

Brett Richards: Well, we’d like to get through the first 100,000 meters kind of by this time next year. I think that’s very doable. And then once we get to that stage, we’ll be looking to do a mineral resource estimate update on the existing resource. And we will also be doing an update to the existing PEA or Preliminary Economic Assessment that was done in 2013. That PEA that was done by Moss Lake Gold Mines back in kind of Wesdome’s tenure illustrated several hundred million dollar NPV on a $700 or $800 million Capex and that was using $16.50 Canadian gold price. So we need to kind of recalibrate this to today’s gold price. We need to calibrate it to a new resource and we’ll come up with what the new economics are on a potential project for Moss Lake. And I think the kicker in all this is understanding what we have from copper or copper gold potential resources on our land package as well. So it’s going to be a pretty exciting ride for in the next 12 to 18 months as we go through all these exercises.

WSA: Right and perhaps you can talk about your background and experience Brett and who the key management team is at Goldshore?

Brett Richards: Sure. I’ve been in this space for quite a while around 35 years now. I’ve run many listed companies in the gold space and in the copper space. Listed in Toronto, some listed in London. Some of the companies that I have led include Avocet Mining in London, include Roxgold in Toronto, include Midnight Sun Mining, which is a copper play in Zambia, which is on the TSX. And I’ve also run a number of private companies for private equity companies. So I have a very good balance. I feel I deliver a very good balance between what investors want and I’m guided by that because private equity operates on a completely different kind of parallel to public companies. It really is about sustainable value and return and I want to deliver that same style and that same level of return to the Goldshore shareholders. So I’m quite familiar with this space working in all parts of the world in very difficult jurisdictions in Southeast Asia and in Africa. But also in Ontario I’ve started my career at Kinross and then I was one of the founding members of Katanga Mining, which was bought by Glencore in 2008.

One of my key guys who has been with me on the last 10 or so projects is our VP of Exploration. His name is Pete Flindell. Pete is an Aussie who is now relocated to Thunder Bay. He is running the drill program and running the entire exploration program on the ground. Pete was with me at Avocet in Southeast Asia and in Africa. He was with me at Midnight Sun. And most recently, he was with me at Banro Corporation. And Pete has a great, great understanding of greenstone belts and how to take these projects through the development phase from early stage resource or mid-stage resource like we have and taking it through its gamut to become a real project that isn’t just a junior mining resource. This is a real project and Pete is well positioned to do it. He spent his first 12 years with Newmont. We’ve both worked for big companies and I think that in itself is probably going to be a mid-tier or a larger gold company that would be interested in Moss Lake somewhere down the road. So we know the standard as to how we need to work. We know the standard of data. We know the standard of policy and protocol required in order to deliver a project of this magnitude.

I often say, we’re not taking this from A to Z. We’re taking this at L because we already have a four million ounce resource. So we’re taking this through a period of development. And although at the end of the day, I suspect this is going to be well over $1 billion in Capex and it’s probably going to have a substantial $100 million NPV that will be kind of the basis on who we would partner with who has the capacity to finance that has the capacity to build that. And we have a defined role and our role is to take this from L to about O not A to Z.

WSA: Right, well, what are the specific steps that you’re taking to maximize shareholder value and get your message out to the larger investment community?

Brett Richards: A large percentage of my time, Juan, is spent talking to investors and talking to institutions, talking to retail wealth managers, etcetera about the value proposition. And the value proposition is simple and I believe we have a real project. We’re positioned against our peers in a very attractive and favorable place right now. And I see the macroeconomics for gold going in one direction in one trajectory—We’re back to $1800 this morning. I see gold trading kind of between $1800 and $2200 for the foreseeable future. There will be pullbacks like we’ve just seen. There will be probably pull-ups above 2200 in the next period of time as well. And a lot of those are driven by either substantial global events, black swan events, global pandemics, those types of things.

And the real catalyst to this is, is the inflation this type of economy globally starts to create and then the flock back to gold as a staple against inflation. So I see it’s well positioned in the market. I see it’s well positioned in this cycle. And I’m excited about getting the story out there to as many people. We have a very heavy conference season coming up in September, October, November and early December where I’m going to be meeting literally hundreds and hundreds of people and institutions in order to get our story and the awareness of our story out there. So yeah, I’m very excited about the future.

WSA: Well, once again, we’re speaking with Brett Richards, President and CEO at Goldshore Resources, which trades on the TSX Venture, GSHR and over-the-counter, GSHRF. Current US share price is $0.44 a share, market cap around $44 million US. So before we conclude here, why do you believe investors should consider the company as a good investment opportunity today?

Brett Richards: For a couple of reasons. One, the first one being there is very little exploration risk here. Why do I say that? I say it because not just because of the jurisdiction we’re in. I say it because we have a four million ounce seed resource, which covers a very small area of our land package. We have an extra large land package up in Thunder Bay and there is a lot of exploration potential in this area. This is a project that is very similar to Detour Gold or Kirkland Lake’s Detour Gold or Cote Lake or Rainy River. This is going to be a big tonnage,a high volume operation low grade deposit probably around a gram a ton. And it’ll be quite sizable and you can scale up operations like this to be to have quite large capacity. So if you want size and scale, if you want leverage to the gold price and if you want a project that has limited exploration risk given the history and the historical resource, I believe Goldshore is the place to be. We have a very, very strong group of guys driving this.

We have an advisory board that consists of very, very well-known names. David Garofalo, who was the formerly the CEO of Gold Corp. Bryan Slusarchuk, Adrian Rothwell, who is the CEO of Angold. And we have a very, very strong board with two Wesdome representatives on it. Mike Michaud, who is the VP of Exploration for Wesdome. And Heather Laxton, who is the Director of Sustainability for Wesdome. So we have the people, we have the capacity, we have the financing in place. We have the project and we’re entering a period of time where I think really, really separates Goldshore from any just normal junior gold mining company. And I think that’s where the value proposition lies and that’s why I think people are going to be rewarded by understanding Goldshore better.

WSA: Yeah, well, we certainly look forward to continuing to track the company’s growth and report on the upcoming progress. And we like to thank you for taking the time to join us today Brett and introduce our investor audience. It was great having you on.

Brett Richards: Thanks Juan. And thanks everybody for listening today.