ABOUT: African Gold Group is a Canadian-listed exploration and development company with a focus on developing a gold platform in West Africa. The Company is primarily focused on the development of the Kobada Gold Project in Southern Mali, a low capital and low operating cost gold project with the potential to produce more than 100,000 ounces of gold per annum.

INTERVIEW TRANSCRIPTS:

WSA: Good day from Wall Street, this is Juan Costello, Senior Analyst with the Wall Street Analyzer. Joining us today is Danny Callow, CEO and President at African Gold Group. The company trades on the TSX Venture, AGG, and over-the-counter AGGFF. Thanks for joining us today there, Danny.

Danny Callow: Thanks Juan. Really good to be with you today.

WSA: Yeah, appreciate it. So please start off with providing us there with an intro of the company.

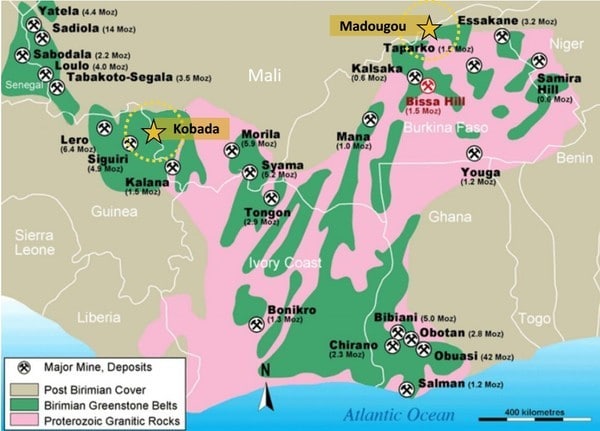

Danny Callow: Okay, great. So we’re in Mali — we have a flagship asset in South Western Mali, pretty much in the middle of the Birimian Greenstone Belt, which is the prolific gold bearing belt that runs northwest, southwest through the country. We have some fairly prestigious neighbors, who are operating mines, and Mali certainly hosts most of the world’s major miners, so we’re in good company. Kobada has now completed a definitive feasibility study for a 100,000 ounce per annum gold operation. We are continuing to explore the property, we have significant upside, and I’m sure we will talk a little bit about that later. But overall we’re construction ready, fully permitted, ready to build a 100,000 ounce mine in one of the largest gold producing countries in West Africa, so we’re very excited.

WSA: So bring us up to speed there in some of the most recent news, as you just completed your feasibility study and update on your Kobada project.

Danny Callow: Yeah. So we’re really focusing quite a bit right now Juan, on the technical side. We delivered a definitive feasibility study last year, which showed a very robust, exciting, economically viable project, but since then, we’ve done a fair amount more drilling. And we’ve also, most recently, in the last few months focused on metallurgical test work around our sulfide ore body. We have a very simple geology with oxides on top and very close to surface and sulfides underneath. The study last year focused only really on the oxides, we’ve now taken the time to do very comprehensive testing on the sulfides, and we’ve found them to be exceptionally easy to process. Results show they are free milling, which means that we don’t have to go through any rigorous program to take the gold out, and the downstream side of our plant will be able to treat those sulfides as well without any modifications. So what that has enabled us to do, is to be able to bring in a much larger resource into our updated definitive study that we’re busy with now which should see a fairly substantial increase in our gold ounces, which is key, obviously, to extend the mine life, and also a sizeable improvement in the economics of the project as well. So that’s really been the focus for the last couple of months, getting the sulfides tested, updating the definitive feasibility study and that is a study that will be completed in about a month-and-a-half time.

WSA: Right. Well, you mentioned some of those shorter term milestones, what are some of the goals that you’re hoping to accomplish over the course of the next six months?

Danny Callow: Yeah. So we’ll drop out an updated definitive feasibility study by the end of August of this year. That, as I said, should show some fairly sizable improvements in the size of the resource on the property, and it will also hopefully show some significant improvements in the financials, so we should see a much better NPV and IRR because of the increased ounces. So that’s all going to happen in the next month-and-a-half, two months, and then obviously post that we have an opportunity to put the drills back in the ground again hopefully, and to continue to look to grow the resource.

WSA: Yeah. So what are some of the factors that you feel make your project unique from some of the other players in the sector and able to capitalize on some of the key trends you’re seeing?

Danny Callow: I think, there’s obviously a lot of competition in West Africa, Mali is Africa’s 4th largest producer, I think where we differentiate ourselves is that we have a very robust project that is effectively ready to build. So we have all of our permits in place, we have a very comprehensive feasibility study that is taken to a very high level of engineering design. So I guess we’re probably only one of a handful of companies that are in this position. So if we push the button on construction here, we could bring first gold out within 19 months. So we’re certainly not an explorer like many of the companies in West Africa, we’re effectively ready to build, and I think that differentiates us. Along with that, we have a very low, all in sustaining cost number of around $782 an ounce, which is definitely down in the lower quartile of the gold producers in West Africa. Very low operating costs of around $700 an ounce and some very substantial free cash flows because of that.

So even though gold is taking perhaps a little bit of strain, we’re still seeing free cash flow margins of anything upwards of $900 to $1,000 an ounce, which means that, at 100,000 ounces per annum, we generate a significant amount of cash once we bring this project into construction. So this 19 month look-ahead in terms of getting the first gold becomes very attractive for investors, because obviously once that goes into production, then there’s some substantial cash that’s generated, which can obviously go back into paying dividends and investing back into the assets. So that’s I think what differentiates us from most of the companies out there.

WSA: Yeah, certainly, and perhaps you can talk about your background experience, Danny, and who the key management team is?

Danny Callow: Sure, fine. So my background is building and operating mines in Africa over the past 28 years. I’m actually from England, originally, I studied in the UK Mining Engineering, so I’m a qualified mining engineer. I spent the last 12 years working for Glencore building all of their Central African copper and cobalt operations. So, we probably spent an excess of $2 to $2.5 billion building some very large mines for Glencore in Central Africa. And I’m a mine builder, so I came into this company with a very strong strategic focus on getting it to a level where we could build it and bring it into operation. I have a full team behind me that is available once we start to build — that have all built mines with me over the last 15 years or so. Right now, we have a very small team, keeping the overhead cost quite lean and mean. But we have our VP Corporate Development, Daniyal Baizak. We have a very good Country Manager, Sekou Konate, who is a seasoned mining guy in Mali, very well known, very well connected, and he’s our man on the ground there. And as I say, we have a team that we can pull in at a short notice once we move into the construction and development phase. So I think we have a fairly competent team there. And then on the other side of this is that the engineering company that’s done all of this detailed design for us, is a company called SENET. SENET are very experienced in building and operating mines in West Africa. They have probably built 12 mines of similar size to what we’re looking at. And they’ve been involved in doing the detailed engineering design on this project as well. So, between SENET on the engineering side, and my team on the construction side, I think we have a very strong team to take this project through into the construction phase.

WSA: Right. I guess you’re still well-funded as you had that a private placement just a few months ago.

Danny Callow: Correct. So, the private placement enabled us to do a number of things. The one was, obviously to complete the drilling program that we’ve started. The other thing was to clean up the balance sheet to basically make us debt free, which I think is really important. And it also enabled us to do this fairly comprehensive update to the feasibility study, which will be delivered in the next six weeks or so. That being said, we’re still okay with cash and our burn rate is pretty low at the moment. So we’re not looking to go out to the market to raise any money in the near future. And hopefully, once the feasibility study is delivered, we’ll start to see some positivity around the share price as well.

WSA: Right, I was just going to ask you as far as the valuation, what do you wish investors better understand about the company, which would result in that higher valuation, but I guess, like you said, they’re just waiting on some news to come out or some results?

Danny Callow: I think, Juan, there’s a couple of things. I mean, the one is that obviously Mali is a country that has had a bit of a rough ride for the last 12 months, there’s been a couple of government changes, you don’t hear good news coming out in the north and the central part of the country. So I think unfairly, Mali gets a little bit of a bad rep. My experience in Mali is very different to what you would read in the press, and our experience with dealing with government is actually very positive. So I would like investors to know that Mali is very open for business, it’s the third largest gold producer in Africa. We have all of the majors there – B2Gold, Barrick, AngloGold Ashanti, IAMGOLD, all operating very well, they’re producing large numbers of ounces of gold.

And I think that’s been facilitated by a very strong mining code and a very strong government focus on attracting investment. So I find Mali a great place to do business. And I hope that investors understand that Mali is really a proactive place to do business. And I guess the second thing is that we often get mixed up with a whole bunch of explorers, and probably some of our valuation comes through as being seen as somebody that’s just continuing to drill and grow the resource. I think it would be good for everybody to know that we are construction ready, and the quicker we can bring this into construction, the quicker we can start to deliver some substantial cash flow return to investors, which should see our share price jump up to what we would expect to see with some of our peers, which in my opinion is probably 250% to 300% higher than it is now.

WSA: Right. And yeah, you mentioned, the government there and the location, and you guys are also doing like your social responsibility there. I think, I saw a picture of you guys built like a well or a dam there, or a canal?

Danny Callow: Yeah, obviously at our stage of development, we are doing relatively small projects. But some of the things that are very key there are eliminating malaria. Malaria in Mali is quite a serious disease. One of the ways you can eliminate that is to divert standing water away from villages and towns, so we spent a lot of time constructing drainage channels and fixing bridges, and fixing roads, to allow good access for the villagers back to the main centers. So a lot of that has been done over the last year or so. But all of this will have ultimately roll up into something much more substantial when we move into the production phase, which would be a much more defined management plan to deal with some very large social projects. And those are our sort of, in the sort of strategic side now, but we know that once we move into production, we can bring those on and really add some value in the social side.

WSA: Surely. So once again, joining us today is Danny Callow, CEO and President at African Gold Group, which trades on the TSX Venture AGG, and over the counter AGGFF, currently trading at about $0.11 a share US, market cap just slightly south of 20 million US. So before we conclude here, Danny, why do you believe investors should consider the company as a good investment opportunity today?

Danny Callow: Well, I think Juan, if you take a look at any of the sort of peer comparisons that you would look at with our type of company, whether it’s enterprise value to total resources, or enterprise value to total reserves, you will see that we are significantly undervalued to many of our peers at this stage in their progression. So I would say that there is certainly a potential for a 250% to 300% improvement in our share price based upon what we’re seeing with some of our peers. Other than that, you know, gold is still trading at around $1,800-plus an ounce, we can produce gold on this project at $780 an ounce, but there’s not many mining investments right now that would turn $1,000 of free cash back to the bottom line. So I think that West African Gold is very positive, the mining environment is very positive. We have a great project with some very good underlying fundamentals, which will be better in six weeks’ time when we update the study. And I think this is a great time to get in, because if you get in now, you have the potential to see a 2, 3, 4, 5 bagger here, once the share price increase takes hold. So I really think that it’s a great stock to invest in, and it’s a project that needs to be built. And we’re doing everything we can to get the name out there so that we get this thing built, and then we’ll start to see some substantial returns to investors and shareholders.

Juan Costello: Yeah, well, we certainly look forward to continuing to track the company’s growth and report on your upcoming progress. And we’d like to thank you for taking the time to join us today there, Danny and introduce our investor audience to African Gold Group. It was good having you on.

Danny Callow: Yeah, thanks, Juan. It was really great to chat to you and thanks very much for your time.